Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 15, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Short sellers target Star Wars toymaker Jacks Pacific ahead of earnings

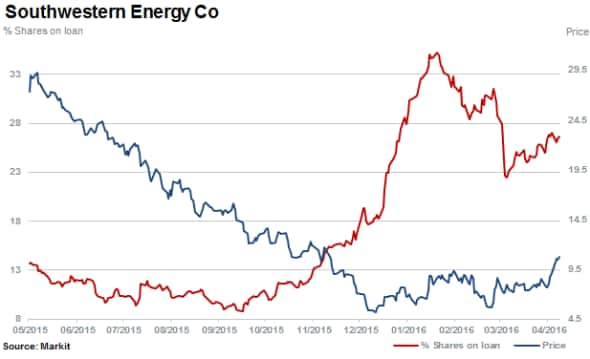

- Southwestern Energy second most shorted ahead of earnings, at risk of squeezing

- Lower dividends expected at ASM Pacific Technology and Keppel

North America

Jakks Pacific the maker of toys including 'life' size Star Wars figurines is most shorted ahead of earnings in North America this week. Short sellers have increased positions in the stock by more than a third so far this year with 27.6% of shares currently outstanding on loan. Shares have declined by fifth after peaking in September 2015, ahead of the latest instalment in the Star Wars Franchise which was released in December 2015.

Southwestern Energy, the third largest producer of natural gas in the US, has seen short sellers once again increase positions, rising by 18% after covering seen in 2016. This is despite an impressive recent rally in shares, spiking 48% in April off a low base after tumbled by more than two thirds over the last 12 months. The stock is currently ranked in the top percentile of firms at risk of experiencing a short squeeze as identified by Research Signals' Short Squeeze model.

Servicing shale oil companies in North America, Basic Energy Services shares have fallen 70% in the past 12 months with a fifth of shares currently outstanding on loan.

Europe

Most shorted ahead of earnings in Europe is Tgs Nopec Geophysical with 17% of its shares outstanding on loan. Servicing oil exploration companies, Tgs was among the most shorted firms coming into 2016. However, short sellers have covered 15% of positions since the middle of February as markets and oil prices stage a rally.

Scandinavian budget airline Norwegian Air Shuttle continues to attract short sellers despite shares jumping 44% since the end of January 2016. Shorts have only covered 10% of positions with 12.9% of shares outstanding on loan currently.

Third most shorted in Europe is Finnish based Metso who offers services and equipment into the mining, aggregates and oil and gas industries.

Short interest in Metso has more than doubled in the past 12 months, while shares are down by 15%.

Apac

Most shorted ahead of earnings in Apac for a consecutive quarter is Hotel Shilla with 15.8% of shares outstanding on loan. The Korean operator of hotels and duty free shops has been battling a decline in tourism impacting revenues, specifically emanating from China.

Short sellers have tracked shares in Artspark holdings over the last 12 months, rising to 12% of shares outstanding on loan. Shares are 38% down from highs seen earlier in the year but including this sudden drop are still up 71% in the past 12 months.

Also making it into the top ten most shorted stocks ahead of earnings in Apac is ASM Pacific Technology and Kepple with 4.7% and 4.1% of shares outstanding on loan respectively.

MarkitDividend Forecastingis expecting a reduction in dividends at both firms. At ASM Pacific Technology, a 23% reduction is expected largely attributable to the weak economic growth.

A 16.7% lower dividend is expected at Keppel Corp mainly due to abandoned and delayed offshore oil-rig orders as crude oil prices remain at multi year lows.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}