Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 15, 2016

Week Ahead Economic Overview

After the IMF has downgraded its growth forecast for the global economy, data watchers are eagerly awaiting flash PMI results for the first available information on economic trends at the start of the second quarter. Meanwhile, the European Central Bank announces its latest monetary policy decision, while labour market and retail sales data are updated in the UK.

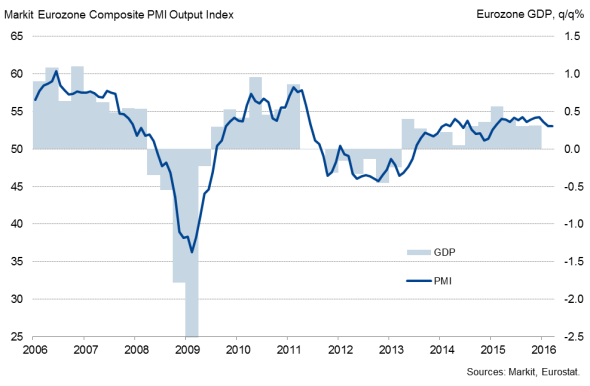

It is expected that the European Central Bank will leave monetary policy unchanged when it meets on Thursday. In March, the bank introduced more aggressive stimulus measures as inflation remained ultra-low and economic growth had been "weaker than expected" at the beginning of the year, according to Mario Draghi. However, the ECB's Nowotny stated that low inflation should not be "over-dramatized" and that the effect of the slump in oil prices should fade away in the summer, thereby automatically leading to higher inflation. Recent business survey data point to subdued growth in the first quarter of 2016, with PMI data consistent with growth of around 0.3%.

Eurozone economic growth and the PMI

The release of Markit's flash PMI data for the eurozone will meanwhile provide policy makers with the first available information on economic trends in the region at the beginning of the second quarter after in March the PMI failed to gain significant traction from February's 13-month low. Moreover, the European Commission publishes latest consumer confidence data, providing information on how confident consumers feel about the overall state of the economy and their personal financial situation. In March, the index fell to a 15-month low of -9.7.

In the UK, the Office for National Statistics releases updated labour market data on Wednesday, which will include important information on wage growth. The start of 2016 saw UK unemployment fall and employment hit an all-time high. While pay growth also showed signs of picking up, it remained muted by historical standards. However, there are signs that the labour market is slowing, with PMI data signalling the weakest rise in workforce numbers since the summer of 2013.

UK unemployment rate

The release of retail sales numbers will provide further information on the health of the UK's economy in the opening quarter of the year. Data for the first two months of the year suggest that sales are running 1.6% higher than in the fourth quarter, pointing to consumers remaining in an upbeat mood so far this year. However, there are increasing signs that households are growing concerned about incomes, which could weigh on spending in coming months.

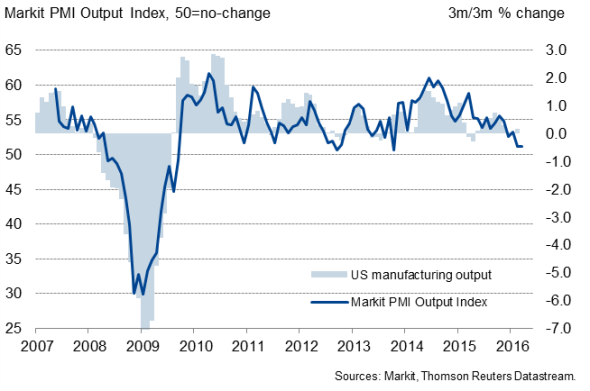

A big question mark hangs over the true performance of the US economy, with Markit's PMI data and the Atlanta Fed signalling a disappointing start to the year, while other institutions suggest the US economy grew robustly in the opening quarter of 2016.

Moreover, while the Fed's latest Beige Book highlights that manufacturing activity increased in most districts covered in late February and March, latest PMI data from Markit pointed to the sector's worst performance since late-2012, with subdued client spending patterns within the energy sector, ongoing pressure from the strong dollar, and general uncertainty about the business outlook continuing to weigh on industry during March, according to the business survey data. Markit releases flash US manufacturing PMI results for April on Friday.

US manufacturing output and the PMI

In Japan, manufacturing results for March suggested that the Bank of Japan may soon see the need for further stimulus, with the Nikkei PMI falling to its lowest level for over three years. Policy makers will therefore pay attention to Flash PMI numbers for April, which are out on Friday. The central bank ended its latest monetary policy meeting having taken no action but saying it was prepared to add more stimulus if required. The IMF has lowered its growth projection from +1.0% to +0.5% for 2016 and expects Asia's second-largest economy to contract by 0.1% in 2017.

Monday 18 April

Wholesale price numbers are updated in India.

In China, house price figures are released.

The National Association of Home Builders publishes its latest Housing Market Index.

Tuesday 19 April

The Bank of Korea announces its latest monetary policy decision.

Russia sees the publication of inflation, retail, unemployment and wage data.

Current account numbers are issued by Eurostat in the currency union.

ZEW releases economic sentiment numbers in Germany.

In the US, building permit and housing starts figures are out.

Wednesday 20 April

Japan sees the release of trade data.

Consumer price figures are issued in South Africa.

In Germany, producer price numbers are out.

Current account data are updated in Greece.

The Office for National Statistics issues latest labour market data, while Markit releases its latest UK Household Finance Index.

Latest jobless figures are out in Brazil.

Wholesale trade numbers are released in Canada.

Mortgage approval and existing home sales data are meanwhile issued in the US.

Thursday 21 April

Monthly GDP numbers are updated in Russia.

The European Central Bank announces its latest monetary policy decision. Moreover, consumer confidence data are issued by the European Commission.

France sees the publication of business confidence figures.

Meanwhile, public sector borrowing and retail sales figures are released in the UK. The latest Knight Frank UK House Price Sentiment Index is also issued.

Initial jobless claims numbers and results from the Philadelphia Fed manufacturing survey are out in the US.

Friday 22 April

Flash PMI results for April are released in Japan, Germany, France, the eurozone and the US.

In Italy, industrial orders and retail sales numbers are updated.

Meanwhile, Canada sees the publication of inflation and retail sales data.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}