Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 15, 2015

US industry woes add to growth worries

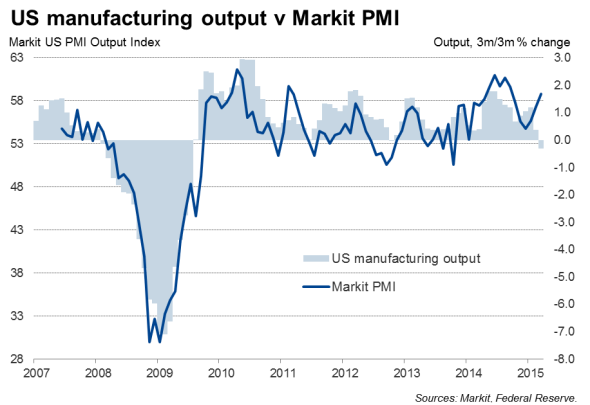

A steep fall in industrial production suggests the US economy is going through its worst growth patch since the financial crisis, dampening expectations of any imminent rate hike by the FOMC.

Industrial production fell 0.6% in March, according to official data from the Federal Reserve, missing expectations. Analysts polled by Reuters were anticipating production to have fallen by a mere 0.3%.

The decline was led by a 17.7% drop in oil and gas drilling, linked to the recent oil price slump. Manufacturing fared better, seeing a 0.1% increase in output, the first rise since November.

The data bode ill for gross domestic product. Looking at the three months to March, industrial production fell by just over 0.2% (an annualized decline of 1.0%), its worst performance since the second quarter of 2009. Sitting alongside a 1.3% quarterly drop in retail sales, which was the steepest decline since the first quarter of 2009, it's becoming increasingly clear that US economic growth slowed sharply in the opening quarter of the year.

Rate hikes postponed

This slowdown effectively kills any chance of policy makers hiking interest rates in June, and adds to fears about the corporate outlook. Worries have intensified that, not only are lower oil prices damaging the energy sector, but also that the dollar's strength is acting as a drag on the economy, hitting overseas earnings in particular.

A review of which companies are seeing the worst downgrades heading into the earnings season reveals that analysts have grown especially pessimistic about firms exposed to energy and basic materials over the past three months, owing to the oil price slump and continuing weakness in commodity prices in general.

However, more worrying in relation to the broader economic outlook is the growing pessimism in relation to the health of industrial companies, which reflects concerns about weakened demand and the impact of the strong dollar. Analysis of revisions to earnings estimates in fact shows that industrial stocks make up the largest proportion of the 10% of shares seeing the worst revisions.

If the earnings season shows corporate performance deteriorating to the extent signalled by the analysts' forecasts, rate hikes may well be postponed until next year.

Glimmers of hope

However, the possibility of interest rates rising later this year should not be completely ruled out. Both factory output and retail sales rose in March, suggesting the official data are starting to corroborate forward-looking survey data, which have strengthened in recent months. The big question is whether this nascent upturn will show further signs of gaining momentum.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-economics-us-industry-woes-add-to-growth-worries.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-economics-us-industry-woes-add-to-growth-worries.html&text=US+industry+woes+add+to+growth+worries","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-economics-us-industry-woes-add-to-growth-worries.html","enabled":true},{"name":"email","url":"?subject=US industry woes add to growth worries&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-economics-us-industry-woes-add-to-growth-worries.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+industry+woes+add+to+growth+worries http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-economics-us-industry-woes-add-to-growth-worries.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}