Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 15, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Short sellers return to Netflix as 'FANG' stock slips 18% post reaching all-time high in 2015

- Slowing PC sales add pressure to shorted tech stocks, AMD and Logitech

- Japanese Retailer,Genky sees fivefold increase in short interest as shares crater 60%

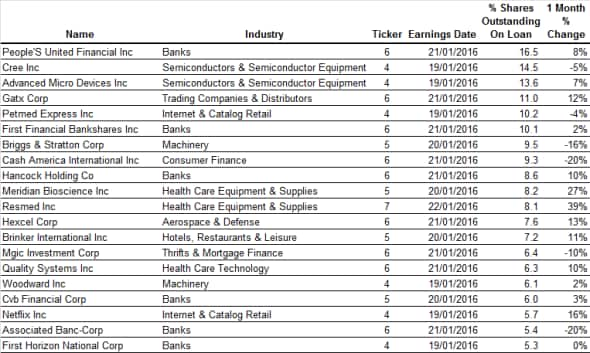

North America

Most shorted North America ahead of earnings this week is People's United Bank. Shares in the regional bank have fallen 10% since December 2015, with short interest climbing to 16.5% of shares outstanding on loan.

Second most shorted is LED lighting manufacturer Cree with 14.5% of shares outstanding on loan. The firm reported revenues for the previous quarter which declined 1%, while net income fell 25%. These results followed a business restructuring announced in June which combined have seen shares tumble by a third in total over the last 12 months.

Third most shorted ahead of earnings is Advanced Micro Devices (AMD) with 13.6% of shares outstanding on loan. Despite falling 25% year to date, shares in the chipmaker have rallied by 38% since July 2015.

Gatx, a North American provider of rail cars and locomotives has seen short sellers build up positions in the stock throughout the year, with short interest spiking higher to 11.3% of shares outstanding on loan. Shares have continued to fall, down 36% over the last 12 months. This has occurred as the US suffers a freight recession as a result of the commodities slump and falling energy prices.

Netflix one of the best performing stocks of the S&P 500 in 2015 and 'FANG' constituent are once again attracting short sellers with 5.8% of shares outstanding on loan. Short interest has increased to levels last seen in 2013 with the stock falling 18% from highs reached in December 2015.

However, the stock has faced more aggressive short selling campaigns in the past demonstrated by the chart above.

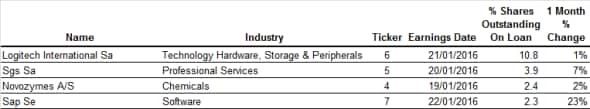

Western Europe

The most shorted stock in Europe ahead of earnings this week is Logitech International with 10.8% of shares outstanding on loan.

Logitech has previously featured among the most shorted in Europe but news of continuing declines in global PC shipments in 2015 has seen some weakness in the shares of the accessory maker in the new year.

Second most shorted ahead of earnings in Europe is SGS SA with 3.9% of shares outstanding on loan. The Geneva headquartered firm provides inspection, verification, testing and certification services and is exposed to global trade and shipping activity.

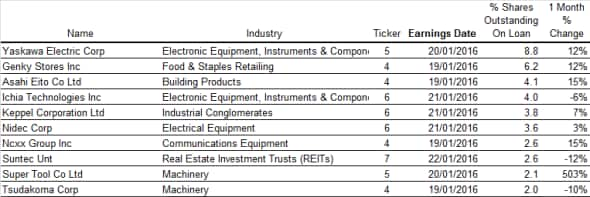

Apac

Leading the most shorted ahead of earnings in Apac is Japanese firm Yaskawa Electric Corp with 8.8% of shares outstanding on loan. After a two month stock rally in late 2015, the systems engineering, robotics and motion control firm has seen shares fall almost 15% from highs reached in December 2015.

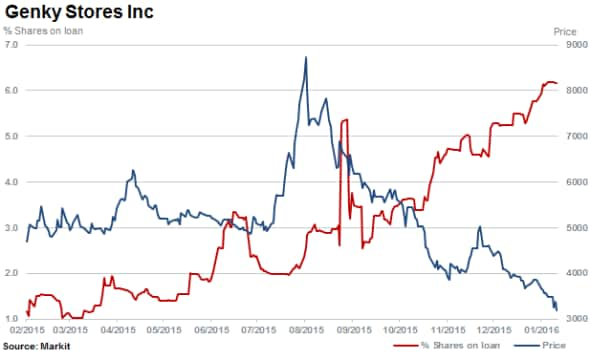

Japanese drug and pharmaceutical retailer Genky Stores is the second most shorted in Apac. Short interest has increased aggressively in the past 12 months rising fivefold to 6.2% of shares outstanding on loan. Shares meanwhile have plummeted 60% since spiking to a 52 week high in August 2015.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}