Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 14, 2016

Week Ahead Economic Overview

There will be a big focus on China during the week, as Asia's largest economy sees the release of retail sales, industrial production and third quarter GDP results. The Fed will meanwhile closely monitor latest industrial production and inflation data for more signs that the US economy is ready for a rate hike later in the year, while the Bank of England will be keen to see labour market and inflation updates. However, the policy highlight of the week comes from the ECB, which announces its latest monetary policy stance on Thursday.

Analysts will closely monitor a raft of Chinese data, including third quarter GDP, retail sales and inflation numbers for clues on the health of the economy.

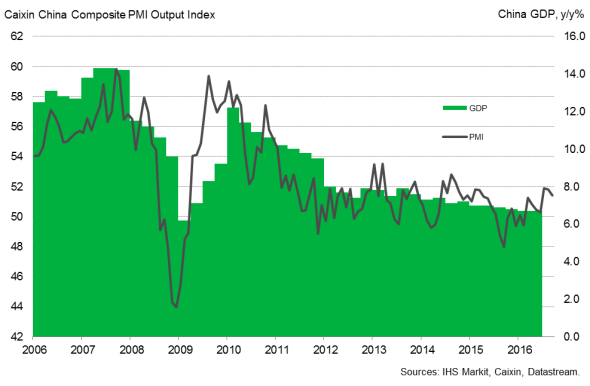

Chinese GDP and the PMI

On Wednesday, the National Bureau for Statistics publishes third quarter GDP data for China. Economic growth slowed to 6.7% in the first half of the year and we expect GDP growth to have slowed to 6.6% in 2016 and to 6.3% in 2017. For the third quarter, it is likely that unexpectedly weak trade data for September are causing net exports to play a mildly negative role in GDP growth, but the growth rate is widely expected to stick at 6.7%.

Although improved PMI data from Caixin and a modest acceleration in the official measure for industrial output pointed to a stabilising manufacturing sector, IHS Markit predicts that a softening housing market and construction will curtail industrial demand in the fourth quarter. Official industrial production numbers for September will be released on Wednesday.

Over in the US, the Fed will be looking for signs that the US economy is ready for a further rate hike later in the year. Expectations are growing that policy makers will tighten monetary policy in December, with initial jobless claims at a 43-year low and minutes from the Fed's September meeting revealing that the decision to keep rates unchanged was a "close call". One of the main reasons for the FOMC to leave rates unchanged was a lack of acceleration in inflation. The release of inflation data for September will therefore be an important steer for monetary policy. IHS Markit expects consumer prices to rise 1.1% in the third quarter and then accelerate to 1.8% in the final quarter of 2016.

US industrial production and capacity utilization results are meanwhile released on Monday. The US goods-producing sector has been struggling so far this year with latest official data showing a 0.4% drop in industrial output in August. Although Markit's US Manufacturing PMI fell to a three-month low in September, some comfort can be gleaned from the third quarter average, which was the best so far this year. Nonetheless, the low level of the headline PMI remains indicative of a near-stagnant manufacturing economy.

ECB policymakers meet as eurozone inflation remains well below the ECB's target of "below, but close to 2%", and the bank's macroeconomic projections suggest that the target won't be reached until at least 2018. With survey data also pointing to only lacklustre economic growth in the region, expectations have therefore been growing that the ECB will extend their QE programme.

However, economists polled by Reuters expect no immediate action, and for the ECB to keep its policy stance unchanged in October. They believe that the bank will instead announce an extension to the programme later in the year. Three days before the ECB meet, Eurostat publishes inflation figures for the currency bloc. A preliminary estimate showed consumer prices rising 0.4% in September.

The Bank of England continues to mull further policy stimulus and will be eager to see updated UK unemployment and wages data on Thursday. So far, the labour market has shown little sign of being impacted by the country's decision to leave the EU, with unemployment holding steady at an 11-year low of 4.9% in the three months to July. Moreover, in July alone, the jobless rate fell to 4.7% and latest survey data suggest that recruitment activity rebounded after a Brexit caused decline. It is therefore likely that unemployment will have held steady at 4.9% in the three months to August. However, wage growth slowed which - with the combination of rising import costs amid the weak pound - could constrain consumer spending in coming months.

UK unemployment rate

Monday 17 October

Industrial production figures and the latest Reuters Tankan results are out in Japan.

Industrial production numbers are released in Russia and the US.

Eurostat publishes inflation data for the currency union.

In Italy, trade figures are updated by ISTAT.

Tuesday 18 October

In Russia and the UK, inflation figures are updated.

Meanwhile, Brazil sees the release of retail sales numbers.

Manufacturing sales data are meanwhile issued in Canada.

Inflation and real earnings figures are published in the US alongside the latest NAHB Housing Market Index.

Wednesday 19 October

M3 money supply data are released in India.

Industrial output, retail sales and third quarter GDP numbers are published in China.

Meanwhile, retail sales, real wages and unemployment data are issued in Russia.

In South Africa, inflation and retail sales figures are out.

Unemployment numbers are updated in the UK.

Service sector data are released in Brazil.

The Bank of Canada announces its latest monetary policy decision.

The US sees the publication of building permit, housing starts and mortgage application figures.

Thursday 20 October

Employment data are published in Australia.

The European Central Bank announces its latest monetary policy decision. Moreover, Eurostat releases current account data for the eurozone.

In Germany, producer price figures are out.

The Office for National Statistics issues retail sales numbers for the UK.

Brazil's Central Bank announces its latest interest rate decision.

Initial jobless claims numbers are meanwhile out in the US.

Friday 21 October

In China, house price figures are issued.

Consumer confidence numbers are published in the euro area.

Public sector net borrowing data are meanwhile out in the UK.

Canada sees the release of inflation and retail sales numbers.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}