Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 14, 2014

Eurozone industrial production suffers largest monthly fall for two years

Eurozone industrial production fell more than expected in August, adding to fears that the region is facing a slide back into recession.

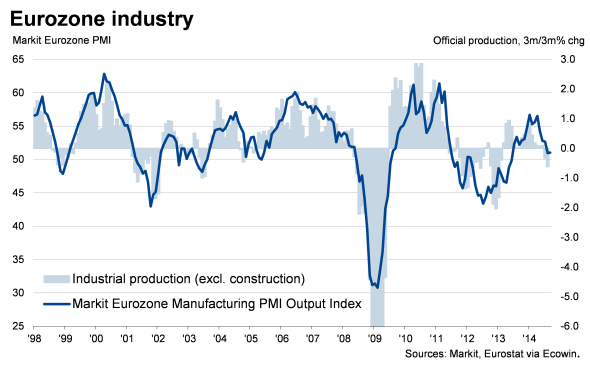

Official data from Eurostat showed industrial production down 1.8% in August, more than reversing a 0.9% increase in July. The fall was the steepest seen for almost two years and left output 1.9% lower than a year ago.

Particularly alarming was a 4.8% drop in capital goods such as plant and machinery, as this suggests companies are pulling back sharply on investment spending as the business outlook deteriorates.

The August drop in production leaves output in the third quarter so far running 0.5% below the second quarter, during which production was flat.

So far in the third quarter, production is running 0.8% behind the second quarter in Germany and Spain, and 0.6 lower in Italy. Output is meanwhile up 0.7% in France, but that needs to be looked at in the context of a 0.8% drop in the second quarter. Clearly the region as a whole is struggling to avoid contraction in the third quarter.

Recession fears grow, but downturn may be exaggerated

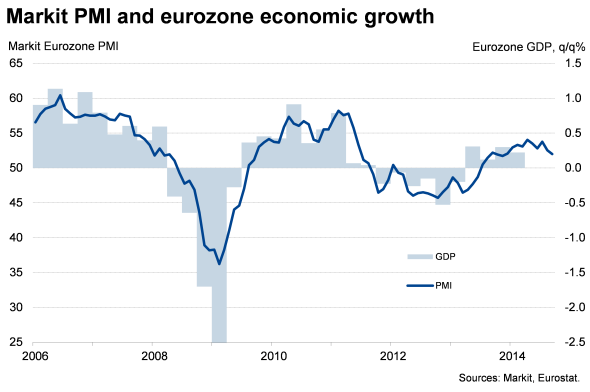

The disappointing industrial production data add to the chances that the eurozone could see a drop in GDP in the third quarter after GDP stagnated in the second quarter.

However, the official data may be exaggerating the deterioration in the region's economic health over the summer months. The PMI survey data suggest the stagnation of both GDP and industrial production in the second quarter was at least in part due to the official data being unable to properly account for extended shutdowns around public holidays, and the PMI numbers in the third quarter point to a modest rise in GDP. Importantly though, the PMI also shows that not all of the weakness in the official production data can be ignored, and that the growth trend has fallen markedly in recent months, piling pressure on policymakers to do more to stimulate the economy.

There's a chance that previously policy initiatives by the ECB will have helped lift economic growth in October. More will become clear with next week's publication of flash PMI survey data.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-economics-eurozone-industrial-production-suffers-largest-monthly-fall-for-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-economics-eurozone-industrial-production-suffers-largest-monthly-fall-for-two-years.html&text=Eurozone+industrial+production+suffers+largest+monthly+fall+for+two+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-economics-eurozone-industrial-production-suffers-largest-monthly-fall-for-two-years.html","enabled":true},{"name":"email","url":"?subject=Eurozone industrial production suffers largest monthly fall for two years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-economics-eurozone-industrial-production-suffers-largest-monthly-fall-for-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+industrial+production+suffers+largest+monthly+fall+for+two+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-economics-eurozone-industrial-production-suffers-largest-monthly-fall-for-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}