Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 14, 2015

Bond market in risk on mode ahead of Fed decision

US bond investors have increased their exposure to the riskiest end of the bond market in the week leading up to the Fed's first decision in four meetings.

- US ETF investors added $450m of high yield exposure last week

- Investors pulled money out of high yield ETFs heading into the last four Fed meetings

- HY bond yields are at three year highs according to Markit iBoxx $ Liquid High Yield index

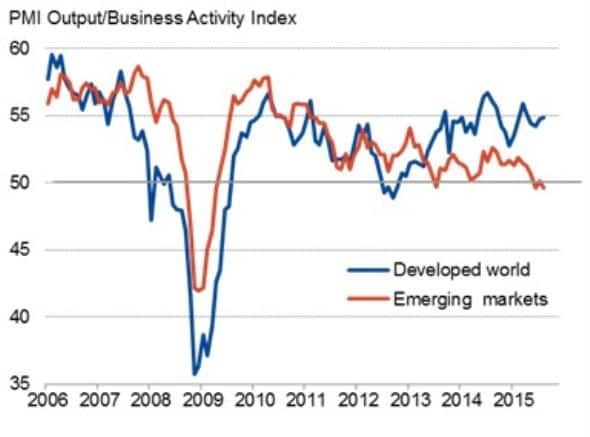

The upcoming Fed Open Market Committee meeting on Thursday was hotly tipped as the defining moment which would see the US start to raise interest rates from historical lows. The narrative has been thrown a curve ball in recent weeks with many now questioning the wisdom of raising interest rates in the wake of recent emerging market weakness. The Markit Emerging Market PMI indicated that these markets have experienced their worst patch since the global financial crisis in 2008, raising questions about the Fed's willingness to raise interest rates before the impact of emerging market weakness to US growth is better understood.

This uncertainty is also reflected in US treasury yields with the Markit iBoxx $ Treasuries index now trading 20bps off the levels seen earlier in the summer when the consensus for a September rate rise was much stronger.

ETF investors add to HY exposure

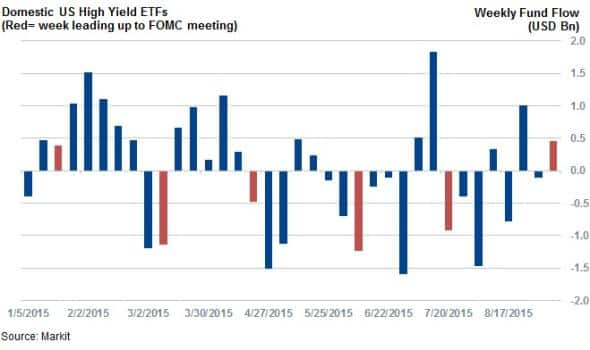

US ETF investors have increased their exposure to high yield bond in the week prior to this week's FOMC meeting, offering another indication of the market's lack of belief in a September rate hike. This relatively strong appetite for high yield bonds saw investors pile $450m of funds into the 28 US listed domestically exposed ETFs.

This was not the case in the four previous meetings as investors were weary of being exposed to the most volatile end of the US bond market, which would arguably feel the brunt of any hawkish Fed policy moves.

Outflows avoid losses

This desire to avoid high yield bonds in the lead up to the FOMC decision has paid out so far this year as the Markit iBoxx $ Liquid High Yield index has delivered negative total returns in the subsequent week during four of the last five meetings.

This underperformance averages out to a significant -0.4%, making the inflows witnessed over the last week even more significant given the large negative swings in the asset class over the last five meetings.

Already priced in?

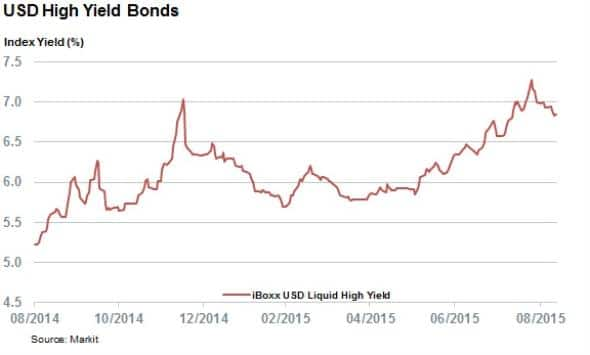

The bull case for the asset class can also be made given the fact that the yields of high yield corporate bonds are at three year highs after climbing 1.6% in the last 12 months.

While a large part of the recent yield spike has been driven by increased risk perceptions of energy and mining issuers, a portion of this trend can surely be attributed to investors taking the Fed's forward guidance on interest rates to heart.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-credit-bond-market-in-risk-on-mode-ahead-of-fed-decision.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-credit-bond-market-in-risk-on-mode-ahead-of-fed-decision.html&text=Bond+market+in+risk+on+mode+ahead+of+Fed+decision","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-credit-bond-market-in-risk-on-mode-ahead-of-fed-decision.html","enabled":true},{"name":"email","url":"?subject=Bond market in risk on mode ahead of Fed decision&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-credit-bond-market-in-risk-on-mode-ahead-of-fed-decision.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bond+market+in+risk+on+mode+ahead+of+Fed+decision http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-credit-bond-market-in-risk-on-mode-ahead-of-fed-decision.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}