Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 14, 2015

Euro bias rewards investors

Investors who have been overweight on European stocks with a high exposure to Emea sales have benefited from rising stock prices compared to other regional operating exposures.

- European stocks with the most domestic sales exposure have strongly outperformed

- Asian and Latin American sales exposure has hurt European stocks

- Returns from European stocks with North American sales exposure turned negative in June

European focus a clear winner thus far

Uncertainty continues to overhang global markets ahead of a potential US rate rise and concerns over the health of Chinese and emerging market economies. These factors and the ECB's €1 trillion stimulus programme have resulted in interesting stock return variations across European equities in recent months.

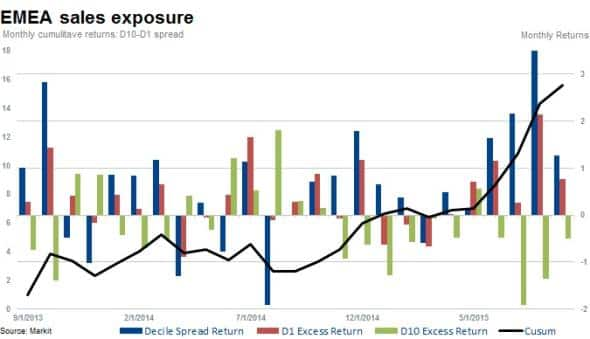

European stocks with greater Emea sales exposure have consistently outperformed peers with exposure to other regional markets over the last two years. Markit Research Signals' Emea sales exposure factor shows that European stocks with the greatest domestic exposure (decile 1) have on average outperformed those with the least exposure in the last 12 months (decile 10).

Across a universe of developed European names, a long-short strategy based on buying stocks most exposed to Emea sales and shorting those with the least exposure would have delivered 14.0% of cumulative returns over the last 24 months.

This strategy was especially successful during the month of August 2015, which saw a strong sell off in global equities on the back of a continued sell off in Chinese markets. This implies that investors are relatively more concerned with the ability of companies to sustain foreign based earnings - rewarding those with increased local sales exposure.

Regional differences

Across all factors in the Markit Research Signals library, the sales exposure factor featured predominantly in both the top and bottom five return spreads delivered in August 2015. This was across a developed Europe equity universe and dependent on the regional exposure.

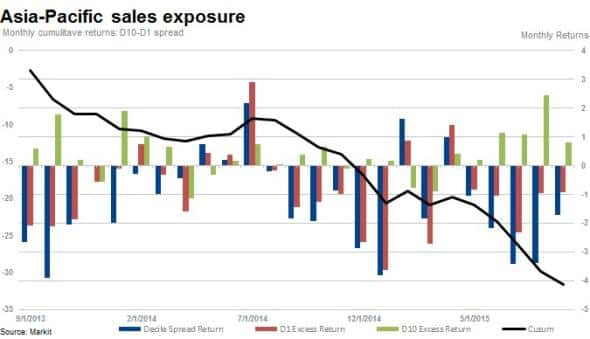

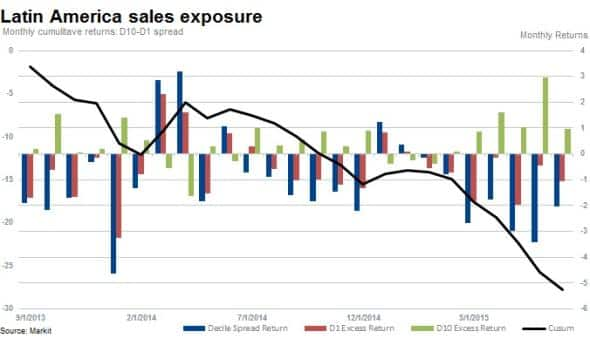

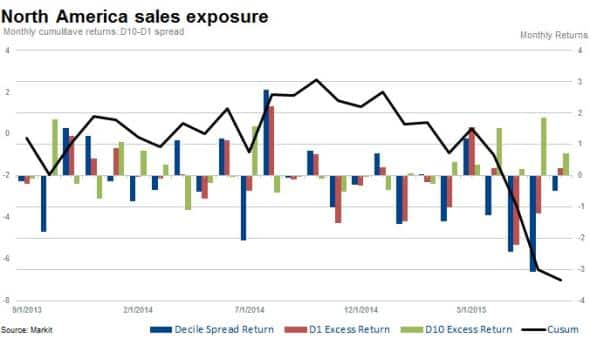

While European names most exposed to Emea delivered strong returns, their peers most exposed to Latin America, Asia-Pacific and North America drastically underperformed.

European stocks that have the most exposure to Apac have materially underperformed by a cumulative 32% in the last 24 months (when employing the same long-short strategy).

A similar trend has been seen with Latin American exposure. The factor exposed to North American sales has only recently ventured into negative territory. The long-short strategy in North and Latin America has delivered negative cumulative returns of 25.7% and 6.5%, respectively. over the last 24 months ending August 2015. Cumulative spread returns for North America, however. only turned negative in June 2015 after 18 months of outperformance.

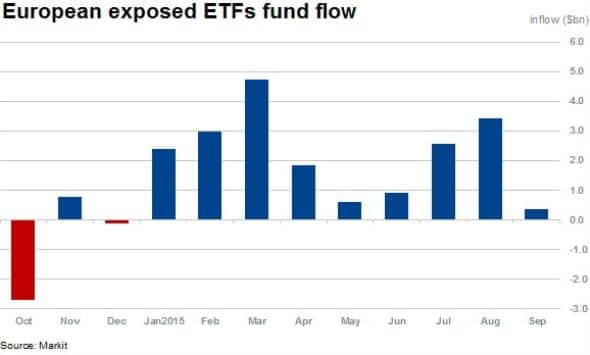

Investors flock to Europe focused ETFs

Broad European tracking ETFs have seen strong inflows year to date of $19.8bn, the largest year recorded thus far. Strong inflows have continued in the second half of the year with $2.5bn and $3.5bn recorded in July and August, respectively.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-Equities-Euro-bias-rewards-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-Equities-Euro-bias-rewards-investors.html&text=Euro+bias+rewards+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-Equities-Euro-bias-rewards-investors.html","enabled":true},{"name":"email","url":"?subject=Euro bias rewards investors&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-Equities-Euro-bias-rewards-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Euro+bias+rewards+investors http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092015-Equities-Euro-bias-rewards-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}