Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

STRUCTURED FINANCE COMMENTARY

Aug 14, 2017

Risk Intervention: CLO Managers Maneuver Dodd-Frank Hurdles

Despite the perceived threat of risk retention capital requirements to CLO issuance in 2017, managers have been resilient and versatile in adjusting to the new regulation. Origination projections ranging from $50-65 billion have been toppled as issuance has exceeded $60 billion moving into August. Post-Crescent Letter compliant deals have shown strong refinancing volume as 2015 vintage deals approach their call date. At the start of the year, the majority of issuers sought compliance via horizontal slices, but over time managers have created innovative vertical slice solutions via third-party financing. Additionally, positive news came from Europe this June as the STS ("Simple, Transparent, and Standardised") securitization regulation maintained 5% retention capital as compliant, despite word of a potential increase to levels as high as 20%.

Deals compliant via a horizontal slice have priced slightly wider given the nature of controlling interest in the deal from higher consolidation in the equity tranche. Issuance picked up drastically despite a slow start to the year as managers learned to navigate the post-Dodd Frank landscape.

Horizontal Slice:

A popular trend emerging amongst EU issuance is third-party retention fund structures sourcing long-term capital from private investors. Napier Park has introduced this model and retained compliant horizontal equity interests in Contego CLO IV and St. Paul's CLO V. Chenavari has also structured a similar retention vehicle in the EU earlier this year for Toro CLO 3. These transactions are seen as major developments in risk-retention compliance, displaying risk appetite for locking up capital in CLO equity tranches for long durations. TCI Capital Management also has $350 million in commitments to invest in third-party managed CLO equity.

Vertical Slice:

RBC has arranged a model for Venture XXVII CLO and HPS Loan Management 11-2017 for risk-retention via a vertical slice. A majority-owned affiliate (MOA) or capitalized-majority owned affiliate (C-MOA) will hold a Series A note that will receive 5% of interest/principal payments to the underlying debt tranches of the CLO. Jefferies has structured similar vehicles for the re-sets of Cathedral Lake II/III for Carlson Capital with an additional Series B note and collateral management fee cash flows. Nearwater Capital has also mobilized $2-3 billion for duration-matched repo funding targeting CLO vertical slices.

L-Shaped Slice:

Although its popularity remains strongest amongst CMBS transactions, $1.44 billion in re-set deals have also elected L-shaped slices to comply with risk retention in the U.S (Palmer Square CLO 2013-2, Palmer Square 2015-2, and AMMC CLO XIV).

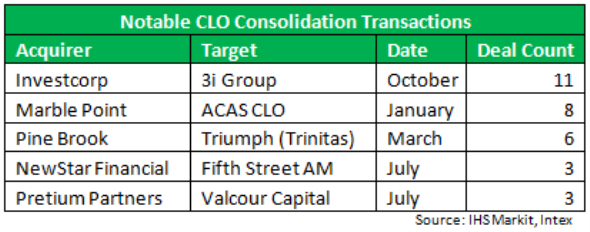

Consolidation:

2017 Debut Managers:

- Rockford Tower Capital (Rockford Tower CLO 2017-1)

- Antares Capital (Antares CLO 2017-1)

- Ellington (Ellington CLO 2017-1)

- AB Private Credit Investors (ABPCI CLO I)

- CBAM (CBAM 2017-1)

- Pacific Asset Management (Trestles CLO 2017-1)

- Nassau Corporate Credit (Nassau 2017-1)

IHS Markit's Securitized Products Pricing service provides independent evaluated pricing, sector level time series and transparency metrics across Agency Pass-Through, Agency CMO, Non-Agency RMBS, Consumer ABS, European ABS, CMBS, TruPS, CDO and CLO asset classes. For further information please email: USABSPricing@Markit.com

Paul Sloand, Associate, Securitized Products

Tel: +1 646 679 3434

paul.sloand@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-Structured-Finance-Risk-Intervention-CLO-Managers-Maneuver-Dodd-Frank-Hurdles.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-Structured-Finance-Risk-Intervention-CLO-Managers-Maneuver-Dodd-Frank-Hurdles.html&text=Risk+Intervention%3a+CLO+Managers+Maneuver+Dodd-Frank+Hurdles","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-Structured-Finance-Risk-Intervention-CLO-Managers-Maneuver-Dodd-Frank-Hurdles.html","enabled":true},{"name":"email","url":"?subject=Risk Intervention: CLO Managers Maneuver Dodd-Frank Hurdles&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-Structured-Finance-Risk-Intervention-CLO-Managers-Maneuver-Dodd-Frank-Hurdles.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk+Intervention%3a+CLO+Managers+Maneuver+Dodd-Frank+Hurdles http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-Structured-Finance-Risk-Intervention-CLO-Managers-Maneuver-Dodd-Frank-Hurdles.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}