Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 14, 2015

Eurozone sees only modest second quarter growth as France grinds to a halt

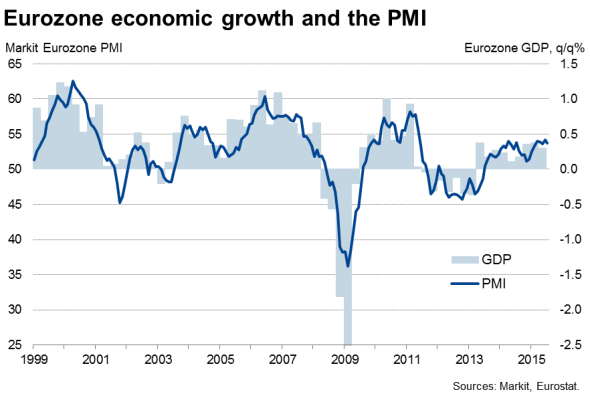

The eurozone economy grew slightly less than expected in the second quarter but nevertheless showed encouraging resilience against the backdrop of the Greek debt crisis.

The ECB will not be overly worried by the pace of economic growth coming in slightly below expectations, and will probably view the performance of the economy over the first half of the year as moderately encouraging given the headwind of the Greek crisis. If allowances are made for volatile GDP data so far this year in countries such as France and the Netherlands, the underlying trend over the first six months of the year is more positive. With PMI data remaining close to four-year highs in July, the region has started the third quarter with robust momentum, meaning the economy is on course to grow by 1.5% this year, which will most likely persuade the ECB that its current stimulus remains appropriately expansive.

However, the divergences in second quarter performances, notably the huge variation between France and Spain, will no doubt mean the ECB will show no respite in its calls for governments to match the central bank's stimulus with structural reforms to boost competiveness and productivity.

Modest recovery

Eurozone gross domestic product rose 0.3% in the three months to June, down slightly on the 0.4% rate of expansion seen in the first quarter.

The weaker-than-expected increase is largely attributable to France, where the economy has once again ground to a halt. France appears to have relapsed into its role of the sick man of the eurozone, with its economy stagnating after a 0.7% growth spurt in the first three months of the year, a revival which always looked too god to be true. If rising government expenditures are excluded, the French economy in fact contracted by 0.1% in the second quarter.

However, the disappointment was not confined to France, with growth in Italy of 0.2% coming in slightly behind expectations of a 0.3% rise. The upturn was driven by reviving consumption in the domestic economy, with trade flows acting an anchor despite the weakened currency providing exporters with a competitive advantage.

Growth in the Netherlands also missed consensus, slowing from 0.6% in the first quarter to 0.1%.

There was a more encouraging picture in Germany, which remained a key driver of the Eurozone economy in the second quarter given its sheer size, despite slightly missing expectations (albeit in line with survey signals). Gross domestic product increased 0.4% on the back of improving exports, buoyed no doubt by the depreciation of the euro so far this year. Even the German data included some worrying aspects, with investment acting as a drag, but any downturn in capital expenditures may prove temporary now that the shadow of the Greek debt crisis appears to have lifted.

The star performer among the euro area's largest economies is Spain, where the government estimates GDP to have leaped 1.0% in the second quarter. Survey data point to Spanish companies enjoying robust growth of demand at home as well as an upturn in exports. An unlikely other shining light was Greece, where GDP rose 0.8%. However, a record plunge in the PMI data in July indicates that this performance could be reversed in the third quarter.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-Eurozone-sees-only-modest-second-quarter-growth-as-France-grinds-to-a-halt.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-Eurozone-sees-only-modest-second-quarter-growth-as-France-grinds-to-a-halt.html&text=Eurozone+sees+only+modest+second+quarter+growth+as+France+grinds+to+a+halt","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-Eurozone-sees-only-modest-second-quarter-growth-as-France-grinds-to-a-halt.html","enabled":true},{"name":"email","url":"?subject=Eurozone sees only modest second quarter growth as France grinds to a halt&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-Eurozone-sees-only-modest-second-quarter-growth-as-France-grinds-to-a-halt.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+sees+only+modest+second+quarter+growth+as+France+grinds+to+a+halt http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-Economics-Eurozone-sees-only-modest-second-quarter-growth-as-France-grinds-to-a-halt.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}