Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 14, 2015

Market risk appetite diverges

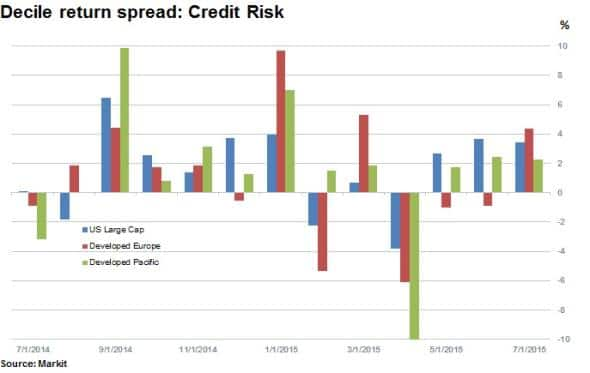

Equity markets in the US and Asia have been stuck in risk off mode over the last 12 months, demonstrated by the fact that companies with low CDS spreads have outperformed their peers with high spreads.

- Low risk equities have outperformed high risk stocks in Asia and North America by 20% and 17.8% in the 12 months

- Low risk European shares have not delivered the same relative returns

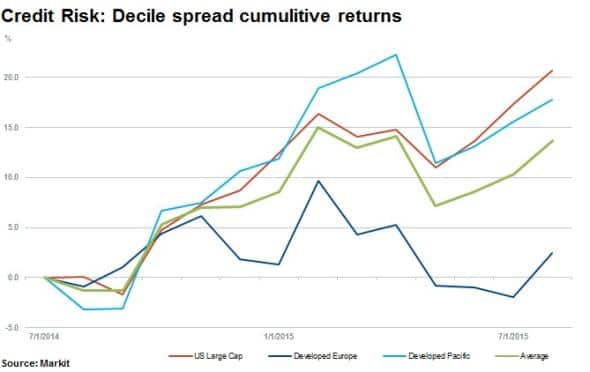

- Risk averse trends in US and Asian markets driven cumulative returns approaching 20%

Risking it on credit

Gauging the market's risk appetite is never an easy task, but the market's perceived risk of default, implied by credit default swap (CDS) spreads, does go some way to take the pulse.

Measured by implied risk based on CDS spreads, Markit's Research Signals' Credit Risk factor provides an efficient way to rank equities based on a company's perceived ability to pay its debts.

Universes are limited to those that have an active CDS market, but over 900 shares currently have an active CDS market associated with the corresponding equity instrument. The US is the best represented market with 408 shares, but the analysis still holds in Europe and Asia with over 250 names represented in both universes.

Over the last 12 months, using credit risk as a basis for a long short strategy over three major stock universes has yielded strong returns in the US and Asia. A strategy in which investors take a long position in the 10% of shares with the lowest CDS spread while shorting the 10% with the highest most risky spreads would have returned an average of 14% across all three regions.

But these returns are not uniform globally, with the returns delivered by the strategy in the US (20%), and Asia (17.8%) far outpacing those seen in Europe (4.3%)

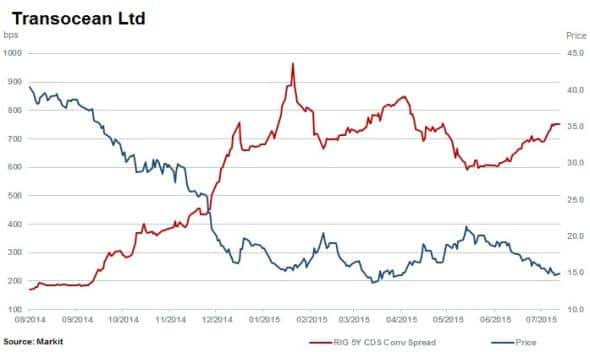

Returns in the US have generally been driven by names with relatively less credit worthiness, as seen by the fact that the equities with the highest CDS spreads have fallen in the last 12 months.

Energy and Telecommunication Services are the most represented among this group with Transocean Ltd earning the lowest credit risk rank. US Non-Cyclical Goods & Services and Healthcare are currently the most attractively ranked sectors.

Overall in the Apac region, low credit quality names have underperformed in recent months; driving the majority of factor returns in the region.

Within the Developed Pacific universe, according to factor rankings, Utilities are currently the most attractive while Financials and Energy are the least. In terms of country rankings, Hong Kong, which has a lot of exposure to China is the least attractive (riskiest) market overall, followed by Singapore which is also relatively exposed to China.

On the other end of the risk scale Japan currently ranks the most attractive.

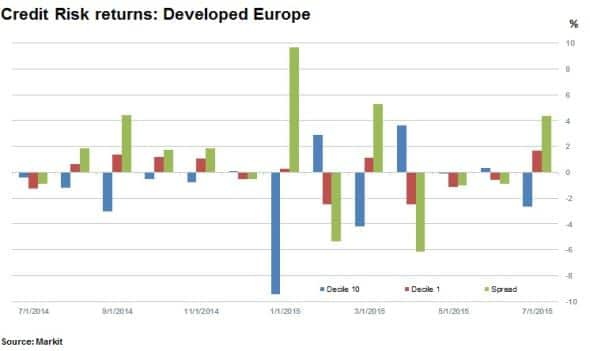

European equities with a higher credit risk ranking have outperformed so far in July, indicating that investors may be flocking to quality. Interestingly, this has reversed the cumulative monthly performance year to date, turning to positive 2.4% on a spread return of 4.3% half way through July.

Materials major Vedanta Resources, one of the lowest ranking names currenlty in Europe (poor credit risk) has seen its shares shed 12% in July alone.

Overall the sectors driving credit trends in Europe are Healthcare and Financials which are the most and least attractive sectors respectively.

As for Greece, the four companies which rank in the universe earn the highest possible credit risk rank of 100. Beyond Greece, Portugal also ranks unattractively with companies such as Banco Comercial and Banco Bpi in the high risk tenth decile.

Sweden and Switzerland are the most attractive countries by aggregate Credit Risk ranking in Europe.

Research Signals

With investment signals covering more than 30,000 securities in 80 countries to support security selection and strategy development, Research Signals provide tools to enable performance analysis, research, idea generation, back testing, portfolio exposure analysis and bespoke model development.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-equities-market-risk-appetite-diverges.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-equities-market-risk-appetite-diverges.html&text=Market+risk+appetite+diverges","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-equities-market-risk-appetite-diverges.html","enabled":true},{"name":"email","url":"?subject=Market risk appetite diverges&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-equities-market-risk-appetite-diverges.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Market+risk+appetite+diverges http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072015-equities-market-risk-appetite-diverges.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}