Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 15, 2015

Australia's commodities exposure drives credit risk

The global commodities slump has seen Australian corporate credit risk surge over the last 12 months.

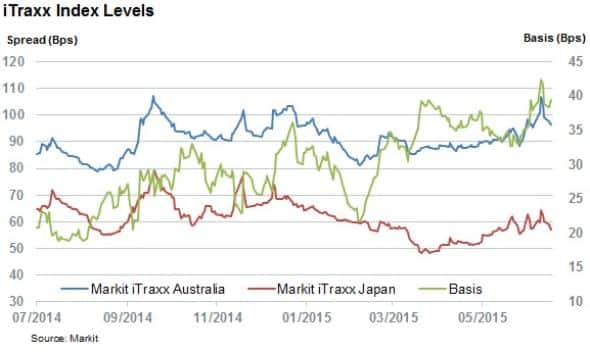

- The Markit iTraxx Australia index has risen by 12bps in the last year to date

- The basis between Australian and Japanese credit has doubled in the last 12 months

- Natural resources exposed names have led the widening

Natural resources represent over half of all Australian exports, which is making both investors and policy makers wary in the wake of the recent commodities slump. 15 years ago, natural resources made up just 32% of all Australian exports, and the growing reliance on exports for the country's tax base has seen a former government adviser liken the country to a "banana republic".

This reliance is best demonstrated by the fact that the country's tax income fluctuates by A$10bn for every $10 swing in the price of iron ore. That commodity currently trades at a seven year low of $44 per tonne, down from $95 12 month ago. Weak Chinese demand has seen some industry analysts forecast a fall below $40 per tonne in the coming year.

Australia's economic struggles have only been compounded by the continuing weakness in coal and oil.

Australian credit risk surges

The country's reliance on natural resources has also seen investors treat Australian corporate credit with increased risk in the last 12 months. Australian corporate credit risk, as gauged by the Markit iTraxx Australia index which tracks liquid CDS spreads for Australian companies, has jumped by 12bps in the last 12 months to 97bps.

The recent 52 week high was registered last week when the Chinese stock market crash sent many commodities to new recent lows.

Australia's surging corporate credit risk marks a strong contrast with Japanese fortunes, as the Japan iTraxx index has fallen by 7bps over the same period. This means that the extra protection required by investors to protect Japanese corporate credit over Australian issues has doubled in the last 12 months to 39bps.

Commodities drive surge

Not surprisingly, mining and oil firms have been driving much of the credit deterioration trend as three of the five constituents of the index seeing the largest amount of credit deterioration in the last 12 months.

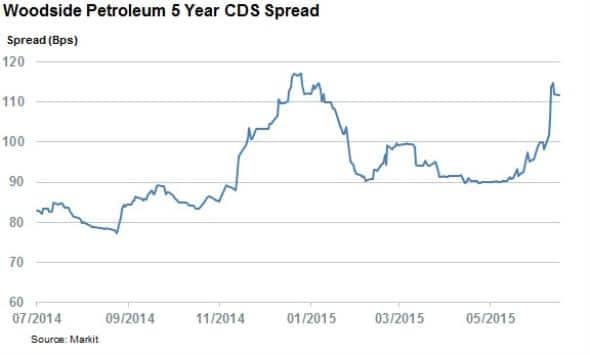

The worse credit deterioration in the natural resources spaces was seen in Woodside Petroleum whose CDS spread has jumped by a quarter in the last 12 months to 106bps.

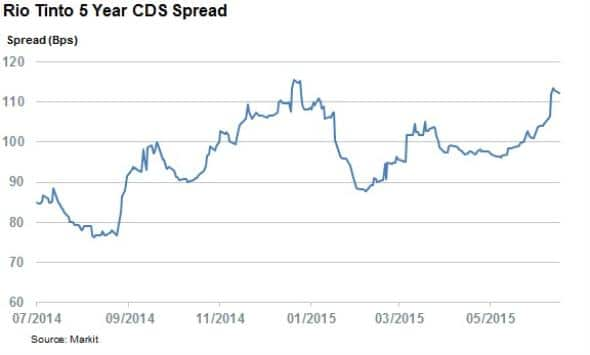

Mining credit deterioration was led by industry giants BHP Billiton and Rio Tinto whose CDS spread have jumped by 21bps and 19bps respectively. In terms of credit risk, Rio Tinto is seen as the riskier of the two with a CDS spread of 107bps.

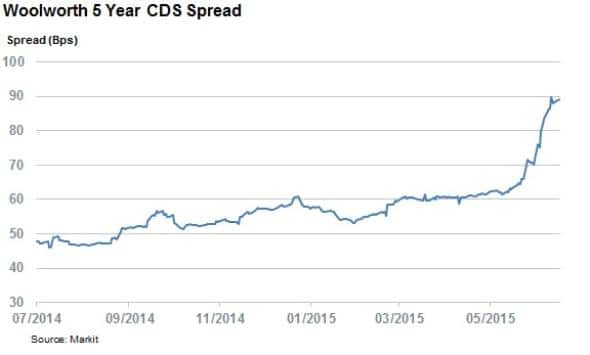

Australian consumers have also been feeling the commodities driven economic slump and this has seen the country's largest retailer Woolworth's lead the credit deterioration. 5 year CDS spreads in the retailer have surged by the 39bps to 87bps in the last 12 months. It's worth noting that the widening seen in the last few weeks appears to be linked to reports of a potential takeover from US private equity firm KKR.

The other large Australian retailer, Westfarmers, has also seen its CDS spreads widen significantly, with the 5 year spread jumping 19bps to 72bps. Westfamer also has exposure to the natural resource sector through its chemicals and resources divisions. These businesses contributed around 11% of the group's ebitda last year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Credit-Australia-s-commodities-exposure-drives-credit-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Credit-Australia-s-commodities-exposure-drives-credit-risk.html&text=Australia%27s+commodities+exposure+drives+credit+risk","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Credit-Australia-s-commodities-exposure-drives-credit-risk.html","enabled":true},{"name":"email","url":"?subject=Australia's commodities exposure drives credit risk&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Credit-Australia-s-commodities-exposure-drives-credit-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia%27s+commodities+exposure+drives+credit+risk http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Credit-Australia-s-commodities-exposure-drives-credit-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}