Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 14, 2015

US retail sales rise for first time in four months, but trend worst since 2009

A rebound in retail sales in March provides evidence that the US economy is pulling out of a soft patch seen at the start of the year. The upturn plays into the hands of policymakers wanting to start raising interest rates in coming months. However, the revival is far from convincing, which suggests that the majority of rate setters will want to see further evidence of a strengthening economy before committing to any tightening of policy.

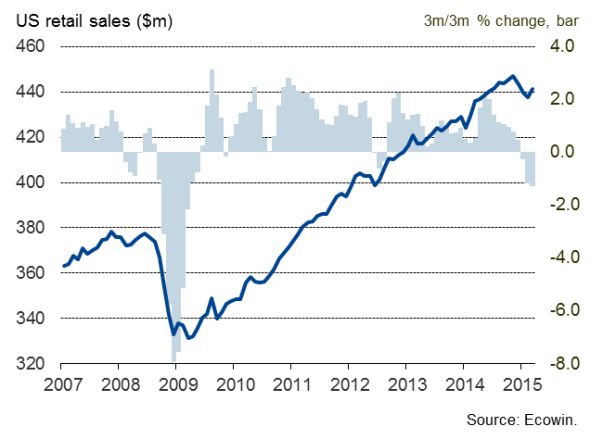

Total retail sales

US retail sales rose 0.9% compared to February, according to official data. The upturn points to a welcome reversal of consumer spending, coming on the heels of three successive months of sharply declining sales.

The retail sales data also support survey evidence which indicate that the slowdown seen in the opening months of 2015 is likely to have been temporary and that, after a weak first quarter, growth looks set to pick up in the second quarter.

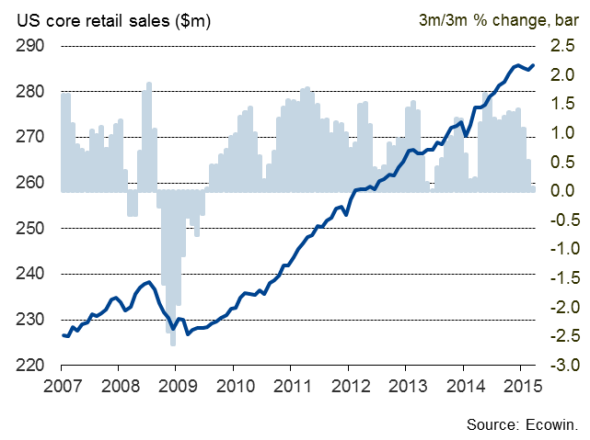

Core retail sales

With the timing of the first rate hike by the Federal Open Markets Committee 'data-dependent', the improvement in retail sales after the weakness seen at the turn of the year adds to the likelihood of policymakers voting to hike rates this year.

The latest FOMC minutes showed that policymakers are currently split on when to start tightening policy. Some FOMC members are already keen to start raising rates as early as June while others, worried that the economy may have started to slow and sensing few signs of inflation picking up any time soon, consider it better to wait, possibly until next year.

However, the sales rebound is far from convincing. Even with the March upturn, sales are down 1.3% in the first quarter, which is the steepest fall since the first quarter of 2009, when the global financial crisis was at its peak. Core sales, which strip out volatile items such as cars, gasoline, building materials and food services, rose just 0.3% in March, leaving sales up just 0.1% in the first quarter. That compares with a 1.4% rise in the final quarter of last year.

Clearly, the underlying sales trend remains weak, which augurs for policymakers to wait for further evidence on the health of the economy. More insight will be provided with tomorrow's industrial production data, which also suffered declines in the three months to February.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-economics-us-retail-sales-rise-for-first-time-in-four-months-but-trend-worst-since-2009.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-economics-us-retail-sales-rise-for-first-time-in-four-months-but-trend-worst-since-2009.html&text=US+retail+sales+rise+for+first+time+in+four+months%2c+but+trend+worst+since+2009","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-economics-us-retail-sales-rise-for-first-time-in-four-months-but-trend-worst-since-2009.html","enabled":true},{"name":"email","url":"?subject=US retail sales rise for first time in four months, but trend worst since 2009&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-economics-us-retail-sales-rise-for-first-time-in-four-months-but-trend-worst-since-2009.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+retail+sales+rise+for+first+time+in+four+months%2c+but+trend+worst+since+2009 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042015-economics-us-retail-sales-rise-for-first-time-in-four-months-but-trend-worst-since-2009.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}