Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 13, 2015

Japanese dividends attract foreign capital

Japan's efforts to lure foreign investors to equity markets have thus far proven successful; however, ETF flows have stalled after a 15% market rally.

- $15.9bn of inflows seen year to date into foreign domiciled ETFs exposed to Japan

- Foreigners flock to Japan, representing two-thirds of inflows and 50% of the Nikkei 400 ETF AUM

- Nikkei 400 dividend growth expected to outpace the 225 as companies adjust policies

Foreign investors struck by Abe's cupid

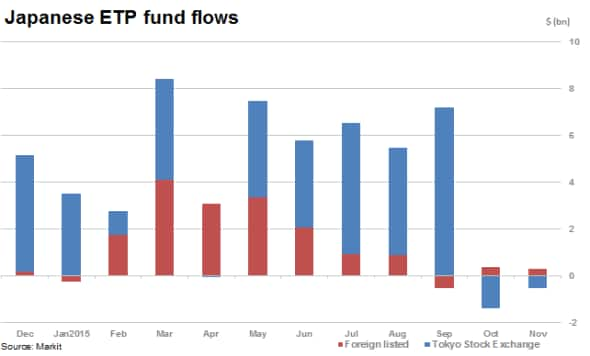

Japanese ETFs have seen tremendous growth in the last five years with AUM growing almost fourfold since 2010 from $47.5bn to reach $198.1bn currently. Inflows year to date, $47.8bn, have already exceeded the total managed by the asset class only five years ago. October did see the trend halt, however, as Japanese funds saw their first monthly outflow in over a year with $157m worth of outflows.

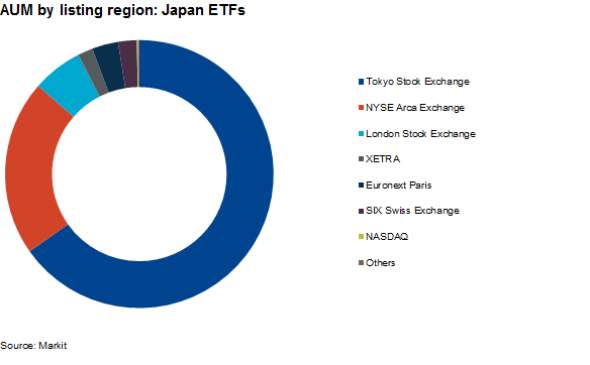

Outflows look set to continue in November as local investors lock in profits after a ~15% rally in Japanese markets while foreign investors continued to buy into non-Japanese listed ETFs. These foreign investors represent a third of the year to date inflows and a representative portion of the AUM of Japanese tracked ETFs.

Growth of the Nikkei 400

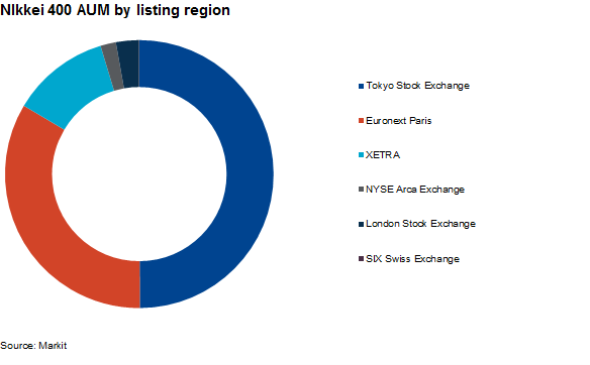

One particular type of product that has resonated well with investors has been the newly launched Nikkei 400.

The index, aimed at attracting foreign capital by including constituent companies that deliver consistently higher returns and corporate governance metrics, seems to be working.

Foreigners have made up two-thirds of year to date inflows into Nikkei 400 ETF products and represent 50% of current AUM, which now stands at $8.7bn. This represents 4.4% of total Japan ETF AUM, after the index only launched in 2014 with subsequent ETF product launches.

Nikkei 400 paying dividends

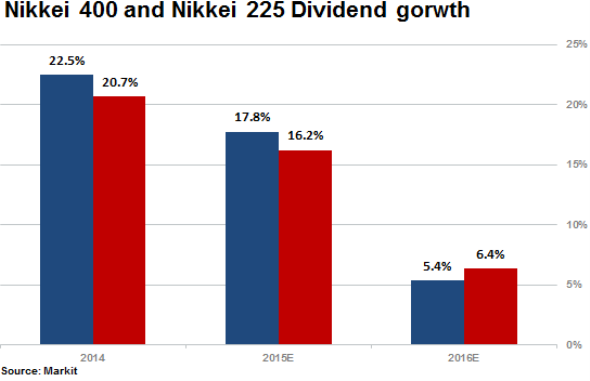

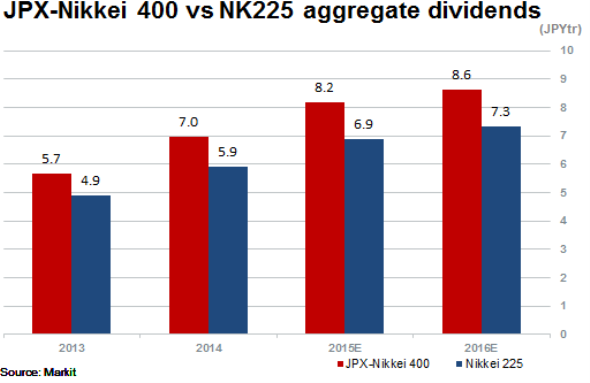

In line with the Nikkei 400's objectives of higher shareholder returns, Markit Dividend Forecasting is expecting dividend growth for the Nikkei 400 to once again outstrip that of the Nikkei 225 index in 2015. Dividend growth of 17.8% and 16.2% is expected for the Nikkei 400 and Nikkei 225, respectively, for 2015, though reducing thereafter.

Strong dividend growth in 2014 and 2015 has been motivated by policy, aimed at attracting capital and has been supported by large exporters lifting pay-outs, in line with earnings outperformance on the back of a depreciating yen.

However, Japanese companies' capacity to increase payments to shareholders is expected to stall somewhat in the coming fiscal year as the aggregate payments made by Nikkei 400 firms is expected to grow by 5.4%, a third of the growth rate forecasted in the current fiscal year.

Despite the slowing growth rate, the

Further strength in the US dollar on the back of a potential rate rise could offset weaker demand emanating from a cooling Chinese market.

*To receive more information on Securities Finance, Research Signals, Exchange Traded Products, Dividend Forecasting or our Short Squeeze model please contact us

To read this article on our commentary website please click here.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-japanese-dividends-attract-foreign-capital.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-japanese-dividends-attract-foreign-capital.html&text=Japanese+dividends+attract+foreign+capital","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-japanese-dividends-attract-foreign-capital.html","enabled":true},{"name":"email","url":"?subject=Japanese dividends attract foreign capital&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-japanese-dividends-attract-foreign-capital.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+dividends+attract+foreign+capital http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-equities-japanese-dividends-attract-foreign-capital.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}