Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 13, 2015

Railroad bonds avoid equity woes

Railroad shares have underperformed the rest of the transportation universe, but their bonds have so far proved resilient to the downturn.

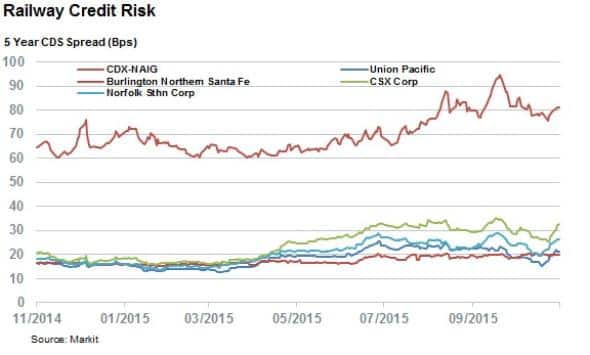

- The negative basis between investment grade and railway CDS has grown in the last year

- CDS spreads still indicate AA ratings across the four largest NA railway operators

- Norfolk Southern credit risk surged when news of a potential takeover came to light

Railway firms have had a tough 2015 so far as falling commodities price hurt some of their steadiest and most profitable contracts. To this end, the railway stocks that make up the S&P Select Transportation index have seen their shares fall by 25% on average year to date, twice the average seen in the index overall.

While these share price declines are in line with similar moves in shares with heavy exposure to the commodities space, bond investors have shown much more patience when dealing with railway firms as the credit risk of railway firms has remained less than the rest of the investment grade market.

CDS spreads rise moderately

While the average CDS spreads across the four largest, most liquid US railway firms (Union Pacific, Burlington Northern, CDX and Norfolk Southern) has jumped from 18bps to 25bps in the last 12 months, this jump has trailed the rise in credit risk seen in the rest of the investment grade universe. This means that the negative basis between the average railway CDS spreads and that of the Markit CDS North American Investment, which measures the "cheapness" of railway CDSs to that of the rest of the investment grade universe has grown from -46bps to -56bps in the last 12 months.

Even with the recent slight rise in CDS of CDS spreads across the sector, CDS spreads across all four railway operators imply a credit rating of AA, solidly in investment grade territory.

Bonds also show same trend

Cash bonds also paint the same picture as the asset swap spread of the Markit iBoxx $ Domestic Industrial Transportation index, of which railway firms make up half the constituent issues, has stayed consistently below the rest of the investment grade corporate bond universe as tracked by the iBoxx $ Domestic Non-Financial index.

If anything the trend has grown as the negative basis now stands at 22bps, up from 18bps at the start of last November.

Norfolk Southern bucks the trend

One firm that has bucked the trend somewhat in recent weeks has been Norfolk Southern. The firms has seen its CDS spreads jump after reports that the firm had held talks with Canadian firm Canadian Pacific about a possible tie-up. This sent Norfolk's CDS spread sharply upwards with the firm's spread now at 26.7bps, up from less than 20bps at the start of the month.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Credit-Railroad-bonds-avoid-equity-woes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Credit-Railroad-bonds-avoid-equity-woes.html&text=Railroad+bonds+avoid+equity+woes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Credit-Railroad-bonds-avoid-equity-woes.html","enabled":true},{"name":"email","url":"?subject=Railroad bonds avoid equity woes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Credit-Railroad-bonds-avoid-equity-woes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Railroad+bonds+avoid+equity+woes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Credit-Railroad-bonds-avoid-equity-woes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}