Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 13, 2015

Oil stumps credit rally; Rolls Royce credit surges

Another setback in oil prices is affecting US HY and inflation expectations ahead of December's expected Fed rate hike, while Rolls Royce gets caught up in the global market slowdown.

- Markit iBoxx $ Liquid High Yield index spread widened 29bps over the past week

- Rolls Royce 5-yr CDS spread widened 25% on the back of slowing global demand notice

- Markit Research Signals has issued an alert on Qatar National Bank on the back of heightened credit risk.

Oil drag

Reports from oil cartel OPEC and the International Energy Agency this week suggested that even though demand is expected to pick up in 2016, oversupply remains prevalent. The news put further pressure on oil prices, sending WTI crude down to $42 per barrel, hitting 11 week lows.

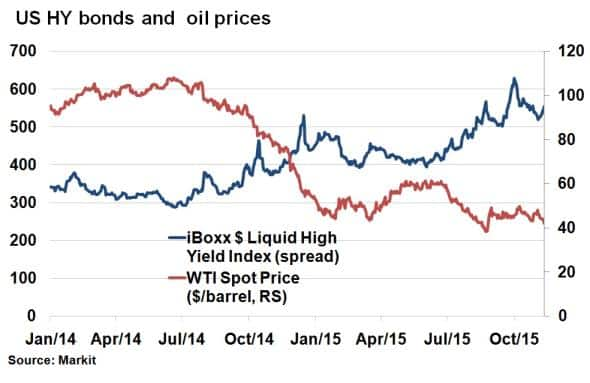

On the back of falling oil prices, the Markit iBoxx $ Liquid High Yield index saw bond spreads widen 29bps over the past week, halting October's credit rally. 12% of the index is weighted towards the oil & gas sector, so naturally a close relationship is maintained. Constituents include many nimble shale gas producers who are highly dependent on oil prices to maintain operations. A spate of defaults has the potential to trigger contagion in the US corporate bond market, unwinding much of the economic progression made by the US since the financial crisis.

Interestingly spreads are already 15bps wider than they were when the price of oil hit six year lows of $38 per barrel on August 26th, suggesting market volatility and slowing global trade are also negatively impacting other sectors in the high yield space.

Falling oil has also gone hand in hand with the broader commodities market. The Bloomberg commodity index is at five year lows, and this has had a drag on inflation in the US. In fact the 5-Year, 5-Year Forward Inflation Expectation Rate has started to fall again, from 1.93% to 1.85% over the past week, just as the Fed looks set to hike rates in December.

Not on a roll

As we have seen over the past few months with Glencore, Volkswagen and Valeant, idiosyncratic risk in credit markets is on the rise.

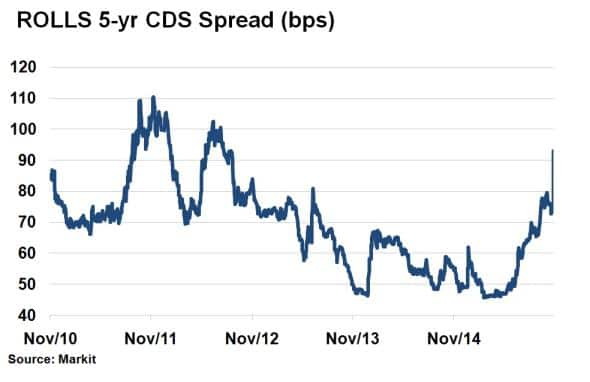

This week marked a turn for British engineering firm Rolls Royce, which issued a profit warning on the back of weaker global demand in some of its key markets.

Its share price plunged and Rolls Royce's 5-yr CDS spread (a measure of perceived credit risk) widened 18bps to 93bps (25%), the highest level in three years and double that seen just six months ago. The level implies that Rolls Royce, an A rated firm, hovers one notch above junk status.

Qatar National Bank

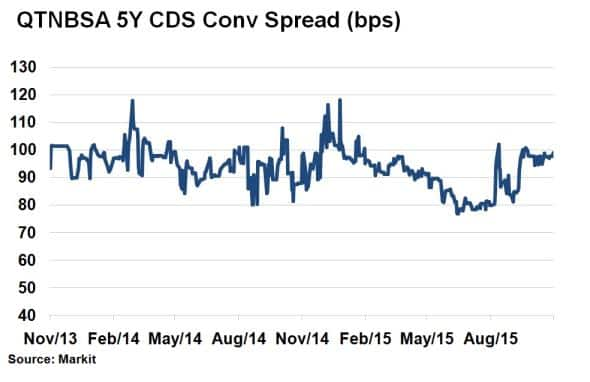

The Gulf region's largest lender, Qatar National Bank (QNB), has seen its 5-yr CDS steadily widen over the past few months. The 20bps rise, coupled with a steady steepening of the credit curve has prompted the Leading Risk Indicators within Markit's Research Signals factor platform to issue a renewed alert on the credit, expecting further deterioration.

Already Qatar's largest Bank, the company has had its sights on expanding aggressively abroad with Turkish Finansbank the latest to be touted. With aims of becoming the largest bank in the MEA region, credit risk has increased.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-credit-oil-stumps-credit-rally-rolls-royce-credit-surges.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-credit-oil-stumps-credit-rally-rolls-royce-credit-surges.html&text=Oil+stumps+credit+rally%3b+Rolls+Royce+credit+surges","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-credit-oil-stumps-credit-rally-rolls-royce-credit-surges.html","enabled":true},{"name":"email","url":"?subject=Oil stumps credit rally; Rolls Royce credit surges&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-credit-oil-stumps-credit-rally-rolls-royce-credit-surges.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+stumps+credit+rally%3b+Rolls+Royce+credit+surges http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-credit-oil-stumps-credit-rally-rolls-royce-credit-surges.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}