Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 13, 2015

Week Ahead Economic Overview

In the US, the Federal Reserve will be watching inflation and industrial output numbers for more information on the health of the US economy. The Bank of Japan meanwhile announces its latest monetary policy decision, with the country also seeing the release of third quarter GDP results. Inflation figures are published in the eurozone and the UK.

Despite US economic growth slowing (as flagged ahead by Markit's PMI), expectations are growing that the Federal Reserve will start raising interest rates before the end of the year. Fed chair Janet Yellen told a Congressional committee that a rate hike in December is a "live possibility" and a bumper jobs report added to signs that the Fed may start tightening monetary policy sooner rather than later.

Policy makers will therefore be watching the release of US consumer price and industrial output data during the week. While the rate of inflation dropped to zero in September, core inflation climbed to 1.9%. Economists polled by Thomson Reuters expect consumer prices to have increased by 0.1% in October.

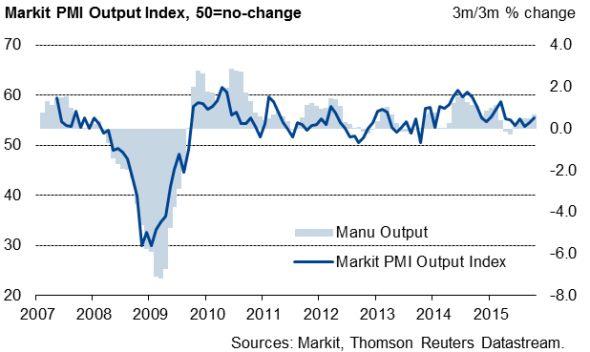

Industrial output numbers are released by the Board of Governors of the Federal Reserve just a few hours after the inflation figures are out. Industrial production has declined in each of the past two months, but latest PMI data from Markit showed that the sector rebounded in October, with the pace of output growth the quickest for seven months. A reasonably strong upturn in new business volumes moreover suggests that growth should be maintained as we move towards the end of the year.

Manufacturing output and the Markit PMI

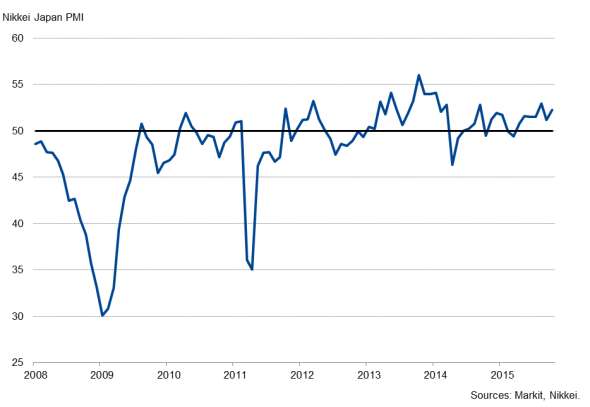

The Cabinet Office publishes third quarter GDP results in Japan on Monday, with a rebound on the cards after the economy contracted 0.3% in the three months to June. The Nikkei PMI surveys, compiled by Markit, indicate that Japan has enjoyed modest economic growth in the three months to September, with an acceleration signalled at the start of the fourth quarter. Following the release of GDP numbers, the Bank of Japan announces its latest monetary policy decision on Thursday.

Nikkei Japan PMI

In the eurozone, the European Central Bank (ECB) will be closely watching the release of inflation data, out on Monday. It is a possibility that the ECB will announce an extension of its quantitative easing programme, following comments from bank boss Mario Draghi that "the degree of policy accommodation will need to be re-examined in December."

Consumer prices have dipped into deflationary territory twice this year so far and have been below the ECB target of 'below but close to 2.0%' in every month since February 2013. The Markit PMI surveys signalled that output prices fell in October, upping the odds of inflation in the region remaining ultra-low in the coming months. Other notable data releases in the currency union include current account and consumer confidence numbers.

Eurozone inflation

The Office for National Statistics (ONS) publishes inflation and retail sales numbers in the UK. While the Bank of England governor Mark Carney has indicated that a decision on whether to raise interest rates will come into sharper relief around the turn of the year, the data are still likely to add to the policy debate. Consumer prices have been hovering around zero throughout much of 2015 so far, with PMI data also showing that average selling prices barely rose in recent months. Factory gate prices in fact fell at an increased rate, driven down by sharply lower raw material prices, and charges levied for services rose only marginally on average. Latest inflation numbers are released on Tuesday.

UK retail sales surged in September, as "promotions centred around the Rugby World Cup" boosted spending, according to the ONS. Official retail sales data for October are released on Thursday.

Monday 16 November

Third quarter GDP numbers are published in Japan.

In India, wholesale price inflation figures are issued.

Eurostat releases latest inflation data for the currency union.

The latest Bank of Scotland Report on Jobs is out.

Canada sees the publication of manufacturing sales numbers.

The Federal Reserve Bank of New York publishes the results of the latest Empire State Manufacturing survey.

Tuesday 17 November

Russia sees the release of industrial production figures.

ZEW issues economic sentiment data for Germany.

Italy meanwhile sees the release of trade balance numbers.

The Office for National Statistics releases latest inflation figures for the UK.

Inflation, earnings, industrial production and NAHB housing market data are out in the US.

Wednesday 18 November

In Australia, wage inflation data are released.

House price numbers are published in China.

The latest UK Household Finance Index is issued by Markit.

Meanwhile, South Africa sees the release of inflation and retail sales figures.

Building permit and mortgage data are issued in the US.

Thursday 19 November

Japan sees the publication of trade numbers.

Monthly GDP, unemployment, retail sales and wage data are out in Russia.

The Bank of Japan and the South African Reserve Bank announce their latest monetary policy decisions.

Current account data are meanwhile updated in the eurozone.

Retail sales and CBI orders numbers are issued in the UK. Moreover, the latest UK House Price Sentiment Index is released.

In Brazil, inflation and unemployment figures are published.

Wholesale trade data are out in Canada.

The US sees the release of initial jobless claims numbers. Moreover, the Federal Reserve Bank of Philadelphia issues results of the latest manufacturing survey.

Friday 20 November

Consumer confidence numbers are updated in the euro area.

Germany sees the release of producer price data, while current account figures are issued in Greece.

Meanwhile, inflation and retail sales numbers are updated in Canada.

The Federal Reserve Bank of Kansas City publishes the results of the latest Survey of Manufacturers.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}