Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 13, 2017

Hiring surge still shows no signs of feeding through to higher pay growth

Official data once again highlight the unusual state of the labour market and wider economy. Companies are taking on staff in strong numbers, driving unemployment down to its lowest since 1975. But wage growth remains stubbornly weak.

Booming jobs market

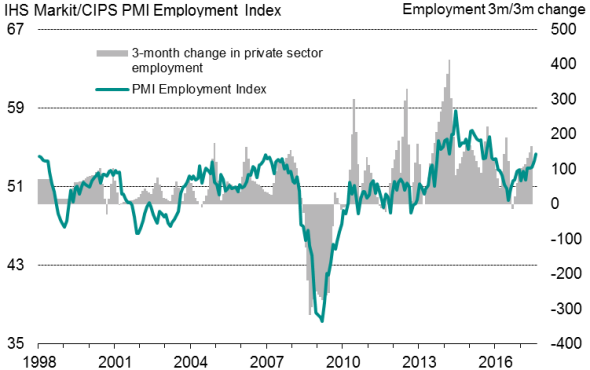

Employment rose by 181,000 in the three months to July, according to the latest data from the Office for National Statistics, spurred by a 167,000 increase in private sector payroll numbers. The overall rise was the largest since the closing months of 2015.

The upturn marks a further improvement in hiring by businesses. After last year's Brexit vote, private sector hiring slowed sharply, and employment even declined in the three months to October, its first such drop in five years. However, the recruitment trend has since perked up, in line with business surveys. Both the PMI and the REC recruitment industry survey have witnessed a growing appetite among companies to take on extra staff in recent months.

The concern is that this upturn in employment is not being matched by a commensurate increase in investment in capital, such as machinery and equipment and even buildings. Business investment has been flat over the year to the second quarter, and recent survey data show construction of commercial property declining at one of the steepest rates since the global financial crisis.

The evidence therefore suggests that companies are using more workers to squeeze more out of existing capital. However, the flip side of this is downward pressure on productivity, as production in effect becomes more labour intensive.

Employment

Wage growth disappoints

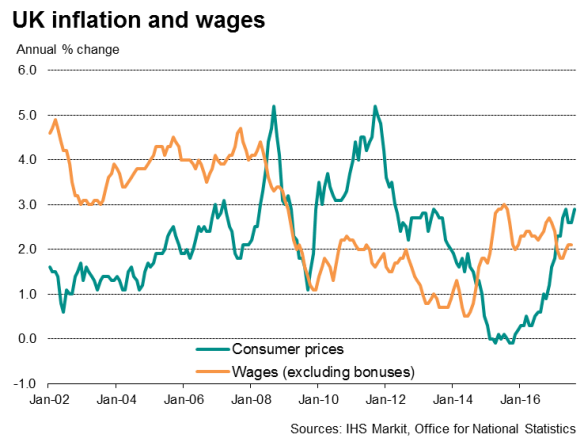

This drop in productivity also goes some way to explain weak wage growth. Average pay growth (both including and excluding bonuses) was stuck at just 2.1% in the three months to July. With the latest inflation data showing prices rising at an annual rate of 2.9%, households' real incomes are being increasingly squeezed. Not surprisingly, the pay squeeze is feeding through to lower consumer spending. Recent data from Visa showed spending to be on track for its weakest year since 2013.

The rise in employment numbers should of course provide some support to consumer spending, and with the jobless rate dropping to 4.3%, its lowest since 1975, it's possible that the tighter labour market will start to generate more upward pay pressures. Certainly the recruitment industry is seeing starting salaries continue to rise at solid rates, but this has been the case for quite some time now, suggesting there is no basis to expect pay growth to start accelerating any time soon.

Policy on hold?

Today's data therefore highlight that there's still no sign of average wage growth picking up despite the low level of unemployment, which provides a strong argument for policymakers to wait until wage growth revives rather than hiking rates early in the expectation that it will do so. It may yet be some time before we see pay growth approach anything like worrying levels from a monetary policy perspective.

In the meantime, the recent upturn in inflation is hurting households and subduing the pace of economic growth. Survey data suggest the economy will see another sluggish 0.3% expansion in the third quarter, with consumer-facing sectors acting as a drag.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-economics-hiring-surge-still-shows-no-signs-of-feeding-through-to-higher-pay-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-economics-hiring-surge-still-shows-no-signs-of-feeding-through-to-higher-pay-growth.html&text=Hiring+surge+still+shows+no+signs+of+feeding+through+to+higher+pay+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-economics-hiring-surge-still-shows-no-signs-of-feeding-through-to-higher-pay-growth.html","enabled":true},{"name":"email","url":"?subject=Hiring surge still shows no signs of feeding through to higher pay growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-economics-hiring-surge-still-shows-no-signs-of-feeding-through-to-higher-pay-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hiring+surge+still+shows+no+signs+of+feeding+through+to+higher+pay+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-economics-hiring-surge-still-shows-no-signs-of-feeding-through-to-higher-pay-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}