Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 13, 2016

Bank of England warns of economic risks from Brexit

The Bank of England left policy unchanged at its May meeting, as widely expected. No serious discussions on any change in policy are anticipated at least until after the June 23rd referendum, given the uncertainty surrounding the outcome of the vote.

The Bank also updated it growth and inflation forecasts, but recognises that the projections carry huge uncertainty in the light of whether the UK votes to leave or remain in the EU. In particular, the Bank stepped up its warnings about the potentially damaging impact of the UK leaving the EU, notably highlighting a potential sharp depreciation of sterling and postponement of purchases by businesses and households. As such, growth would be weaker, unemployment higher and inflation stronger in the event of a UK exit.

The Bank did not produce a forecast under a Brexit scenario, and its central projection is one where the UK remains in the EU, with a Remain vote helping sterling revive around half of the losses seen in recent months. Under such assumptions, economic growth would hit 2.0% this year, rising to 2.3% next year, slightly weaker than the projections of 2.2% and 2.4% seen in its February projections.

Forecasts revised down

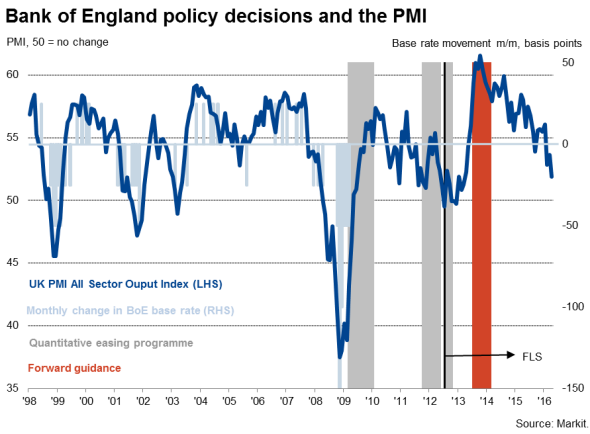

The pace of economic growth has slowed more than expected so far this year, down to 0.4% in the first quarter with PMI business survey data point to a further marked slowing in April. The near-stalling of the economy has pushed the PMI surveys into territory which would normally be associated with the Bank of England leaning towards providing more stimulus to the economy.

Survey responses indicate that companies are already attributing at least some of the economic weakness to Brexit uncertainty. The Bank sees that a rebound in the pace of growth in the second half of the year is therefore a clear possibility in the event of a Remain vote.

Inflation would meanwhile exceed the Bank's 2.0% target in two years' time, suggesting rate hikes would therefore be warranted at some point over the two-year horizon. Economists generally expect the first rate hike early next year, again working on the assumption that the UK remains in the EU.

Risks skewed to the downside

However, even with uncertainty lifting in the event of a Remain camp win, a return to robust growth in the economy is by no means assured, suggesting risks are skewed to the downside of the Bank's projections, as Brexit concerns appear to have merely compounded other headwinds facing the UK economy this year. Most importantly, global economic growth has slowed dramatically in recent months, linked largely to a slowdown in the US, thereby removing the main engine of global economic growth in recent years.

Irrespective of the EU referendum outcome, until the global economy lifts out of the low gear that it has slipped into, there seems little prospect of UK growth accelerating to levels that would worry policymakers into hiking interest rates.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-bank-of-england-warns-of-economic-risks-from-brexit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-bank-of-england-warns-of-economic-risks-from-brexit.html&text=Bank+of+England+warns+of+economic+risks+from+Brexit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-bank-of-england-warns-of-economic-risks-from-brexit.html","enabled":true},{"name":"email","url":"?subject=Bank of England warns of economic risks from Brexit&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-bank-of-england-warns-of-economic-risks-from-brexit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+warns+of+economic+risks+from+Brexit http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-bank-of-england-warns-of-economic-risks-from-brexit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}