Week Ahead Economic Overview

The Federal Open Market Committee will announce their latest interest rate decision, while industrial output numbers are also updated in the US. In the UK, George Osborne presents the last budget before the general election, while the Bank of England issues minutes from its March meeting. Moreover, the eurozone sees the release of employment and inflation data.

The Federal Open Market Committee will announce their interest rate decision for the US on Wednesday, where all eyes will be drawn to the accompanying statement to see if the word "patience" has been dropped in terms of the timing of the first rate hike. "Patience" has been taken to mean there will be no rate hikes for at least the next two meetings, so removing the word will leave the Fed with the option of hiking rates in June. However, with worries mounting about a strong dollar, and recent data suggesting the pace of economic growth may have slowed sharply in the first quarter, it looks likely that the Fed will want to see signs of the economy picking up again, leaving September as the most likely month for rates to start rising.

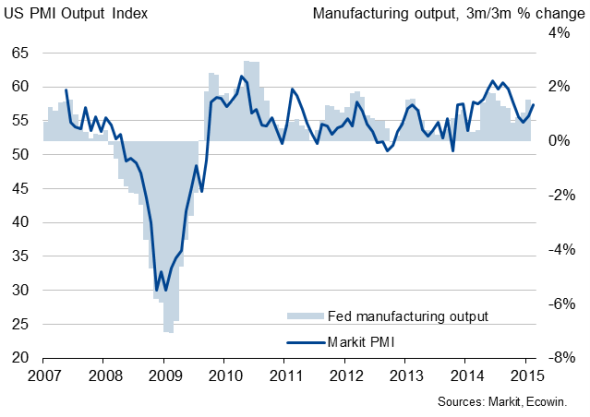

Industrial production data are also updated during the week and will give further insight into the country's manufacturing sector. Markit's PMI data signalled an acceleration in output growth in February, with the survey data consistent with production rising at an annualised rate approaching 4%.

US manufacturing output and the PMI

In the UK, the focus is on the Chancellor's last budget before the general election. George Osborne is likely to set out ambitious goals for reducing the public sector deficit, but also find money to offer some pre-election sweeteners after recent borrowing figures have surprised to the upside.

The Bank of England releases minutes from its March meeting, in which the Bank held interest rates steady at 0.5%. The minutes are likely to show that all nine Monetary Policy Committee members again voted to keep policy on hold. While the current UK economic performance is perhaps the best we've seen since the financial crisis, there are many reasons to believe that interest rates will remain low for the rest of the year. These include uncertainty about the general election, low inflation and weak wage growth.

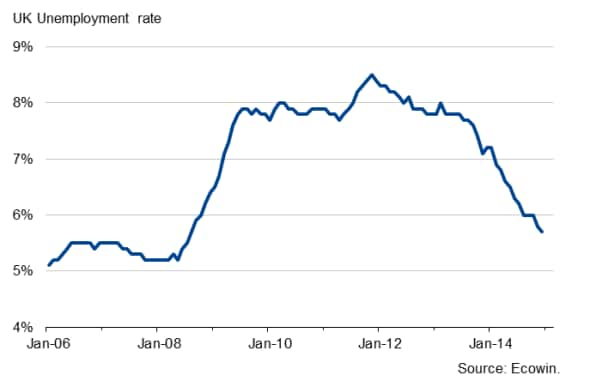

Labour market data are meanwhile likely to show a further drop in unemployment, after PMI data signalled the second-strongest rate of job creation in the UK economy since data were first available back in 1998. Furthermore, Markit's latest survey of recruitment consultancies also signalled a pick-up in hiring activity.

UK unemployment

In the eurozone, final inflation numbers for February are the highlight for data watchers. A flash estimate for February showed consumer prices down -0.3%, up from -0.6% in January. However, fears of the eurozone falling into a deflationary slump are looking overplayed, for now at least. Markit's PMI data indicate that, rather than postponing purchases in the hope that prices will fall further in the future, consumer spending appears to be rising as households take advantage of lower prices. Other important releases for the currency bloc in a relatively quiet week include economic sentiment data published by ZEW, employment and trade numbers.

Monday 16 March

Markit publishes the results of its latest Global Business Outlook Survey.

The Bank of Scotland Report on Jobs is published.

Wholesale price inflation numbers are meanwhile issued in India.

China publishes its latest FDI numbers.

German Bundesbank releases its Monthly Report for March.

In Brazil, payroll job growth data are updated.

Industrial production numbers are released in the US by the Board of Governors of the Federal Reserve, while the NAHB Housing Market Index is also out.

Tuesday 17 March

The Bank of Japan announces its latest monetary policy decision.

Employment data and inflation numbers are issued for the eurozone by Eurostat, while ZEW release their latest economic sentiment data.

Meanwhile, industrial output numbers are released in Russia.

Current account data are out in South Africa.

Housing starts and building permits figures are released in the US, while manufacturing sales numbers are issued in Canada.

Wednesday 18 March

UK Budget Day.

The latest UK Household Finance Index is released by Markit.

In India, M3 money supply information are issued, while China sees the release of house price numbers.

Meanwhile, trade data are out in Japan.

Eurostat publishes updates on wholesale trade data and construction numbers for the currency bloc.

The Bank of England publishes minutes from its latest monetary policy meeting. Unemployment numbers are also updated in the UK.

Iceland's Central Bank meanwhile announces its latest monetary policy decision.

The European Central Bank's Governing Council meet, but no interest rate decision is scheduled.

South Africa sees the release of inflation and retail sales numbers.

The Federal Reserve's Federal Open Market Committee announces its latest interest rate decision.

Thursday 19 March

Labor costs data are updated in the eurozone. Furthermore, the European Central Bank releases its monthly bulletin.

The Swiss National Bank announces its latest monetary policy decision, while Norway's central bank also holds an interest rate meeting.

Unemployment data are issued in Russia.

In the US, initial jobless claims and current account data are out.

Friday 20 March

Russia sees the release of monthly GDP data and inflation numbers.

Producer price figures are meanwhile issued in Germany.

Eurostat publishes current account data for the currency union.

In Canada, inflation and retail sales numbers are out.

The OECD launches the China 2015 Economic Survey.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com