Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 13, 2015

Tentative signs of contagion

There were tentative signs of contagion in the eurozone, but the week is ending on an optimistic note

- Spain and Italy widened significantly earlier this week

- But Greece is still bearing the brunt of risk aversion

- Hopes that a deal can be agreed triggered a rally on Friday

This week we saw the first signs of contagion, albeit tentative, from the impasse in Greece. Spain, where the anti-austerity Podemos party is leading the opinion polls, saw its CDS spreads widen 11bps to 94bps (2003 ISDA definitions), while Italy was 13bps wider at 113bps.

The defiant speech of new Greek prime Alexis Tsipras on Sunday was the trigger. Market participants expected Tsipras to strike a more conciliatory tone after the ECB last week stopped accepting Greek government bonds as collateral. But the Greek government is refusing to kow-tow to the troika, and the threat of its banking system being starved of funds is not producing the retreat that Europe's leaders no doubt desired.

Greek banks still have access to Emergency Liquidity Assistance from the national central bank, though this is reviewed every two weeks by the ECB and can be withdrawn at any time. The risk of a disorderly exit from the eurozone has increased this week, though a compromise including a politically acceptable form of debt forgiveness remains the most likely scenario.

Indeed, the contagion this week has to be placed in context. Spain's spreads have widened almost 30bps since January 23rd, a considerable move. But at 94bps they are still 45bps tighter than this time last year, and they are more than 500bps tighter than the 624bps reached in the wake of Greece's credit event in 2012.

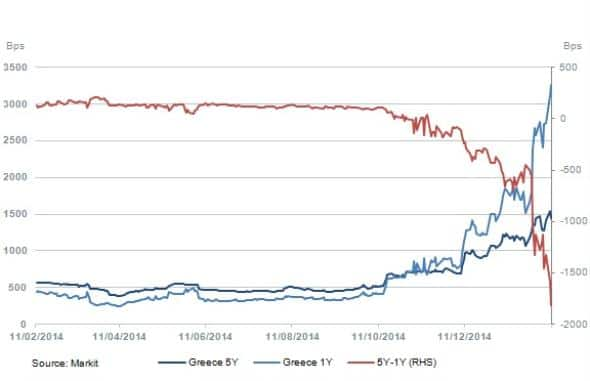

The Hellenic Republic's bonds and CDS have borne the brunt of the failure to reach agreement. The latter are nowhere near as liquid as they were during the height of the eurozone debt crisis. But they are still quoted, and the 45 points upfront (2014 definitions) level reached on Monday suggests that another credit event is a real possibility. The inversion of Greece's credit curve is another indicator of the country's severe credit distress. The one-year spread is now trading at well over 3,000bps, and the inversion has worsened significantly in recent weeks.

Hopes that progress towards a deal may be announced on Monday have triggered a recovery today. But if there is still a stalemate next week, we can expect more volatility as the February 28th bailout deadline approaches.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-credit-tentative-signs-of-contagion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-credit-tentative-signs-of-contagion.html&text=Tentative+signs+of+contagion","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-credit-tentative-signs-of-contagion.html","enabled":true},{"name":"email","url":"?subject=Tentative signs of contagion&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-credit-tentative-signs-of-contagion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tentative+signs+of+contagion http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-credit-tentative-signs-of-contagion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}