Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 13, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Oil and gas continues to be a key focus for North American short sellers with 6 firms among the top twenty

- Italian and Portuguese Telecoms firms see the highest short interest in Europe

- Australian mineral firms dominate most shorted companies in APAC

North America

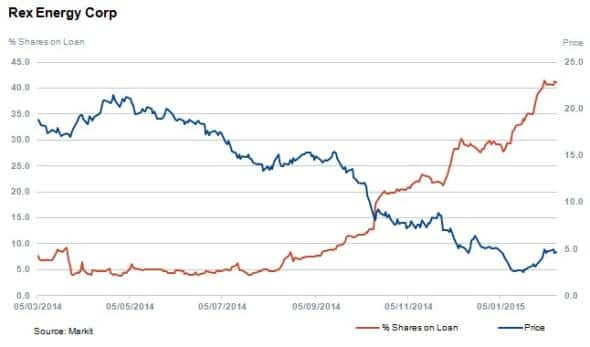

Six oil and gas firms crowd the top ten most short sold companies in North America this week, seeing an average of 25% of shares outstanding on loan. Topping the list is Rex Energy Group, an oil and natural gas explorer and producer with 41% of shares outstanding on loan.

Rex is yet another example of how far commodity markets have shifted in just over six months. The company's previous earnings filing described a much healthier operating environment despite a then 17% drop in oil prices within the third quarter. The firm reported record strong third quarter production volume growth of 72% year on year realising $90 per barrel produced. In the fourth quarter, for which the company will release results next week, oil prices dropped by a further 39%. Short sellers have climbed into the stock and investors seem to be heading to the door, however the firm seems to be relatively well hedged based on a January presentation. 70% of 2015 oil production prices are locked in with an average floor price of $71. The company is due to release earnings on February 19th 2015.

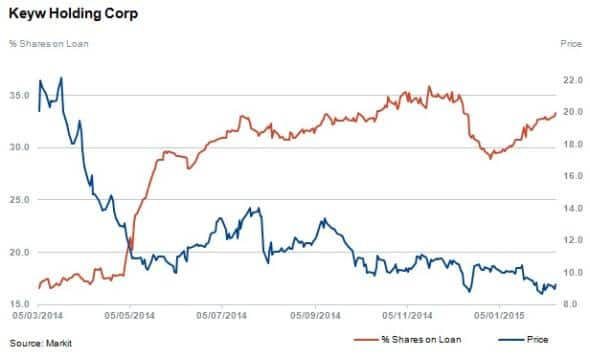

Cyber security and geospatial solution provider Keyw is the most shorted non-oil related company in North America ahead of earnings. Keyw shares are trading at $9.23, below the company's 2010 IPO price of $10 after seeing a 52% decline in the past year while shares outstanding on loan increased to 33%. The firm, which works predominantly with government agencies, has seen analysts cut forecasts with a consensus loss expected for the quarter and full year.

Other notable companies in North America ahead of earnings where short sellers have made large moves in the last month include;

Financial Engines has seen shares outstanding out on loan increase by a fifth in the last month to 22%. The company provides technology based portfolio, investment and retirement planning services.

Shares outstanding on loan for Phh, a specialised outsource provider of mortgage management services have increased by 28% in the last month to 17% while the stock has been trading within a 5% range over the last 12 months.

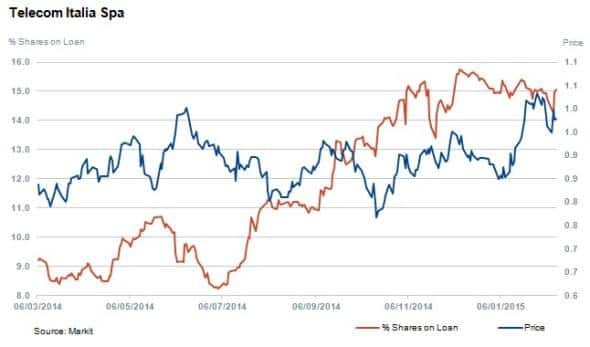

Portugal Telecom and Telecom Italia are the most shorted companies in Europe this week ahead of earnings.

With 12% and 15% of shares outstanding out on loan respectively both companies have seen large increases in short interest over the last 12 months.

Short sellers have followed Portugal Telecom and covered positions as the share price declined over 79% but shorting activity has increased in the past few weeks. Telecom Italia has rallied by 14% over the same time period, with short sellers holding on.

The telecoms market globally continues to go through a stage of consolidation as 'quad play' emerges and larger operators compete to acquire businesses to drive growth as revenues stagnate and margins compress.

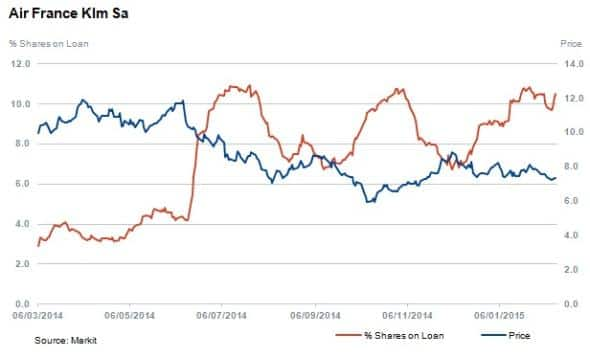

Third most short sold in Europe is Air France KLM which has seen a substantial increase in short interest over the last year, and while the company might may have benefited more from lower oil costs than low cost carriers due to being relatively less hedged, other issues such as pension costs, underperforming routes and the worst strike in the company's history has seen shares outstanding on loan increase to 11% while shares declined by 15%.

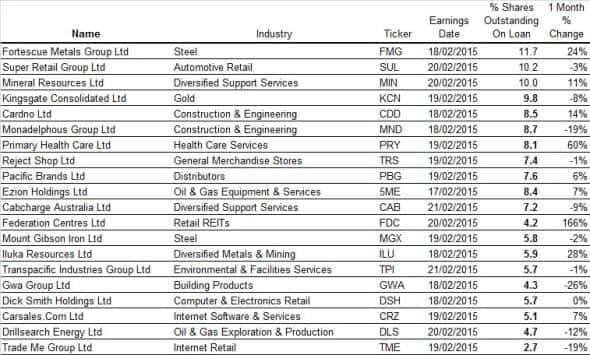

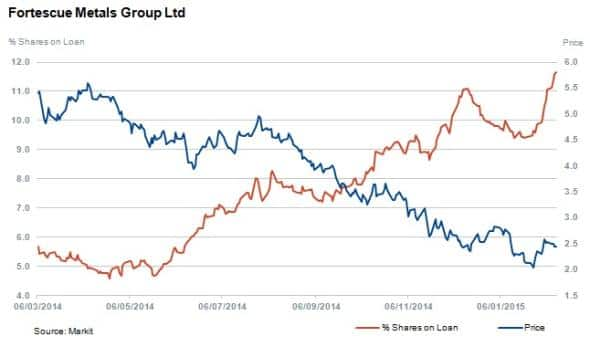

Australian firms represent the most shorted companies due to report earnings in the next week in APAC. Leading the pack is Fortescue Metals Group with a 24% increase in shares outstanding on loan in the last month to 12%.

The explorer and producer of iron ore projects worldwide has seen its share price decline by 50% over the last 12 months as iron ore prices drop and demand from its biggest customer, China, is showing signs of slowing.

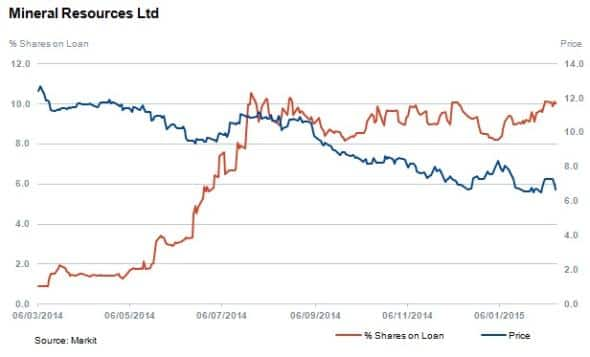

In third position is Mineral Resources, an Australian based company providing crushing services to the gold, iron ore and coal companies.

Short sellers had already taken positions in mineral resources in the middle half of 2014 when shares outstanding on loan peaked at 10.6%. Currently the figure is closer to 10% but has remained between 10.6% and 8% since July 2014 as shares declined by 39%.

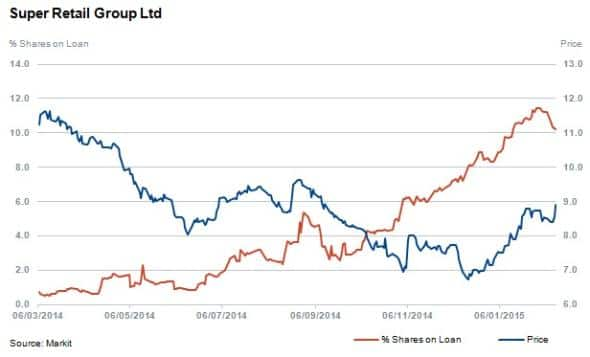

Second most shorted in APAC is Australian and New Zealand based retailer, Super Retail, which has 10% of its shares outstanding on loan. The company focuses on automotive parts and accessories, camping products, gardening and outdoor products and boating equipment. Short interest in the stock has steadily increased over the last 12 months and is up 475% while the share price has decreased by 15%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}