Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 13, 2016

Financials is fastest-growing area of global economy in December

The final batch of Markit’s detailed global sector PMITM data for 2015 showed that finance, food & drink, pharmaceuticals and hi-tech services companies enjoyed the strongest growth at the end of the year. This followed the general pattern shown over 2015 as a whole, where healthcare, financials and technology registered the strongest growth rates. Notably, metals & mining posted the steepest drop in production in more than three years in December.

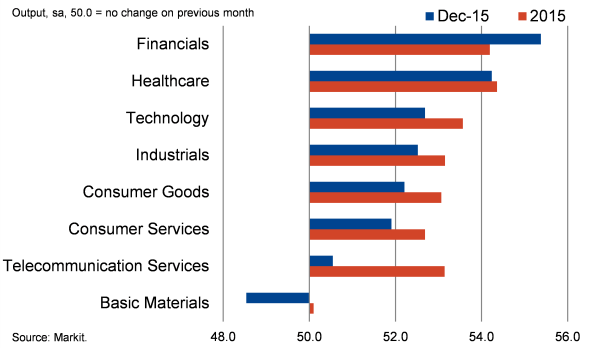

At the broad level (see chart 1), financials has now led global growth for the past four months. Conversely, the basic materials manufacturing sector has footed the table ten times in the past 12 months. Telecommunication services also performed comparatively poorly in the second half of 2015.

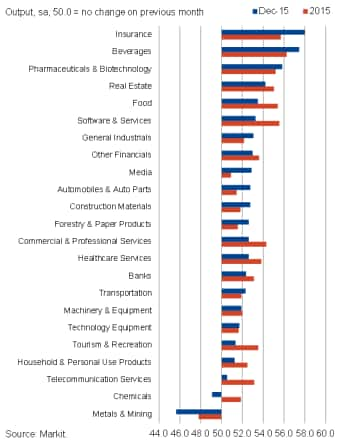

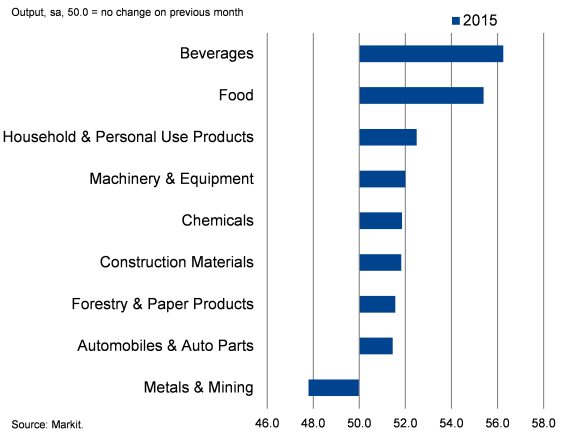

Drilling down to a more detailed level (see chart 2), insurance registered the strongest increase in business activity in December, followed by beverages. These two sectors also saw the strongest growth over 2015 as a whole. In contrast, metals & mining posted a drop in output for the eleventh successive month, and at the fastest rate since October 2012. Chemicals was the only other sector to see a fall in production during December.

Chart 1: Global Sector PMI: broad sectors

Chart 2: Global Sector PMI: detailed sectors

Healthcare excels in 2015

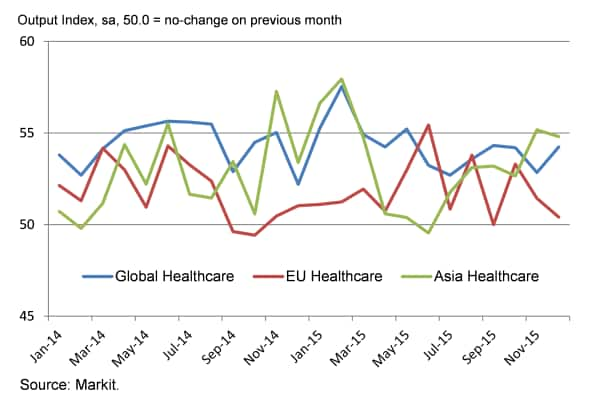

Looking at the year as a whole, healthcare was the best-performing of the broad sectors monitored worldwide. Activity rose solidly throughout 2015, with the pace of expansion having hit a joint-record high back in February. Underpinning growth were its constituent sectors, pharmaceuticals and healthcare services. Pharmaceuticals, in particular, was one of the year’s top performers at the detailed level.

Sector data for EU and Asia showed divergent trends, however, with healthcare activity growth nearing stagnation at times in Europe but often leading the way in Asia. In fact, the annual average PMI reading for healthcare in Asia was the highest since 2012.

Chart 3: Healthcare PMI

Solid growth in financials and technology

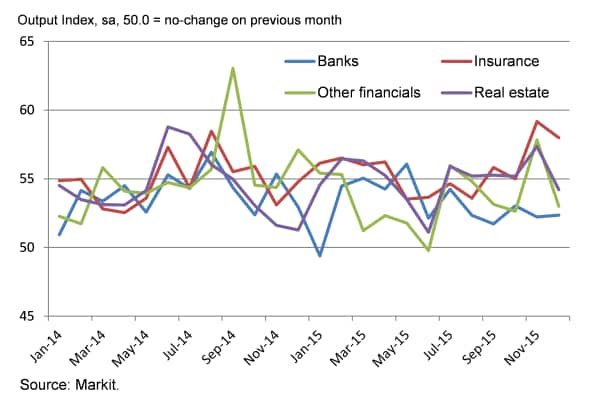

Financials and technology were the second- and third-fastest growing areas of the global economy respectively in 2015. Insurance was a key driver of financials growth (see chart 4), having finished the year on the crest of a wave (the Q4 average was the highest since Q3 2010), with real estate also among 2015’s fastest-growing sectors.

The remaining two financial sectors saw strong growth over 2015 as a whole, though both suffered blips in the first half of the year: activity fell for the first time in recent history at banks and other financials in January and June respectively.

Meanwhile, it was software & services representing technology near the top of the league table, although hi-tech equipment was one of the worst performers of the year on average.

Chart 4: Financials PMI constituent sectors

Beverages tops detailed rankings after record year

Beverages firms bucked the general trend for manufacturers in 2015 (chart 5), posting the highest annual average in over six years of data collection. Buoyed by sharp growth of new work, beverages was the strongest sector in the EU as well as globally. Moreover, it was the biggest climber in terms of league position, having placed nineteenth for average growth in 2014.

Food production was the other category to disrupt the dominance of services at the summit of the Output Index league table. It placed fourth in 2015 overall, largely on the back of record expansions seen in Q1.

Chart 5: Food & drink outperform other manufacturers

Basic materials is weakest area in 2015

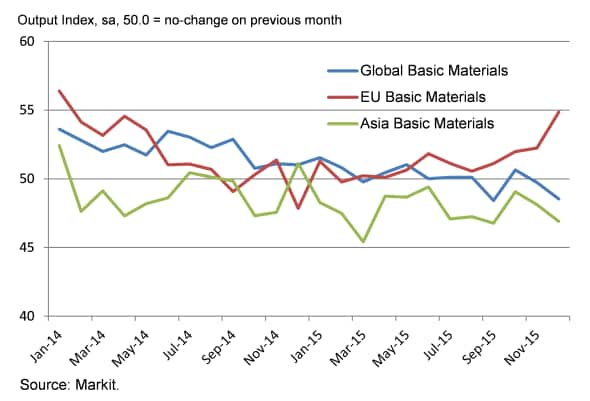

Food & drink apart, 2015 was a poor year for manufacturers worldwide. Basic materials, in particular, registered a near-stagnation in output growth over the past 12 months. It was the worst-performing of the broad sectors covered by the survey in every quarter on average. The year finished on an especially low note, with output falling back-to-back in November and December for the first time since 2012. Basic materials was bottom-ranked in both Asia and the EU, with Asian data pointing to an ongoing contraction throughout 2015.

Chart 6: Basic Materials PMI

At the detailed level, media and automobiles & auto parts were among the laggards in 2015. Autos firms saw a survey-record rate of decline in output during August, while media struggled to recover from being the worst-performing category in 2014.

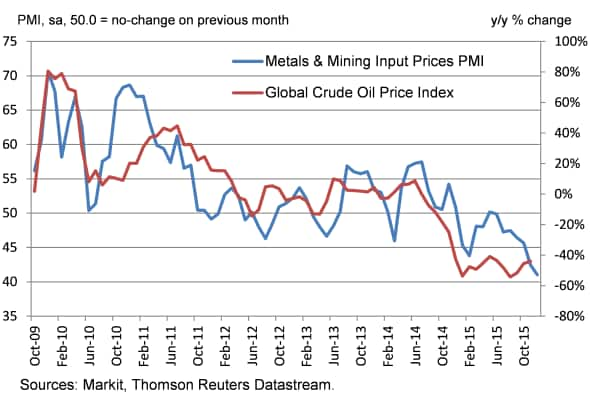

That said, metals & mining was the only sector globally to record an average below the neutral 50.0 mark this year. It was the main drag on its parent sector, basic materials, though chemicals and forestry & paper products grew only modestly. Interestingly, input costs and output charges were falling sharply towards the end of the year at metals & mining firms – reflecting lower global commodity prices and highlighting a period of uncertainty in the sector heading into 2016.

Chart 7: Metals & Mining Input Prices vs Global Oil Prices

Philip Leake | Economist, IHS Markit

Tel: +44 149 146 1014

philip.leake@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-economics-financials-is-fastest-growing-area-of-global-economy-in-december.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-economics-financials-is-fastest-growing-area-of-global-economy-in-december.html&text=Financials+is+fastest-growing+area+of+global+economy+in+December","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-economics-financials-is-fastest-growing-area-of-global-economy-in-december.html","enabled":true},{"name":"email","url":"?subject=Financials is fastest-growing area of global economy in December&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-economics-financials-is-fastest-growing-area-of-global-economy-in-december.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Financials+is+fastest-growing+area+of+global+economy+in+December http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-economics-financials-is-fastest-growing-area-of-global-economy-in-december.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}