Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 12, 2014

The volatility battleground

Volatility has declined since the spike in October, but developments in Greece and oil price effects have disturbed the calm conditions.

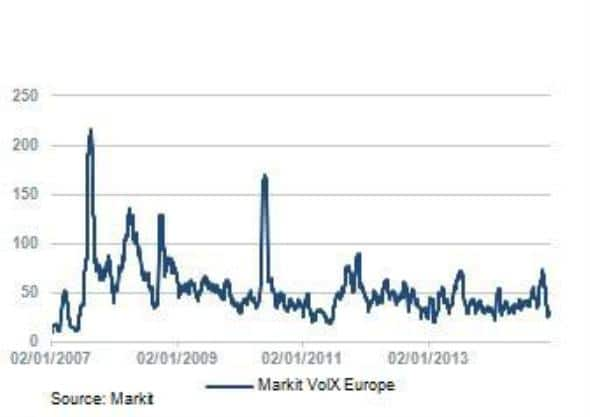

- The Markit Volx Europe has recovered from the 75% hit in October

- Greece's Illiquid CDS are widening again

- ECB more likely to implement full QE after weak TLTRO

Volatility was the name of the game earlier in the first quarter as credit was swept up in the maelstrom affecting other asset classes, particularly US Treasuries and equities. The main credit indices spiked upwards and the Markit VolX Europe, which tracks realised volatility in European investment grade CDS, spiked upwards to 75%, its highest level since the taper tantrum of 2013.

But if investors expected this trend to continue into year-end then they may be mistaken. Spreads have recovered from the widening we saw in October, and the VolX returned to 28% last week - a level more in keeping with the current QE dominated era. Expectations that the ECB will implement full QE (government bond purchases), probably in the first half of this year, are surely driving the improvement. However such a policy is not a given, and there will surely be considerable opposition from Germany. The uncertainty could reignite volatility.

Other factors might also disturb the clement conditions. The price of oil continues to plummet, which creates winners and losers. A look at how sovereign CDS has performed recently shows clearly which countries are losing out. Russia's spreads breached 400bps for the first time since 2009 (now trading at 457bps), and Venezuela's CDS are quoted at an eye-watering 61 points upfront. Both countries are, of course, major exporters, and an oil price of $60 a barrel creates serious damage on their finances.

But the huge difference in their spreads is down to the fact that Russia has considerable reserves that help it see out periods of low oil prices, while Venezuela, alas, does not. The latter country is now the worst credit in the sovereign CDS universe by some distance, although Ukraine (43 points upfront) is catching up.

Greece has also returned to the news agenda. A snap presidential election was called, and if the government fails to get a majority it could trigger a general election early next year. Uncertainty about the result and the possibility of the leftist Syriza party gaining power was enough to send Greece's CDS wider. They were quoted at 31.5 points upfront (or 1,065 bps), which is the widest level since September 2013, only months after Greece resumed trading in the CDS market in June.

The sovereign is still relatively illiquid and the recent changes to the Isda definitions mean sovereigns trade slightly wider than the previous contract. Nonetheless, it is back in the top 1000 DTCC entities, and Greece's CDS will be closely watched ahead of the election.

Risk aversion is certainly in the ascendency as the week draws to a close, with the Markit iTraxx Europe trading at 63bps (8bps wider than the levels reached earlier this month). The VolX has also started to rise, though the current 36% level is nowhere near the 75% seen in October. Greece and the myriad of knock on effects from the falling oil price are clearly unnerving the markets.

But the ECB's calming presence remains, and this week the probability of full QE increased. The funds borrowed under the second TLRTO were well below expectations, and even with the ABS and covered bond programmes the ECB has a gargantuan task to meet its target of a €1bn balance sheet expansion. Its only hope seems to be government bond purchases, even if it is anathema to German monetary tastes.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-credit-the-volatility-battleground.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-credit-the-volatility-battleground.html&text=The+volatility+battleground","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-credit-the-volatility-battleground.html","enabled":true},{"name":"email","url":"?subject=The volatility battleground&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-credit-the-volatility-battleground.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+volatility+battleground http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-credit-the-volatility-battleground.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}