Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 12, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the coming week.

- Sanderson Farms holds on to its top short position among poultry stocks worldwide

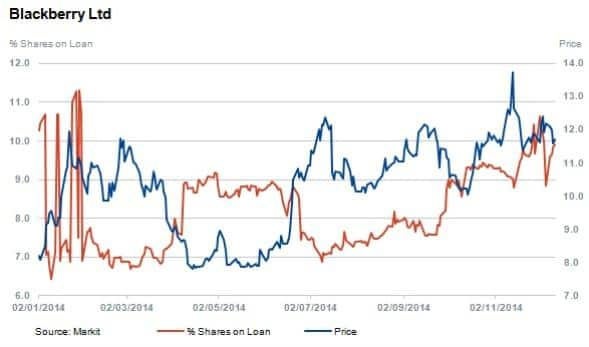

- Short sellers bet on Blackberry's demise as the firm continues to struggle

- Imagination Technologies and Choada Modern are the most significant shorts in Europe and Japan

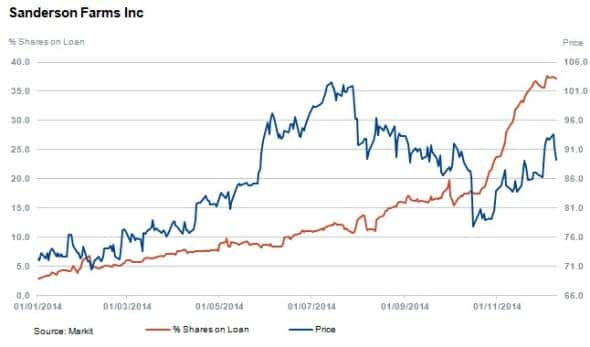

Topping this week's list of shorted shares in North America is poultry group Sanderson Farms.

Sanderson Farms is the twelfth largest poultry producer in the world, but remains the most shorted firm globally since our last report focusing on the sector. Short sellers continue to hold their positions with shares outstanding on loan increasing marginally from 36% to 37% while the share price has increased by 5%.

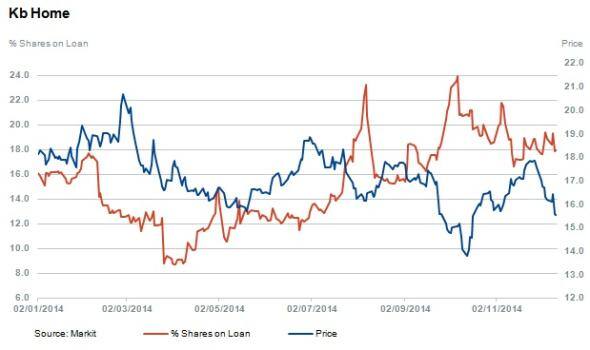

KB Home Inc. takes the silver medal in this week's table of most shorted ahead of earnings in North America. There are currently 18% of shares outstanding on loan.

The company missed analyst expectations for earnings in late September, sending shares falling by the most in nine months. The company reported that home deliveries in the third quarter were slightly down due to construction schedule delays and mortgage closings. The share price has since been quite volatile, recovering from lows following the earnings miss and then subsequently falling again in the last few weeks.

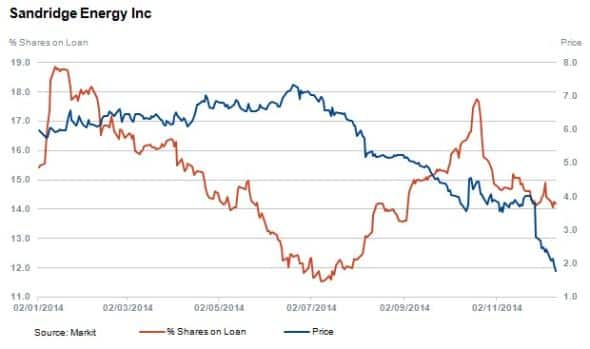

Explorer and producer of natural gas and crude oil is the most shorted energy firm ahead of earnings. Shorts have covered from October highs of 17.8% of shares outstanding on loan, with levels decreasing to 14.2% currently as the share price continues to decline. The stock is down 70% year to date.

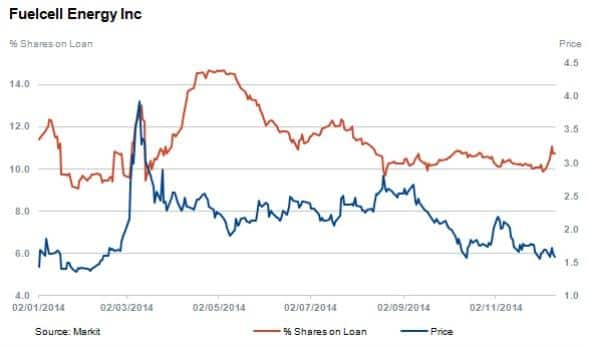

Fuel Cell Energy currently has 10.7% of shares outstanding on loan. The share price is down 60% year to date. The stock had previously suffered due to an earnings miss in the third quarter but the share price is relatively flat year to date, down 5.4%.

The last share who has close to 10% of shares outstanding on loan in North America is troubled Canadian handset maker Blackberry. The company's stock has seen short interest increase by 16% in the past month reaching 9.9%, while the stock is up 28.7% year to date.

The company has surprised analysts this year, reporting lower than expected losses even as the handset continues to lose market share and sales plummet. Expectations are for 2015 sales being almost 40%* lower than 2014s figure of $7.1bn, coming in $4.3bn.

Current earnings consensus points for a marginal loss to breakeven level for the full year ending February 2015. In the meantime there have been reports of potential acquirer's interest peaking in the Canadian firm. A strong candidate for the takeover is Chinese firm Lenovo who look to broaden their North American and mobile exposure. Lenovo now sells more handsets than the once giant Blackberry.

*Figures based on Factset consensus

Relte Stephen Schutte, Analyst at Markit

Posted 12 December 2014

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}