Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 12, 2017

Week Ahead Economic Preview

The focus next week will be China's Party Congress, with analysts eyeing the twice-a-decade event for announcements that will shape the country's economic and political environment in coming years. A litany of Chinese data, including third quarter GDP figures, will also provide insights as to recent economic and inflation trends. Meanwhile UK data on retail sales, inflation, employment and wages will help gauge whether the Bank of England will hike interest rates as soon as November.

Other key data highlights include US housing data, which will offer important signals on any hurricane-related impact. South Korea and Indonesia will meanwhile decide on monetary policy, while Japan's general election takes place at the end of the week.

Eyes will be on China's leadership transition when the country convenes its national party congress on 18 October. China watchers will closely watch President Xi's address for clues on the government's priorities for the next five years.

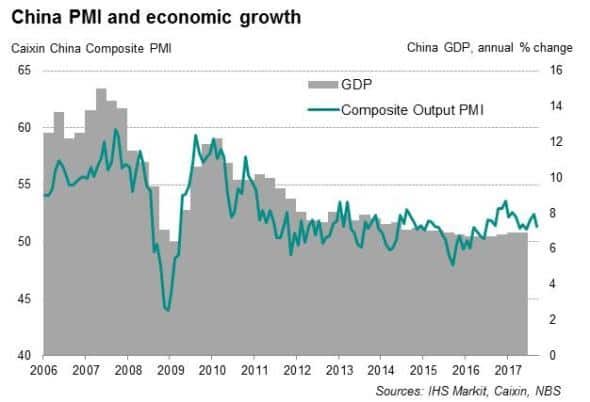

Chinese GDP data for the third quarter will meanwhile be eagerly awaited after a stronger-than-expected performance in the second quarter took analysts by surprise. Latest PMI surveys point to a services-led slowdown in the economy, marred also by a lack of employment growth, weaker inflows of new business and a drop in business optimism. Other key data highlights include industrial production, fixed asset investment, trade, inflation and credit growth.

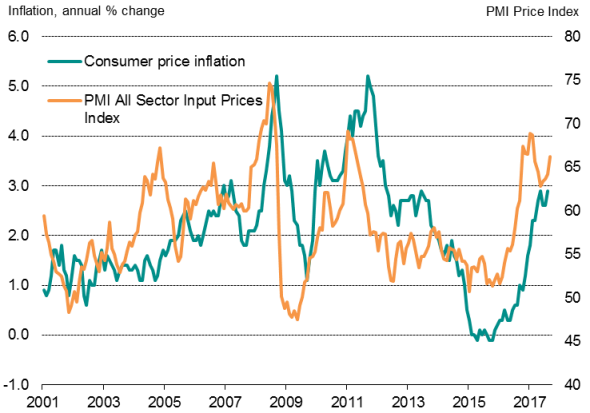

In the UK, official inflation data will meanwhile be gleaned for signs of rising price pressures, as indicated by recent survey data, which will add to the debate on rate hike prospects. Perhaps most important from a policy perspective, however, will be official wages data. Any upturn in wage growth will be seen by many as sealing the deal on the Bank of England hiking interest rates at its November meeting.

UK PMI and inflation

Policymakers will also be keen to see UK statistics on retail sales to provide clues on consumer spending power, and the impact of recent strong inflation on consumption.

Japan's general election will be held on Sunday, 22 October. Recent polls by Kyodo News and Nikkei suggest that Prime Minister Abe's ruling coalition is likely to win a two-thirds majority of the seats. However, a strong showing by the opposition could raise expectations of a premature tightening of monetary policy, after having campaigned on a platform of reduced reliance on fiscal spending and monetary easing, which could affect future growth. Recent survey data signalled that the Japanese economy lost some momentum in September, setting up a stage for slower GDP growth in the third quarter.

The Bank of Korea has kept its policy rate unchanged at a record-low 1.25% since last June but is expected to hike rates sometime next year as the economy improves. September PMI data saw welcome signs of recovery in South Korea's manufacturing sector.

After lowering its policy rate for a second straight month in September, expectations are for Bank Indonesia to leave interest rates unchanged at its next meeting. Recent comments from senior policymakers suggest that the rate-cut cycle is coming to an end. BI deputy governor Perry Warjiyo said that the central bank's 'interest rate setting is now in the neutral position'.

Download the full report for charts and diary of key economic releases.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102017-economics-week-ahead-economic-preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102017-economics-week-ahead-economic-preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102017-economics-week-ahead-economic-preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102017-economics-week-ahead-economic-preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102017-economics-week-ahead-economic-preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}