Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 12, 2014

Buoyant US consumers provide retail sales boost

A further rise in retail sales and upbeat consumer confidence data provide further signs of the US economy having maintained strong momentum in the third quarter.

Viewed alongside recent impressive factory output and business survey numbers, the buoyancy of the consumer in recent months adds yet more evidence to suggest the economy is enjoying another spell of impressive growth in the third quarter.

However, while positive for the economy, the data also add to the likelihood of the first rise in interest rates occurring earlier than mid-2015.

Third quarter retail sales boost

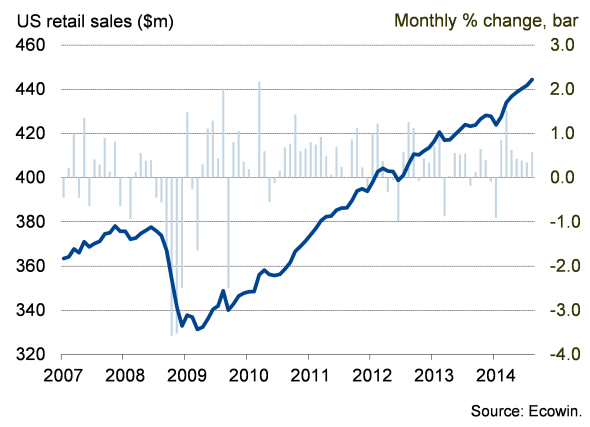

Retail sales rose 0.6% in August, improving on the 0.3% rise seen in July to signal the largest monthly gain since April. The increase means that sales are so far up 1.0% in the third quarter compared to the second quarter.

The latest improvement builds on a 2.3% rise in the second quarter and adds further evidence to indicate that the meagre 0.2% increase seen in the first three months of the year was primarily a function of extreme weather rather than a renewed downturn in the economy, and that the strength seen in the second quarter was more than just a rebound.

Robust core sales provide further encouragement that the underlying trend remains positive. Excluding autos, gasoline and building materials, retail sales were up 0.4% in July, pushing sales 1.1% higher in the third quarter so far compared to the second quarter after a 1.7% gain in the three months to June.

Upbeat consumers

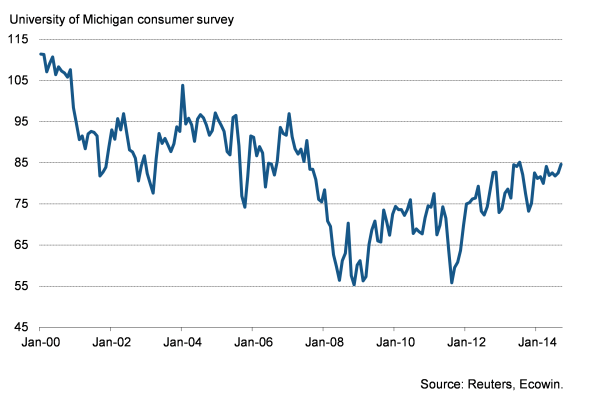

Separate data meanwhile indicated that consumer confidence rose again in September to one of the highest levels seen since 2007. The University of Michigan's indicator of consumer confidence rose from 82.5 in August to 84.6, falling just short of the post crisis high of 85.1 seen in July of last year.

US retail sales

Consumer confidence

Broad-based upturn

Today's data follow industrial production data which also point to the economy having enjoyed a strong start to the third quarter. Manufacturing output rose 1.1% in July, helping drive a 0.4% increase in the wider measure of industrial production.

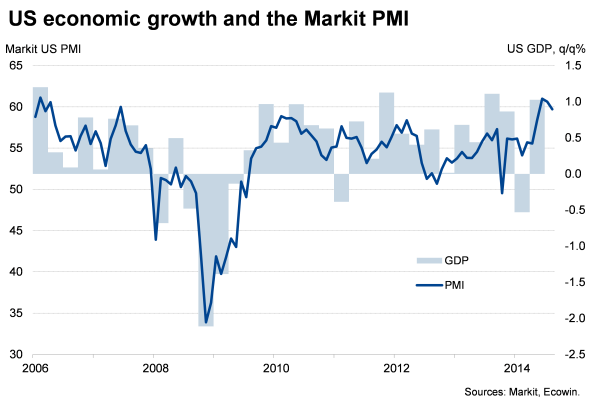

The upbeat official data also confirm survey findings which suggest that the economy is on course have grown strongly again in the third quarter. Markit's PMI surveys of manufacturing and services point to GDP rising at an annualised rate 4%, based on data available for July and August.

Both the official and survey data therefore point to ongoing strong momentum of the US economy in the third quarter, suggesting that the resent slowing in non-farm payroll growth seen in August may prove temporary and that policymakers will be encouraged that further strong job creation will be sustained in coming months.

All of this adds up to policymakers becoming increasingly minded to start tightening policy sooner than the current expectation of mid-2015 if the dataflow continues to impress in coming months.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-buoyant-us-consumers-provide-retail-sales-boost.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-buoyant-us-consumers-provide-retail-sales-boost.html&text=Buoyant+US+consumers+provide+retail+sales+boost","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-buoyant-us-consumers-provide-retail-sales-boost.html","enabled":true},{"name":"email","url":"?subject=Buoyant US consumers provide retail sales boost&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-buoyant-us-consumers-provide-retail-sales-boost.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Buoyant+US+consumers+provide+retail+sales+boost http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-buoyant-us-consumers-provide-retail-sales-boost.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}