Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 12, 2016

Irish business optimism slips to three-year low as Brexit worries dominate

The decision of the UK electorate to vote to leave the European Union has the potential to knock the Irish economic recovery off course, with a number of businesses highlighting Brexit as a key threat to their near-term outlook.

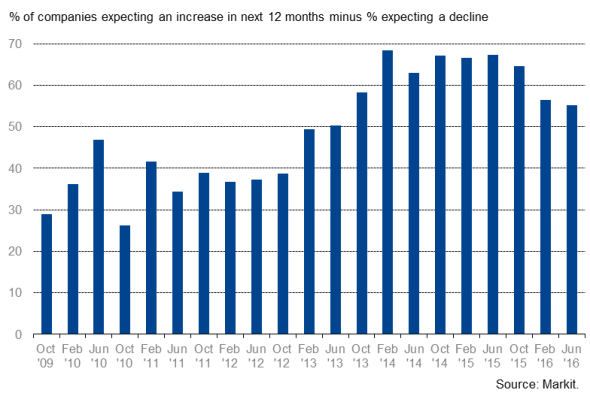

Markit Business Outlook Survey: activity levels

Companies see Brexit as key threat

With the majority of responses to the latest Markit Business Outlook Survey collected prior to the results of the UK’s referendum on EU membership, companies were upbeat in June. Sentiment was largely unchanged from the February outlook survey with the number of optimists regarding their business activity levels in the coming year outnumbering pessimists by some 55%. That’s down to a three-year low from 57% in February and 67% a year ago, but was still the strongest reading of all European countries surveyed by a significant margin.

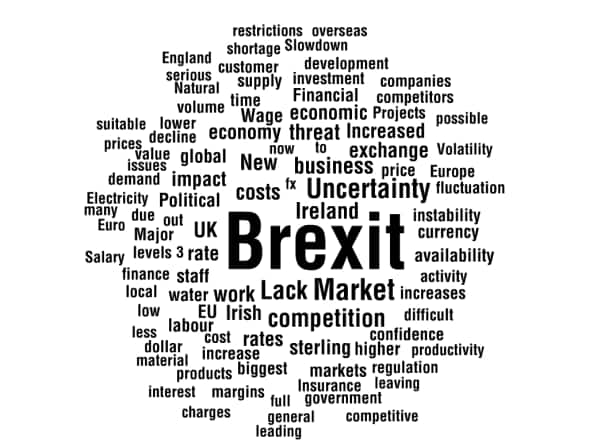

However, when asked to comment on potential threats to activity going forward, the response was clear. Of those companies specifying a threat, 45% mentioned ‘Brexit’.

Ireland is the EU country with most at risk from disruption caused by the UK’s exit due to the close economic ties between the two countries. Around 14% of all Irish exports were to the UK in 2015 and these are now under threat from both a lack of demand among UK customers should an economic downturn occur there, and a lack of competitiveness as sterling depreciates against the euro making Irish goods and services more expensive for UK clients.

Threats to Business Activity [1]

[1] Graphic shows words from anecdotal evidence provided by companies on their key threats to their businesses over the coming year, with size of each word determined my number of times reported.

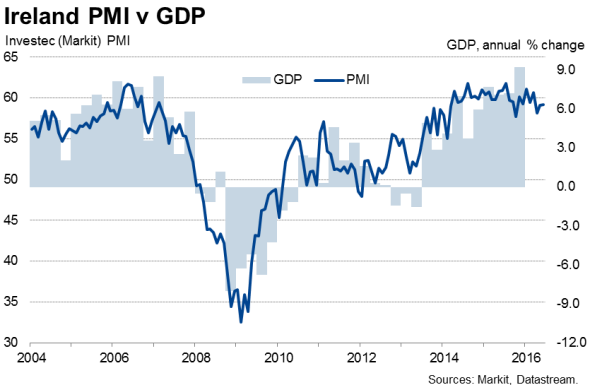

Growth remains strong at end of Q2

Prior to the referendum, Irish firms had signalled continued strong growth in output at the end of the second quarter of the year. Expansions were recorded in each of the three sectors covered by PMI data – manufacturing, services and construction. In fact, both the manufacturing and construction sectors saw sharper rises in output than in the previous month, though services continued to record the fastest overall rate of expansion of the three sectors.

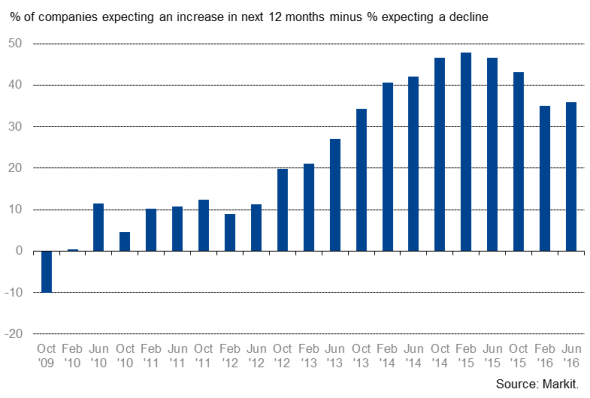

Further marked improvements in the labour market for the coming year were also signalled by the Outlook Survey. The number of firms expecting to take on more staff over the coming year exceeded those anticipating a reduction in staff numbers by 36%, up from 35% in February. However, that’s down from 47% a year ago, suggesting firms hiring intentions have moderated this year compared to last.

A few seeds of doubt also expressed themselves in the Services PMI Future Activity Index, which showed the weakest optimism since August 2013.

The first PMI data with all responses received post-referendum will be available at the start of August and will give a clearer insight as to how the uncertainty following the vote is already impacting Irish businesses.

*Note: GDP series shown is prior to recent technical revisions showing 26% increase in 2015.

Markit Business Outlook Survey: employment

Andrew Harker | Economics Associate Director, IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072016-economics-irish-business-optimism-slips-to-three-year-low-as-brexit-worries-dominate.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072016-economics-irish-business-optimism-slips-to-three-year-low-as-brexit-worries-dominate.html&text=Irish+business+optimism+slips+to+three-year+low+as+Brexit+worries+dominate","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072016-economics-irish-business-optimism-slips-to-three-year-low-as-brexit-worries-dominate.html","enabled":true},{"name":"email","url":"?subject=Irish business optimism slips to three-year low as Brexit worries dominate&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072016-economics-irish-business-optimism-slips-to-three-year-low-as-brexit-worries-dominate.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Irish+business+optimism+slips+to+three-year+low+as+Brexit+worries+dominate http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072016-economics-irish-business-optimism-slips-to-three-year-low-as-brexit-worries-dominate.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}