Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 12, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

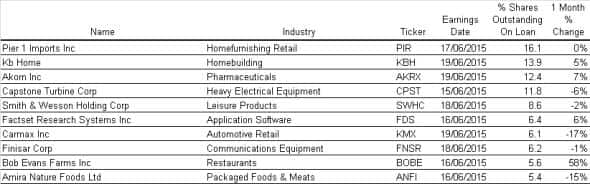

- Home furnisher Pier 1 Imports and homebuilder KB Home are the most short sold in North America

- Majestic Wine shares rally 47% after acquiring Naked Wines sending short sellers covering

- Groceries distributor Metcash the most short sold in Australia as retailers take market share

Pier 1 Imports is the most shorted company ahead earnings this week in North America with shares outstanding on loan increasing to 16%. The company continues to attract short sellers' attention after the company guided sales and earnings lower for the year. Forecasts for 2016 expect single-digit sales growth however operating profits for Pier 1 are forecast to continue to decline.

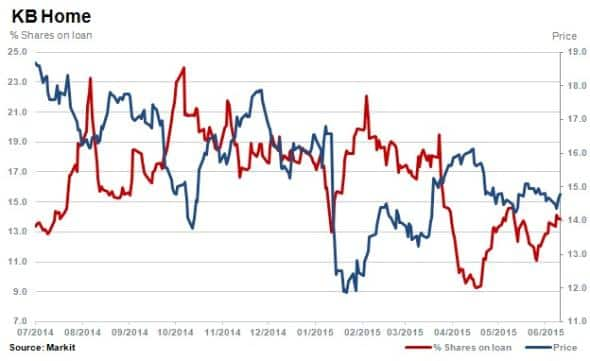

Homebuilder and seller KB Home is the second most shorted name in the region with 14% of shares outstanding on loan. The company has seen short interest track higher by 13% over the last 12 months while the share price has declined 17%.

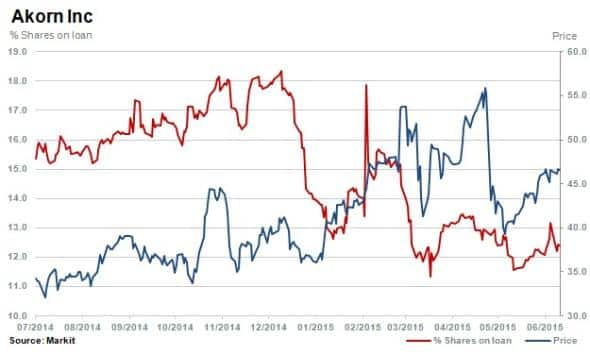

Pharmaceuticals manufacturer and vaccine distributor Akorn is the third most shorted ahead of earnings on the 19th June. With 12% of shares outstanding on loan the stock has rallied by 70% over the past 12 months and 29% year to date, sending short sellers to seek refuge by covering positions 30% in 2015.

Europe

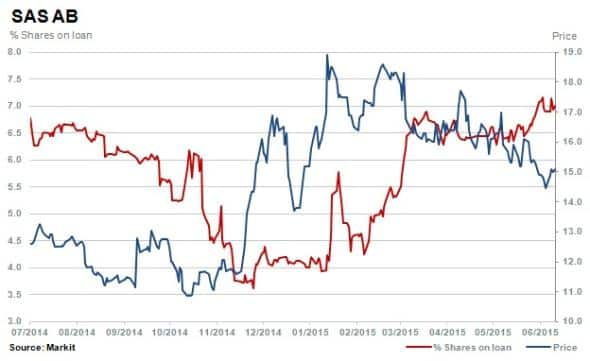

Scandinavian airline SAS is the most shorted ahead of earnings in Europe with 7% of shares outstanding on loan. Short sellers have increased positions 5% in the airline over the last three months while shares have declined 7%.

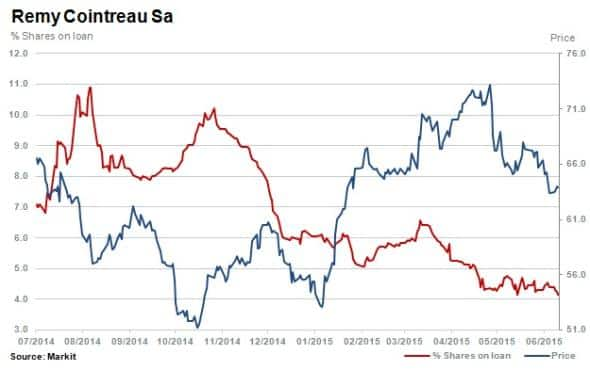

Despite Remy Cointreau being among the top three most shorted ahead of earnings, the company has seen short sellers retreat in 2015. In 2014 the Paris based spirits producer saw demand for products decline. However in January the company guided that the declines were in fact easing. Shares outstanding on loan have decreased from above 10% a year ago to 4.2% currently.

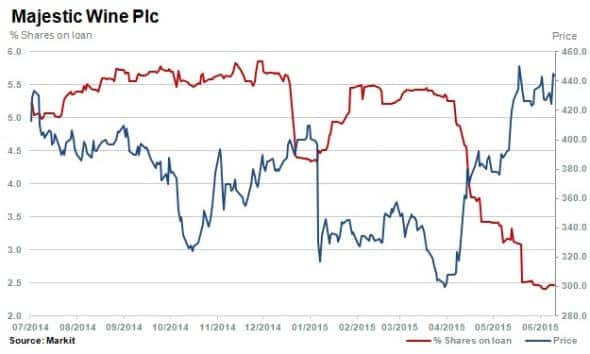

Majestic Wine shares have rallied by a staggering 47% since the beginning of April 2015. Shares outstanding on loan have halved over the same period to 2.5%. Investors reacted negatively to disappointing results earlier in the year with a 10% decline in profits and confirmation of no dividends in 2015 through 2018. However the April announcement of the $103m acquisition of boutique online wine retailer Naked Wines was received favourably by investors.

Asia Pacific

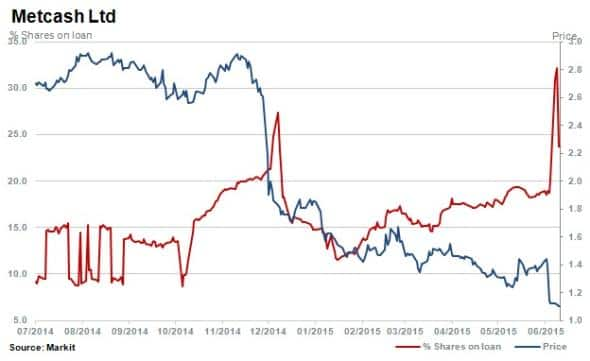

Australian Metcash is the most shorted in Apac with 24% of shares outstanding on loan.

The wholesale distribution company specialises in fast moving consumer goods and recently announced a withholding of dividends for 18 months and large asset write down which sent shares falling by 18%.

Metcash supplies more than 2000 independent chains and has been losing market share to the likes of Aldi, Woolworths and Coles.

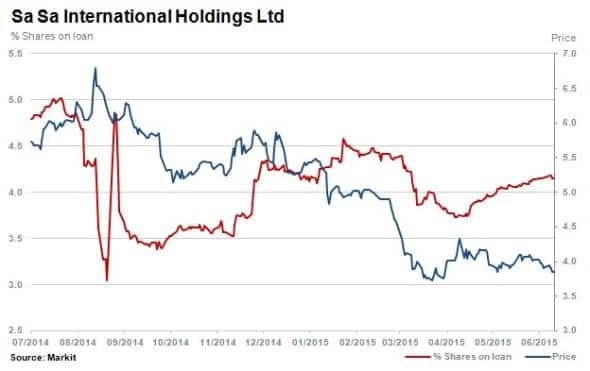

Hong Kong based Sa Sa is the second most shorted company in Apac, with 4% of shares outstanding on loan. The company sells and distributes cosmetics products globally.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}