Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 15, 2015

Periphery sovereign bonds hit by volatility

European periphery sovereign bonds have underperformed their core peers in recent weeks as investors began to require extra yield to hold these assets.

- Investors are requiring 40bps more yield to hold Spanish 10 year bonds compared to March

- French yield spreads have proved relatively steady despite volatility

- Spanish and Italian CDS spreads are driven by Greek woes and up sharply today

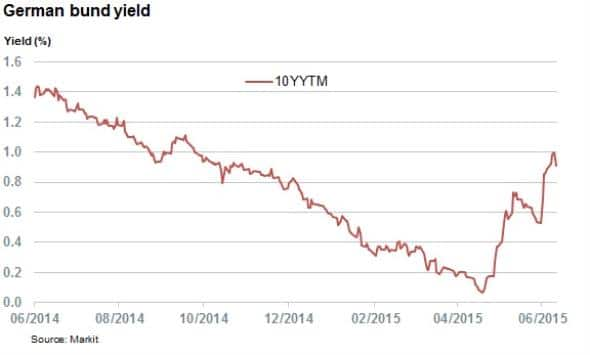

The last week saw the recent bond market volatility continue in earnest. Benchmark rates, as gauged by the 10 year German bund yield, have borne the brunt of the recent volatility which has seen the rate move above the 1% mark on Thursday.

This represents a stunning reversal of fortunes, as 10 year bund yields had been tipped to go negative as recently as the closing week of April when they yielded less than 20bpds.

Periphery spreads widen

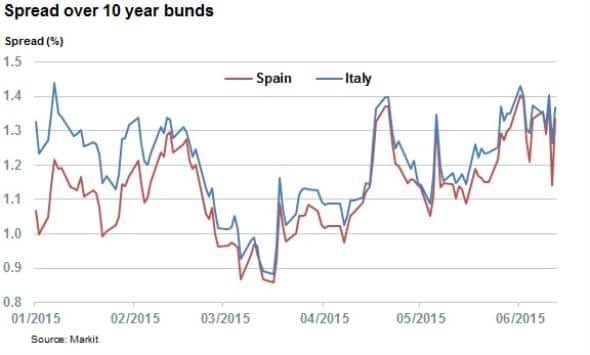

European periphery bonds, as measured by 10 year Spanish and Italian bonds, have also widened from their lows.

Investors had been actively buying periphery bonds in the lead up to the start of the ECB QE program, which had send the yield spread in the two periphery countries down below the 0.9% mark in mid-March. The extra yield required by investors to hold Spanish and Italian 10 year bonds over German issued debt is now over 1.3%.

While it is hard to pinpoint the cause of these surging spreads, they do seem to be mostly driven by unease over the possibility a Grexit; evidenced by significant spread widening in the closing week of April coinciding with the recent low water mark for Greek bonds. The rise of anti-austerity parties in both Spain and Italy is also likely to be playing a role in the rising spreads.

Another interesting point to note is that the spread difference between Spanish and Italian bonds is now roughly the same. At the start of the year, Spanish bonds were trading 35bps wider than their Italian counterparts.

Meanwhile back in the European "core", France's 10 year sovereign bonds have seen their spreads over bunds prove relatively flat; in the 20 to 30bps range.

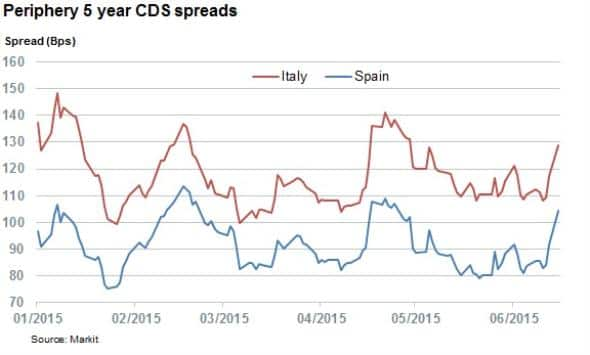

CDS spreads not reflecting volatility

While the Spanish and Italian bonds have reflected the recent market volatility, the two countries have seen their CDS spreads prove relatively resilient in the last couple of months.

Although the current CDS spreads for both Spain and Italy are wider than the yearly lows seen in March, this appears to be driven by Grexit concerns rather volatility in the wider bond market. This is again demonstrated by the fact that CDS spreads spiked in the closing week of April when Greek.

This link between Greece's woes and the risk perception of Spanish and Italian debt has been playing out in the most recent chapter of the debt saga as both these country's CDS spreads are now over 10bps wider this morning.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-Credit-Periphery-sovereign-bonds-hit-by-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-Credit-Periphery-sovereign-bonds-hit-by-volatility.html&text=Periphery+sovereign+bonds+hit+by+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-Credit-Periphery-sovereign-bonds-hit-by-volatility.html","enabled":true},{"name":"email","url":"?subject=Periphery sovereign bonds hit by volatility&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-Credit-Periphery-sovereign-bonds-hit-by-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Periphery+sovereign+bonds+hit+by+volatility http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-Credit-Periphery-sovereign-bonds-hit-by-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}