Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 12, 2015

Greece tensions rise; ETFs driving HY liquidity

Short term Greek government bonds are hitting their highest yields since mid April. ETF growth has boosted US corporate bond trading volumes.

- Greek two year government bond yield spikes to 26% ahead of crucial Eurogroup meeting

- US HY fixed income ETFs have seen AUM grow from $21bn to $44bn in the past four years

- UK banks' 5-yr CDS spread at seven month highs, mirroring eurozone peers

Greece still in a muddle

Tensions in Greece have gone up another notch as the IMF cited no progress in latest bailout negotiations. Greece owes the IMF around €1.5bn by the end of the month which also coincides with expiry of the current bailout programme. Any deal would have to be made well in advance of the June 30th deadline so that respective parliaments can approve the funds.

While Greek equities sold off this morning, credit markets remain calmer. On June 10th the yield on the Greek government bond maturing in 2017 reached nearly 26%, a level last reached in mid April. The latest yield is slightly lower at 25% according to Markit's bond pricing service. Nervousness among periphery nations has also crept up over the past month; Portugal's 5-yr CDS spread widened 28bps during the period.

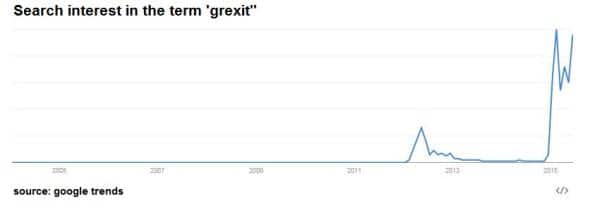

Attention has now turned to next week's Eurogroup meeting where discussions will continue. Meanwhile 'Grexit' has returned to the headlines after a brief hiatus in March and April.

US HY liquidity

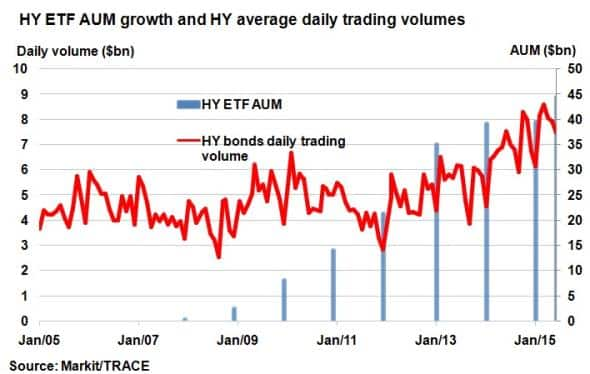

With recent sharp movements in sovereign bonds talk has turned to volatility across global bond markets and the potential effects on US corporate bonds. Lack of liquidity is the main concern. With many US investors accessing corporate bonds through ETFs, some question whether they could pose a risk to liquidity if investors decide to flee.

Corporate bonds ETFs have enjoyed staggering growth since 2011. ETFs tracking US HY indices such as the Markit iBoxx USD Liquid High Yield index (HYG) have grown to over $40bn of AUM since 2007 and have doubled since 2011.This has coincided with a sharp increase in daily trading volumes in underlying US HY bonds. During the same period the average daily trading volume of US HY bonds increased from about $5bn to around $8bn, highlighting the impact ETFs have on liquidity.

UK Banks follow eurozone peers

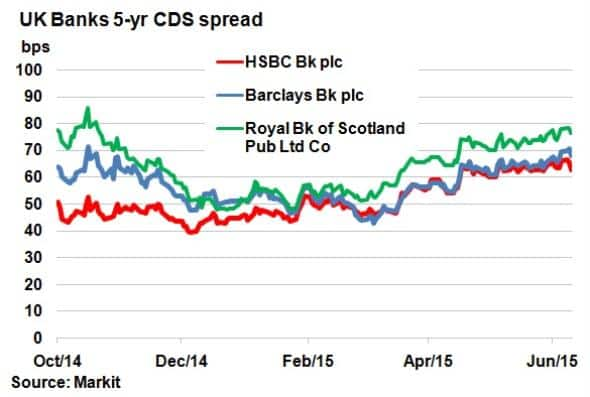

UK bank credit has followed a similar path as their eurozone peers with CDS spreads widening over the past two months. The additional perception of risk comes as European legislators implement laws that aim to reduce government intervention in times of severe bank stress.

This week, Barclays and RBS were downgraded by S&P. Both banks' credit spreads are at seven month highs. HSBC, which recently announced global job cuts and the possibility of moving headquarters from the UK, is seeing 5-yr CDS levels at 52 week highs.

Mixed week for Turkey's credit

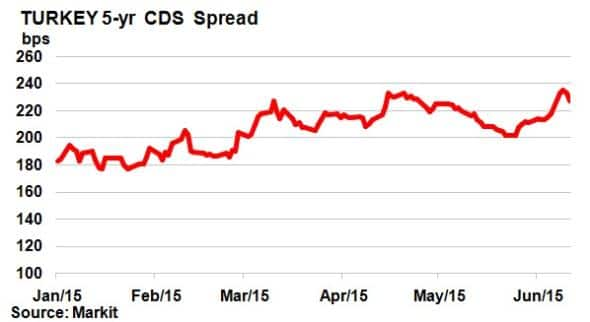

Turkish sovereign credit had a mixed week for. Elections last week resulted in the incumbent AK party failing to win a majority for the first time since 2002, leading to short term political uncertainty. Turkey's 5-yr CDS spread widened 15bps on the back of the result. But it wasn't all negative news with better-than-forecast GDP figures, tightening credit spreads by 5bps.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-credit-greece-tensions-rise-etfs-driving-hy-liquidity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-credit-greece-tensions-rise-etfs-driving-hy-liquidity.html&text=Greece+tensions+rise%3b+ETFs+driving+HY+liquidity","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-credit-greece-tensions-rise-etfs-driving-hy-liquidity.html","enabled":true},{"name":"email","url":"?subject=Greece tensions rise; ETFs driving HY liquidity&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-credit-greece-tensions-rise-etfs-driving-hy-liquidity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greece+tensions+rise%3b+ETFs+driving+HY+liquidity http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-credit-greece-tensions-rise-etfs-driving-hy-liquidity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}