Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 11, 2015

Lower US equity volatility implied"for now

S&P 500 volatility levels have stabilised with moderate positive returns but recent market moves in Europe and in ETPs tracking volatility raise questions on sustained market stability.

- Overall lower overall implied option volatility observed in both the US and Europe

- ETP investors have added almost $1bn ytd to volatility tracking products

- Recent flows into funds that benefit from a rise in volatility

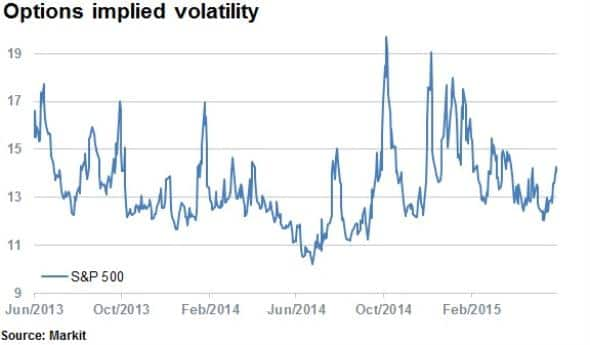

After a bumper 2014 for the S&P 500, the index has managed to eke out only 2.25% in price returns ytd. In light of this relative stability implied market volatility continues to show a long term declining trend, after increasing towards the end of 2014.

In the first week of June, 90 Day At The Money Implied Volatility for S&P 500 options have increased by 10%.

In comparison, the Stoxx 600 is up over 13% ytd despite a 2% decline over the past month. The index has, however, also seen volatility levels decrease in 2015. As with the S&P 500, the recent market sell off saw a spike in volatility in Europe too, indicating increased uncertainty among investors.

The uptick in volatility implied by equity markets could be due to the recent bond market sell off in Europe and emerging equity and bond markets. The sell off occurred after stronger jobs data was released in the US, indicating a strengthening economy and increased likelihood of a rate rise in the near future.

Adding to the growing uncertainty, ECB president Mario Draghi commented that debt markets should 'get used to' increased bond volatility and sustained low interest rates.

Investors react

63 ETPs now track market volatility, providing investors with efficient instruments to gain or reduce exposure to tumultuous markets. Over 50% of AUM in the category is focused on the S&P 500 VIX Short term futures contracts.

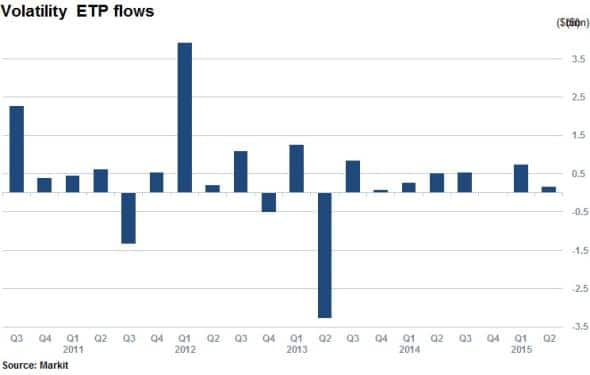

The continued decline in volatility levels has caught the attention of ETP investors, ETPs continued to attract net inflows with Q1 2015 flows the second largest since August 2012.

Not surprisingly, the funds that have seen the largest inflows since the beginning of the latest market volatility moves are those that stand to benefit from a rise in market volatility. Steady inflows have continued in the second quarter of 2015 with almost a $1bn flowing into the category in the first half of the year.

Of the ETPs tracking volatility, long volatility instruments have seen strongest inflows while inverse products such as the Velocity Shares Daily Inverse VIX Short Term ETN with ytd outflows total $633m, have experienced the biggest outflows. This indicates that investors are positioning themselves for increased volatility in the coming months.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Equities-Lower-US-equity-volatility-implied-for-now.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Equities-Lower-US-equity-volatility-implied-for-now.html&text=Lower+US+equity+volatility+implied%22for+now","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Equities-Lower-US-equity-volatility-implied-for-now.html","enabled":true},{"name":"email","url":"?subject=Lower US equity volatility implied"for now&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Equities-Lower-US-equity-volatility-implied-for-now.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Lower+US+equity+volatility+implied%22for+now http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-Equities-Lower-US-equity-volatility-implied-for-now.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}