Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 12, 2015

European consumers buoyed by low inflation

Fears of Europe falling into a deflationary slump are looking overplayed, for now at least. Markit's PMI data indicate that, rather than postponing purchases in the hope that prices will fall further in the future, consumer spending appears to be rising as households take advantage of lower prices.

There are also signs that investors are taking more interest in Europe and its consumers, undeterred by deflation worries. Exchange traded funds have already seen net inflows in 2015 of an almost equal magnitude to those seen over the whole of 2014, according to Markit data. Of these, funds that are specifically exposed to consumer goods and services look set to see the first quarterly net inflow for a year after investors too fright over much of last year as the recovery waned.

Consumer-driven European growth

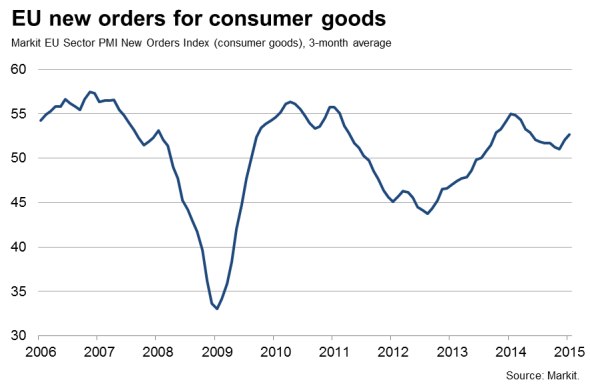

Markit's European PMI data surprised on the upside in January, with growth picking up in the UK, eurozone and eastern European countries such as the Czech Republic and Poland. The detailed sector data provide added insight into what's driving this growth, and reveal a surprising upturn in demand from consumers in recent months. Producers of consumer goods reported the strongest rise in new orders since last May in the three months to January. December had seen the strongest increase for almost a year and a further (albeit more modest) rise was seen in January. By comparison, the order book data had shown a near stalling of demand for consumer goods back in October.

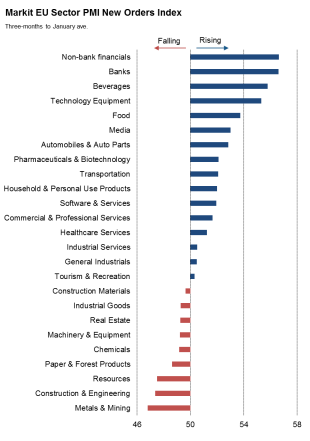

Looking at demand over the latest three months, car makers saw the strongest increase in new orders for nine months in January, while food and drink producers reported the best order book growth for a year. New orders for household goods meanwhile climbed to a five-month high.

While financial firms saw the strongest increase in new orders in the latest three months, food, drink, car makers and media firms were all in the top seven sector rankings, highlighting how consumer-led sectors are currently driving European economic growth.

Rising consumer sentiment

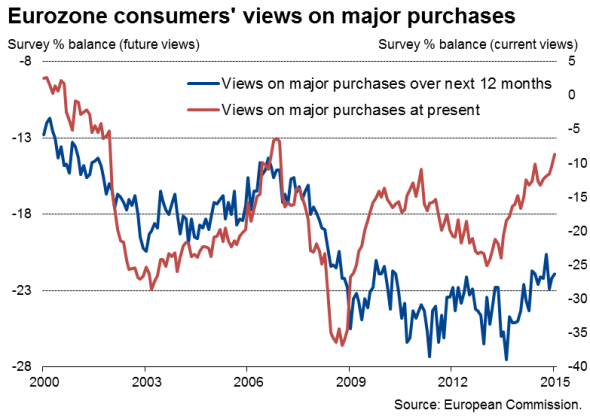

Further growth of household spending looks likely in coming months. Survey data from the European Commission showed households views on making major purchases were the most buoyant since 2006 at the start of the year, pointing to rising current consumption. Intentions to make major purchases over the next 12 months meanwhile remained high compared to this time last year, but are by no means as elevated as views on current purchases. This divergence implies consumers are not deferring current purchases over future spending due to the belief that prices will fall further. However, for a recovery in euro area consumer spending to be sustainable, we would want to see views on future purchases rise more strongly than currently being signalled by the data.

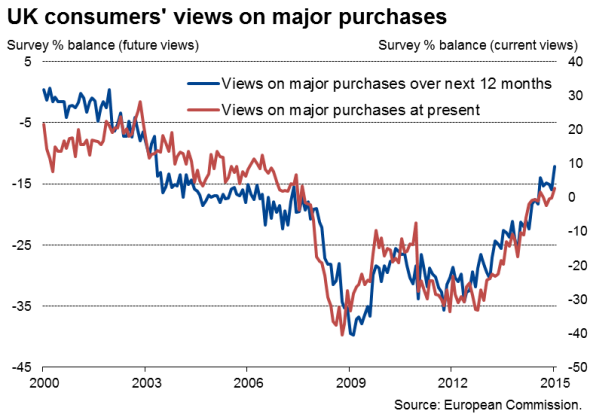

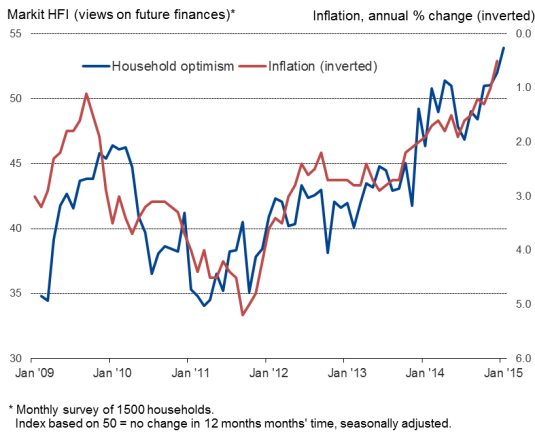

In contrast, the outlook is looking brighter in the UK, where households' views on future and current spending have both hit post crisis highs. Views on whether now is a good time to make major purchases are the most upbeat since 2007 while views on making purchases over the next 12 months are the best since 2003.

UK household financial optimism and inflation

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Economics-European-consumers-buoyed-by-low-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Economics-European-consumers-buoyed-by-low-inflation.html&text=European+consumers+buoyed+by+low+inflation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Economics-European-consumers-buoyed-by-low-inflation.html","enabled":true},{"name":"email","url":"?subject=European consumers buoyed by low inflation&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Economics-European-consumers-buoyed-by-low-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+consumers+buoyed+by+low+inflation http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-Economics-European-consumers-buoyed-by-low-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}