Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 11, 2015

Fed rate hike draws closer as global growth ticks higher

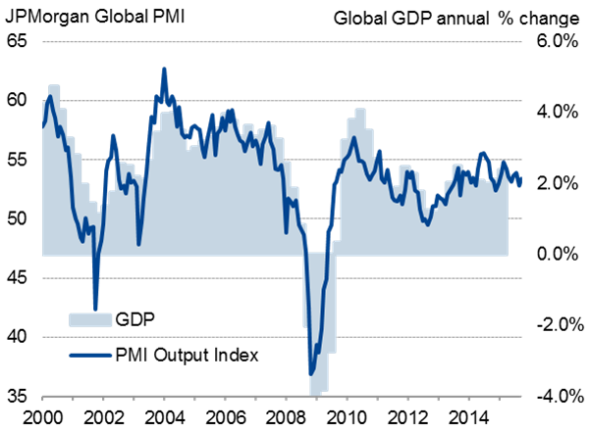

The JPMorgan Global PMI", compiled by Markit, regained some poise after slipping to a nine-month low in September, rising to 53.4. However, the survey merely signals a rate of worldwide GDP growth of just around 2% per annum. Services continued to drive the upturn, as has been the case throughout the past year-and-a-half, though an upturn in the goods producing sector meant the divergence narrowed.

Global PMI and economic growth

Emerging markets act as ongoing brake on global economy

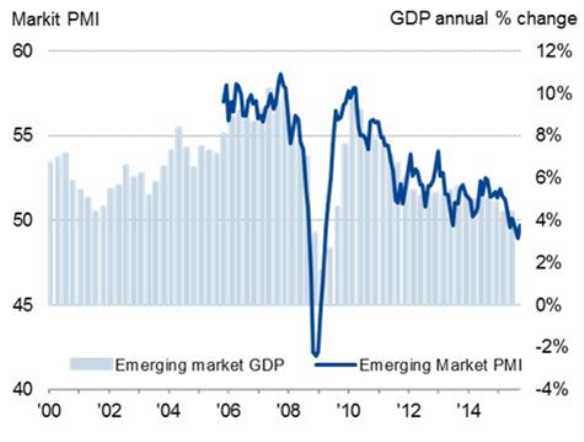

At 49.7, the emerging market PMI remained below the 50.0 neutral level for the fourth time in the past five months. Although the data point to an easing in what has been the worst performance since 2009, the emerging market index is still signalling GDP growth of less than 4%. In the developed world, the PMI also ticked higher but indicated modest GDP growth of just less than 2%.

Emerging markets

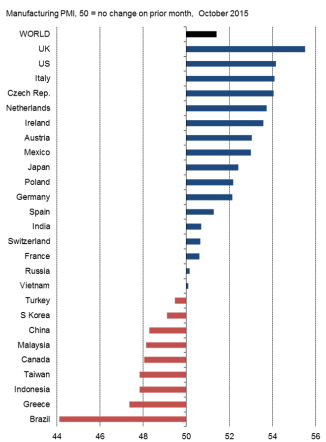

UK and US top manufacturing PMI leader board

The UK leapt to the top of the manufacturing PMI rankings in October, followed by the US and then a clutch of continental European countries. The UK saw an unusually marked improvement in its rate of growth to a 16-month high, lurching out of the malaise seen over the summer months. US growth also accelerated, reaching a six-month peak.

Of the 17 countries that recorded expansions, 11 were from the developed world. Of the nine countries, in decline, all bar two - Greece and Canada - were emerging markets, the latter suffering in its role as key supplier of raw materials to emerging market producers.

The steepest downturn was seen in Brazil, which endured its steepest decline since March 2009, followed by Greece, where the downturn continued to moderate.

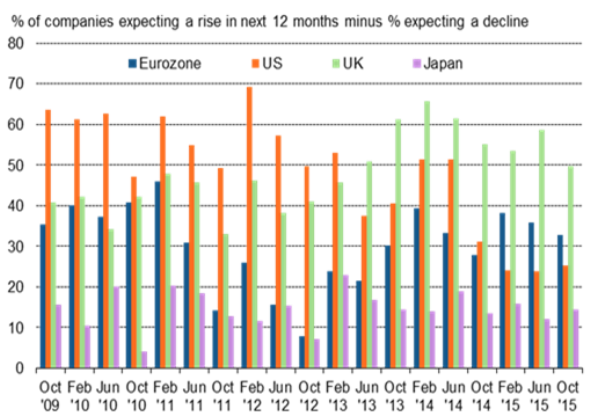

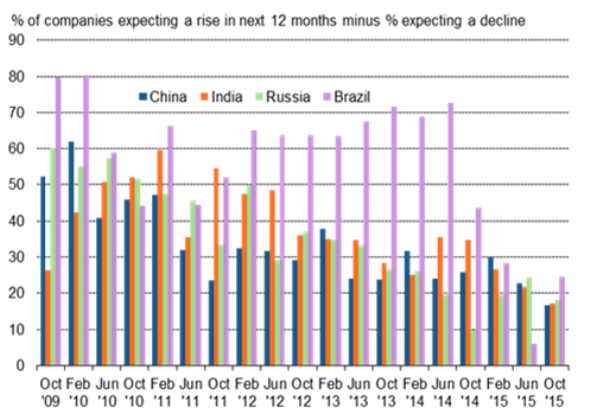

Global business outlook darkest since 2009

It remains to be seen whether the upturn in the PMI data for October is the start of a global growth revival or a blip in an easing trend, but Markit's Global Outlook survey points to the latter. The data showed PMI survey respondents were more downbeat about the next 12-months than at any time since 2009. The survey was accompanied by the OECD revising down its global growth forecasts. Post-crisis lows were seen in both China and India, and confidence also waned in the eurozone and the UK. Meanwhile, optimism remained relatively weak in the US.

Developed world outlook

Emerging market outlook

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-economics-fed-rate-hike-draws-closer-as-global-growth-ticks-higher.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-economics-fed-rate-hike-draws-closer-as-global-growth-ticks-higher.html&text=Fed+rate+hike+draws+closer+as+global+growth+ticks+higher","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-economics-fed-rate-hike-draws-closer-as-global-growth-ticks-higher.html","enabled":true},{"name":"email","url":"?subject=Fed rate hike draws closer as global growth ticks higher&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-economics-fed-rate-hike-draws-closer-as-global-growth-ticks-higher.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fed+rate+hike+draws+closer+as+global+growth+ticks+higher http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-economics-fed-rate-hike-draws-closer-as-global-growth-ticks-higher.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}