Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 11, 2015

UK pay growth dips despite tightest job market since 2008

The UK labour market continued to tighten in September as unemployment fell more than expected and employment rose sharply. Pay growth remained surprisingly weak, however, despite further evidence of growing skill shortages, which normally leads to higher salaries.

Pay growth remains central to policymaking, and interest rates are likely to stay on hold for as the official data show pay growth remaining subdued. Today's data therefore support the Bank's current projections that there will be no need to raise interest rates until 2017 due to persistent low inflation.

We suspect, however, that pay growth will accelerate in coming months, meaning there's clear a risk that inflation could rise faster than the Bank of England is currently anticipating, in turn raising the likelihood of interest rates having to rise within the next year.

Surprisingly weak pay in September

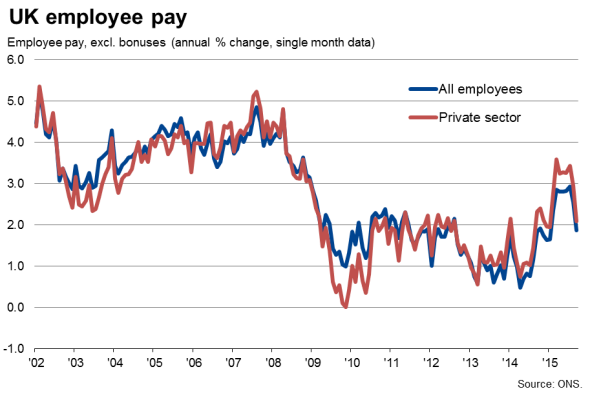

Pay including bonuses rose 3.0% on a year ago in the third quarter, according to data from the Office for National Statistics. Stripping out bonuses, the rate of increase was just 2.5% on a year ago, down from 2.8% in the three months to August. There was unusual weakness in pay growth in September, however, as the rate of increase of regular pay fell to just 1.9% from an average of 2.8% in the prior six months. It should be noted that this latest figure is provisional and subject to potentially substantial revision. We suspect it will be revised higher.

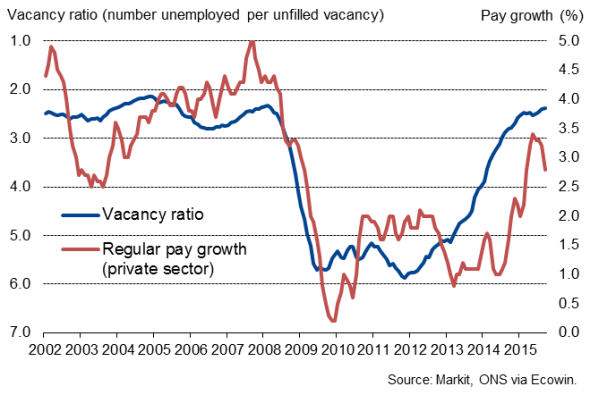

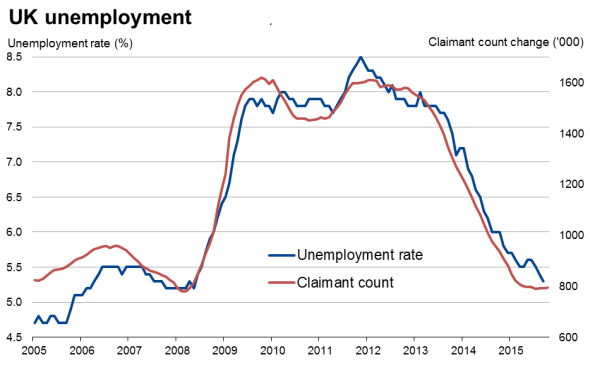

The recent slowing of pay growth is particularly surprising given the tightening of the labour market. The pool of available labour has shrunk considerably. The unemployment rate has fallen to 5.3%, down from 5.4% in the three months to August and its lowest since early-2008.

Labour market tightness

The actual number of people in unemployment fell by 103,000 in the three months to September compared to the three months to June.

There are now just 2.4 unemployed people per vacancy. That's down from a peak of 5.9 four years ago, and a level that normal ignites faster pay growth.

Recruitment consultants also report that difficulties finding suitable staff continue to worsen at one of the most severe rates seen over the past 18 years. Consequently, despite seeing sustained strong demand for staff from employers, recruiters were unable to fill vacant positions in many instances, resulting in weaker employment growth than seen earlier in the year.

With both the monthly recruitment industry and PMI surveys showing jobs growth accelerating again in October, this may be a reflection of employers agreeing to offer higher pay to secure suitable new hires.

The ONS data also show robust hiring: the number in employment increased by 177,000 between the second and third quarters.

Pay hot spots

There are already pockets of high pay growth, which will be ringing alarm bells among the more hawkish policymakers. Within the retail, hotels and restaurants sector, regular pay is rising at an annual rate of 3.9%, while construction workers are seeing a 6.6% rate of increase. However, pay growth in the vast business and financial service sector has slumped to just 2.3% in the third quarter, with a rate of just 1.3% seen in September, and in manufacturing pay is up just 1.6% on a year ago, although this is a ten-month high.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-Economics-UK-pay-growth-dips-despite-tightest-job-market-since-2008.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-Economics-UK-pay-growth-dips-despite-tightest-job-market-since-2008.html&text=UK+pay+growth+dips+despite+tightest+job+market+since+2008","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-Economics-UK-pay-growth-dips-despite-tightest-job-market-since-2008.html","enabled":true},{"name":"email","url":"?subject=UK pay growth dips despite tightest job market since 2008&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-Economics-UK-pay-growth-dips-despite-tightest-job-market-since-2008.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+pay+growth+dips+despite+tightest+job+market+since+2008 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-Economics-UK-pay-growth-dips-despite-tightest-job-market-since-2008.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}