Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 11, 2014

Agriculture investors set for poor harvest

Three years of downbeat commodity prices have seen investors become increasingly disillusioned with agricultural resources - a trend that has continued this year amid fresh lows.

- ETF investors have pulled cash from both commodity and agriculture tracking funds this year

- Short interest has surged in tractor maker Deere and AGCO in recent weeks

- The fall in commodities has helped food & beverage firms, which topped Markit's global sector PMI

Investing in commodities looked set to be a decent hedge against inflation a few years ago which, given the record amount of cash being minted by central banks, weighed on many investor's minds.

This rush to hard assets saw record inflows into all aspects of the commodities world, something which was facilitated by advances in the ETF world which opened previously inaccessible markets to any investor with an equity trading account.

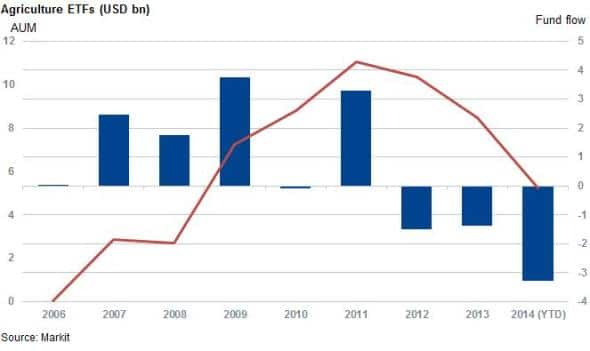

Agriculture funds were no exception, with the asset class seeing just under $6bn of inflows until the end of 2009. Combined with strong commodity prices, AUM managed by these funds topped out at $8.4bn at the end of the first quarter of 2011.

Fast forward three years and a combination of low growth, absent inflation and record harvests resulted in a sharp retreat of commodity prices. This is evidenced by the DBQI, a broad measure of agriculture commodity prices run by Deutsche Bank which is down by a third from its highs in January 2012. This trend, combined with buoyant equity markets has seen investors leave commodity funds for greener pastures.

ETF outflows

ETF flows out of agriculture exposed ETFs continued to go backwards since 2010 with the exception of 2011. The trend has accelerated this year with the 254 agriculture exposed ETFs on track for their worst ever year in term of asset flow in the wake of $3.1bn of redemptions. The AUM for this asset class now stands at only half its peak three years ago.

The largest outflows so far this year have been driven by investors fleeing large broad based commodities baskets, such as the PowerShares DB Agriculture Fund which tracks the previously mentioned DBQI.

Perhaps the worse hit segment of the recent wave of bearishness the sector has been the Market Vectors Agribusiness ETF, which invests in companies that have large exposure to agriculture such as tractor, fertilizer and seed companies. The fund, which is on track to underperform the S&P 500 for another year, has seen over $3bn of outflows since January and stands at just two thirds of its original AUM.

Tractor firms see shorts circle

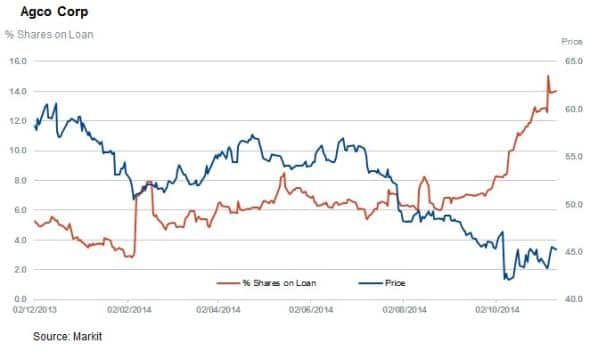

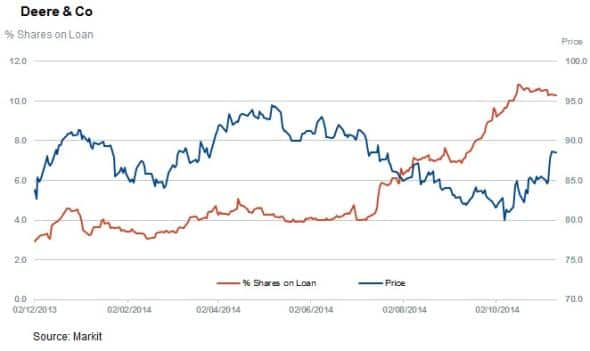

The recent downturn in agricultural commodities has not evaded short sellers as the three main tractor equipment companies have seen a surge in demand to borrow in the last few months.

The most shorted firm is US listed AGCO which has 14% of its shares outstanding on loan. The company which manufactures tractors and combine harvesters under a host of brands has felt the recent downturn in agriculture quite hard and has seen revenue fall by 9% year to date from 2013 along with widely eroding margins. Current short interest represents nearly four times what was seen in January after a severe price fall.

AGCO's peer and industry leader, Deere has mostly echoed its plight in recent months. Its short interest is over twice where it was at in January.

Buoyant food firms

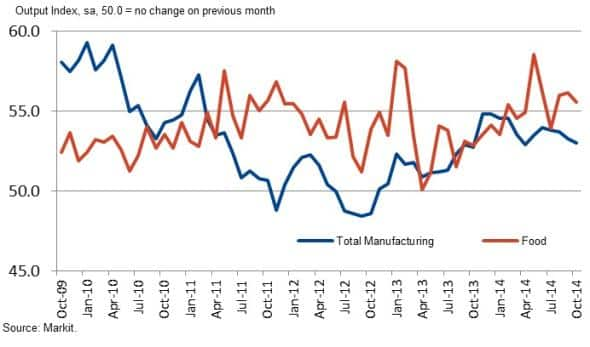

On bright side, the recent fall in commodity prices looks to be feeding through to food producers as these firms remain the fastest growing manufacturing sector in October according to Markit's global sector PMI survey data.

Perhaps most relevant to the recent trend, survey respondents indicated a sharp moderation input prices in the last month, showing that the recent commodities prices are feeding through to firms which directly consume agricultural commodities.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-equities-agriculture-investors-set-for-poor-harvest.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-equities-agriculture-investors-set-for-poor-harvest.html&text=Agriculture+investors+set+for+poor+harvest","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-equities-agriculture-investors-set-for-poor-harvest.html","enabled":true},{"name":"email","url":"?subject=Agriculture investors set for poor harvest&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-equities-agriculture-investors-set-for-poor-harvest.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Agriculture+investors+set+for+poor+harvest http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-equities-agriculture-investors-set-for-poor-harvest.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}