Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 12, 2014

South African ETF investors favour foreign markets

After a downgrading of the country's debt by Moody's last week, we look to investment and capital allocation trends in ETFs in South Africa in the country's twentieth year as a democracy.

- Markit CDS spreads narrow for the country despite a recent ratings downgrade

- International investors have continued to pull funds exposed to the country

- Domestically, only about a quarter of South African assets track South African equities

Keeping the lights on

Moody's joined Fitch and S&P in downgrading South African (SA) sovereign debt last week. The downgrade came in the same week as the government's revision of growth expectations down from 2.7% to 1.4%; the lowest since the financial crisis.

Moody's cited poor medium term growth prospects, structural weaknesses and the prospect of rising interest rates for the downgrade. Wide spread industrial strike action, rising costs and electricity generation are significant barriers to economic growth in the region.

Increasing borrowing costs due to the downgrade and lower growth will dilute the government's ability to drive policy and narrow the budget deficit through tax revenues. A major headache at the moment is state run monopoly or dominant energy generator Eskom.

Stable electricity supply is a keystone of economic growth and to this end the newly appointed finance minister Nhlanhla Nene last week revealed intentions to sell non-core state assets to assist with Eskom's funding gap of $20.6bn.

The funding gap at Eskom is largely due to the current power station build programme that has had its own problems but is overdue to start contributing much needed capacity towards the end of the year, achieving the title of most expensive power station in the world.

The significant shift in policy to sell state assets perhaps indicates the government's new found determination to improve the outlook for Eskom and therefore the country.

CDS spreads tighten

The proposed state asset sale could explain why Markit's CDS data indicates that actual spreads for sovereign debt have narrowed, implying more confidence in the government's ability to honour long term obligations, even post the recent downgrade. However foreign and local investors have divested from equities on net basis year to date.

Equity investors yet to be sold

The regional ETF market exposure is small relative to the 5900+ ETFs that Markit ETP tracks, representing approximately $2.7 trillion of AUM globally.

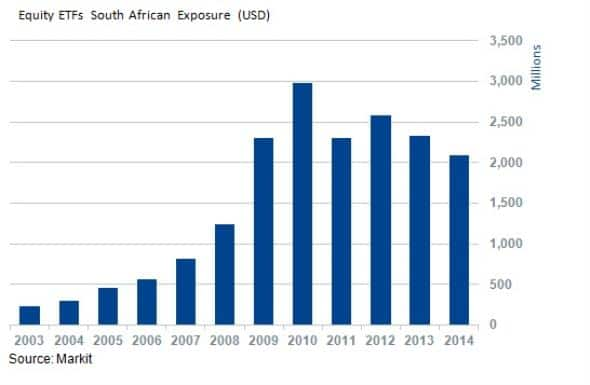

Total ETF exposure to South Africa is down almost a third from peaks reached in 2010.

NYSE listed iShares MSCI South Africa is the main ETF to gain exposure to the JSE. Run by BlackRock Investments, the fund peaked with $616m in AUM in June 2014 and then witnessed a 27% decline with outflows occurring in September and October. Its AUM has now atrophied to $444m. Recovering slightly towards the end of October AUM is currently at $477bn.

Interestingly investors may be getting more international exposure in terms of ETF constituent's revenue composition than they bargain for, as weightings of the country's largest stocks in the Top 40 index include companies with significant foreign derived revenue streams and investments. Sasol for example, a top ten holding of the iShares ETF above, recently announced a perhaps ill-timed (in the short term) investment in the US to convert shale gas into derived products.

Domestic ETF market

South Africa has approximately 40 equity ETFs and a further 30 listed ETPs on the JSE. Other products provide exposure to commodities, currencies and fixed income investments.

The total South African ETP universe represents $6.5bn with gold and platinum making up approximately $3bn. Equity ETFs specifically represent $2.4bn.

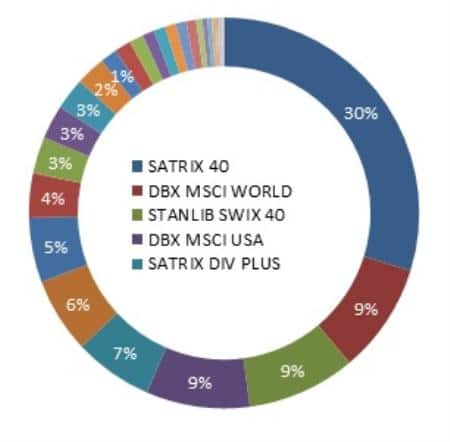

This figure includes the db x-trackers franchise whose offerings represent $656m or 27% of the local equity ETF market. These tracker ETFs provide South African investors with simplified and accessible foreign investment exposure.

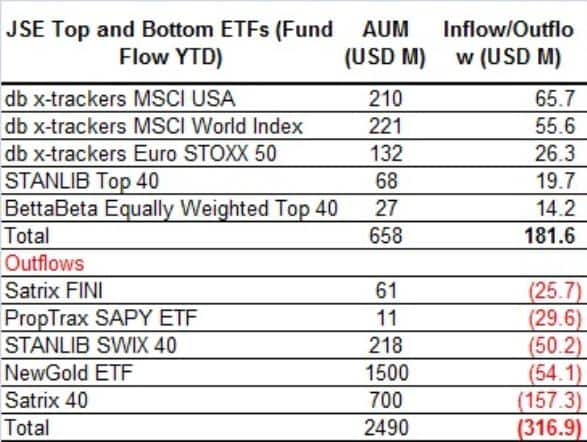

Analysing the AUM flow of funds into locally listed ETFs, investors have flocked towards these trackers in 2014 with the top three ETF inflows going to db x-trackers, which offer foreign exposure. The most popular route for investors with wanderlust is the US as evident by the $66m which flowed into the db x-trackers MSCI USA fund.

Outflows mirror inflows in that the funds seeing the largest outflows track domestic equities, South African property and, interestingly for investors looking to protect the real value of their Rand investments, gold.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Equities-South-African-ETF-investors-favour-foreign-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Equities-South-African-ETF-investors-favour-foreign-markets.html&text=South+African+ETF+investors+favour+foreign+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Equities-South-African-ETF-investors-favour-foreign-markets.html","enabled":true},{"name":"email","url":"?subject=South African ETF investors favour foreign markets&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Equities-South-African-ETF-investors-favour-foreign-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=South+African+ETF+investors+favour+foreign+markets http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112014-Equities-South-African-ETF-investors-favour-foreign-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}