Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 11, 2017

Caixin China PMI surveys end third quarter on softer note

The Chinese economy ended the third quarter on a softer note, with survey data showing a weaker pace of growth in September. The end to the quarter was marred also by a lack of employment growth, weaker inflows of new business and a drop in business optimism. Meanwhile, cost pressures intensified, largely in the manufacturing sector, which points to higher inflation in coming months.

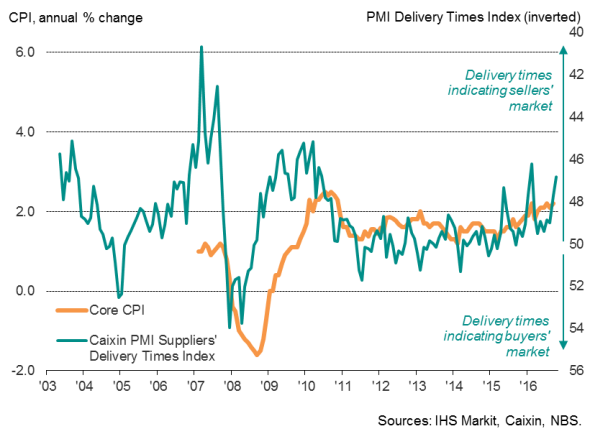

Capacity constraints (supplier delays) and inflation

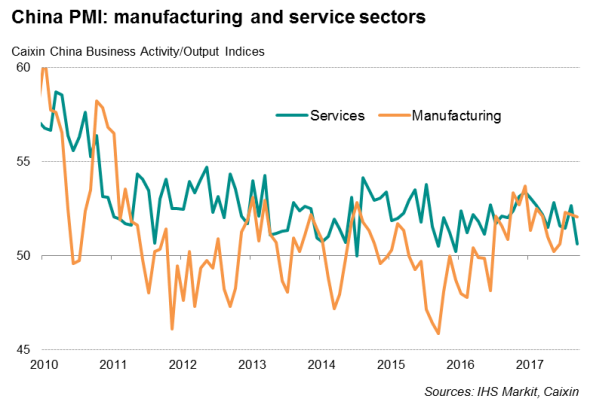

Services-led slowdown

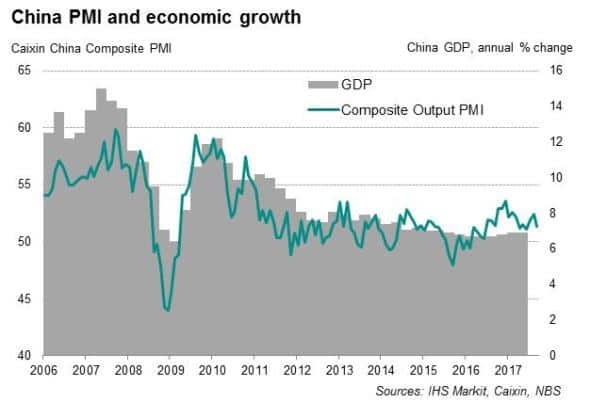

The Caixin China Composite PMI Output index slipped to a three-month low of 51.4 in September from 52.4 in August. The latest reading was one of the weakest seen over the past year.

While the manufacturing sector maintained a relatively steady increase in output during September, enjoying one of the stronger monthly gains seen this year amid on-going export growth, services activity slowed noticeably, acting as a drag on overall growth.

The domestically-oriented service sector recorded the weakest growth in business activity since December 2015, raising some concerns about private consumption.

Forward-looking PMI indicators suggest that the pace of economic expansion may weaken in the final quarter of this year. Growth in new business decelerated to a three-month low in September, registering the second-smallest rise seen in the past year. Business optimism meanwhile dipped to the second-lowest level seen since 2015.

The deterioration in the forward-looking indicators adds to our expectation that China"s pace of economic growth will slow to 6.6%-6.7% in the fourth quarter.

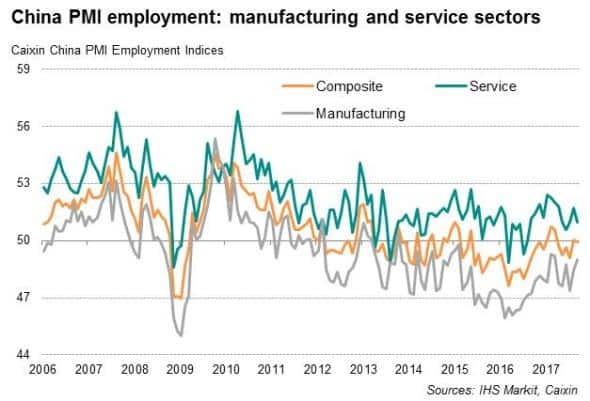

Stagnating employment

The employment trend waned alongside the dip in the pace of output growth in September. In the case of manufacturing employment, layoffs exceeded job creation, with some surveyed firms reporting that they are down-sizing. Although service sector employment rose, the increase was only modest and insufficient to fully offset the manufacturing layoffs, leading to a fractional drop in total employment.

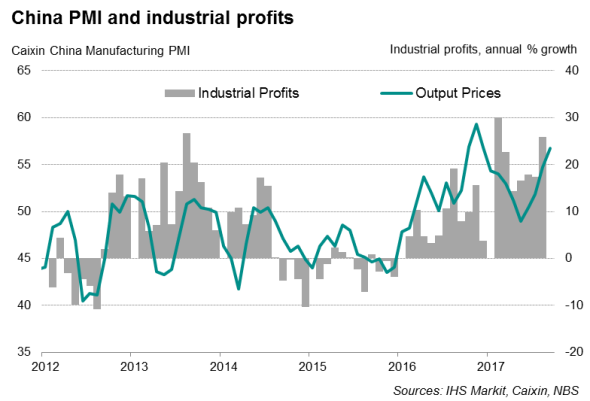

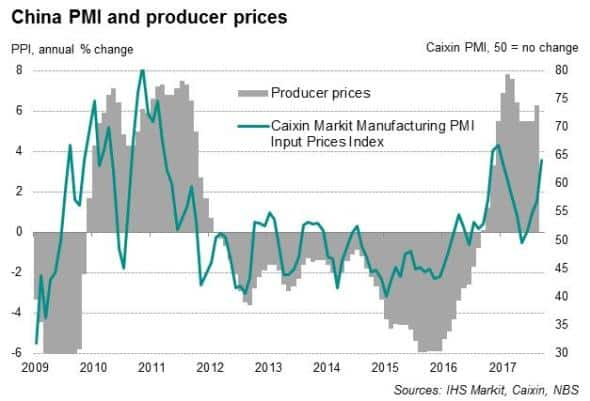

Rising prices

Survey indicators of input costs and selling prices signalled rising inflationary pressures. Input price inflation accelerated sharply to the second-highest so far this year. While higher oil prices were partly to blame, there were also indications that stretched supply chains had pushed prices higher. Supplier delivery times lengthened to one of the greatest extents for over six years in September amid reports of supply shortages linked to stricter environmental inspections as well as demand simply exceeding demand for certain key inputs.

In response, prices charged for Chinese goods and services showed the largest monthly rise to date this year.

Of note, the rise in inflation was lopsided, with the bulk of higher prices coming from the manufacturing sector. By contrast, the service sector reported marginal rates of inflation in both input costs and charges.

However, higher producer prices could start to feed through to consumer inflation, which has been subdued recently, according to official data, largely due to lower food prices. Core inflation, on the other hand, has started to pick up, rising to 2.2% in recent months, its highest since 2011.

The upturn in core inflationary pressures tallies with the shift to a sellers" market signalled by the suppliers" delivery times index, which has historically acted as a leading indicator of core price pressures and therefore suggests that underlying inflationary pressures have risen as demand outstrips supply.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11102017-Economics-Caixin-China-PMI-surveys-end-third-quarter-on-softer-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11102017-Economics-Caixin-China-PMI-surveys-end-third-quarter-on-softer-note.html&text=Caixin+China+PMI+surveys+end+third+quarter+on+softer+note","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11102017-Economics-Caixin-China-PMI-surveys-end-third-quarter-on-softer-note.html","enabled":true},{"name":"email","url":"?subject=Caixin China PMI surveys end third quarter on softer note&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11102017-Economics-Caixin-China-PMI-surveys-end-third-quarter-on-softer-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Caixin+China+PMI+surveys+end+third+quarter+on+softer+note http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11102017-Economics-Caixin-China-PMI-surveys-end-third-quarter-on-softer-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}