Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 10, 2017

Russian economic growth picks up at end of Q3

As the Russian economy continues to recover from recession, solid growth in the manufacturing and service sectors point to the emergence of stronger demand. Relatively muted inflation and falling interest rates, however, may be themes that continue throughout 2017.

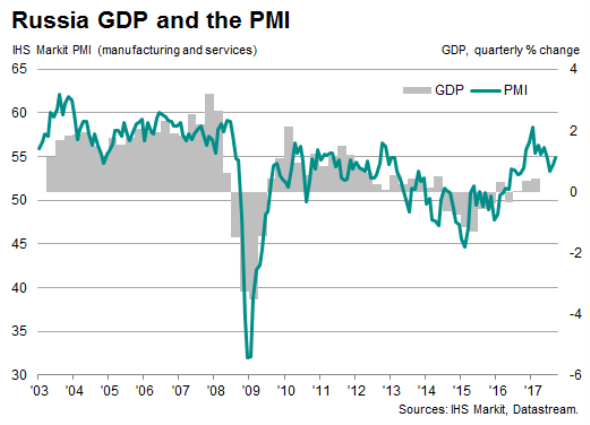

Russian firms have seen a solid progression throughout 2017 so far, with both manufacturers and service providers indicating a sustained recovery in operating conditions. The IHS Markit Composite PMI Output Index suggests that the Russian economy is on course for the best year since 2007. The latest PMI data signalled a sixth successive quarter of growth, the longest sequence of expansion since late-2013.

Official GDP data signalled solid year-on-year growth of 2.5% in the second quarter, with the Composite PMI suggesting another robust performance in the third quarter. The PMI does not include construction and retail, however, and weak performances in these sectors have caused a drag on overall figures in the past. In 2016, PMI component sectors signalled GDP growth of 0.8%. This signalled stronger underlying GDP than was suggested by the final official data, which indicated a 0.4% contraction.

Manufacturing recovery

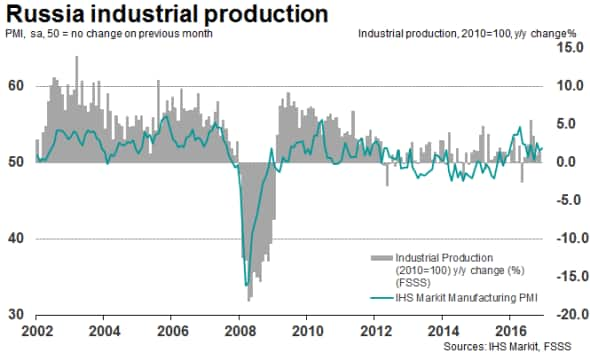

September survey data indicated a further improvement in business conditions in the manufacturing sector, extending the current sequence of growth to 14 successive months. Following an inconsistent performance during the middle of 2017, the IHS Markit Russia Manufacturing PMI signalled a solid overall improvement across the sector in Q3.

Meanwhile, the New Export Orders Index signalled growth in sales from abroad for the first time in four years in September. Anecdotal evidence from the latest survey suggested exports increased due to new client demand, following years of contraction driven by sanctions.

Inflation remains muted

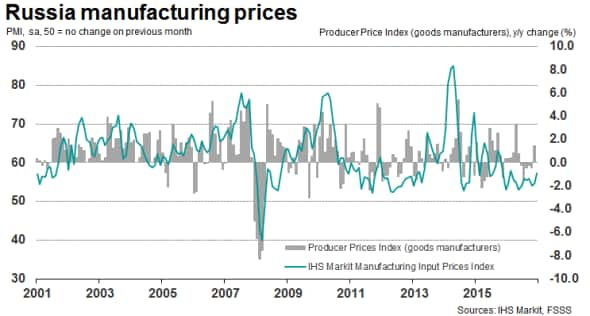

Although domestic demand has started to recover from the recent recession, consumer spending is rising from a low base. Therefore, increased purchasing is not adding significant pressure to inflation. The Manufacturing PMI Input Prices Index signalled an accelerated pace of cost inflation in September average - partly explained by higher oil and energy prices - but it was below the series average.

The Central Bank of Russia recently reduced interest rates for the fourth time this year to 8.5%, with further cuts widely predicted. Despite upturns across the manufacturing and service sectors, disposable incomes have not risen as quickly meaning Russian consumer spending growth has been subdued. Consensus currently suggests that, moving into 2018, the upcoming presidential election and World Cup are expected to influence a positive shift in spending habits.

Although price pressures remain relatively muted, a rise in input costs through global commodity market improvements could heavily impact sector performances as demand conditions are not currently conducive to increasing selling prices. Anecdotal evidence from PMI respondents has suggested firms have been discouraged from passing higher input costs on to clients due to fears of losing sales, with September data indicating a subdued rate of charge inflation relative to the series long-run average.

Employment concerns

September's PMI survey signalled the first rise in manufacturing workforce numbers in seven months. It is a similar positive story in the service sector, where firms reported the strongest growth in employment since May 2013. The overall increase in employment in September was consequently also the largest recorded by the PMI surveys since 2013.

However, with unemployment falling almost consistently throughout 2017, there have been cases of firms struggling to find sufficient skilled labour. Firms may find it difficult to accommodate stronger client demand in the future if skill shortages mean business units are not adequately staffed.

Going forward

IIHS Markit currently forecasts GDP growth of 1.7% in 2017, rising to 2.1% in 2018. The Central Bank of Russia is more optimistic however, and has predicted an increase in GDP between 1.7% and 2.2% during 2017. That said, making further progress from there may require structural changes and greater investment in growing the skills base of the economy. Without such reforms; demographic issues could hold back economic growth in the medium term. Of note, firms surveyed in September reported the highest degree of optimism towards the outlook since May 2013, suggesting growth could accelerate in coming months.

Forthcoming economic data releases:

- October 16th: Industrial Production Y-o-Y (September)

- November 1st: IHS Markit Russia Manufacturing PMI (October)

- November 3rd: IHS Markit Russia Services PMI (October)

- November 13th: GDP Preliminary Growth Rate (Q3)

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102017-Economics-Russian-economic-growth-picks-up-at-end-of-Q3.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102017-Economics-Russian-economic-growth-picks-up-at-end-of-Q3.html&text=Russian+economic+growth+picks+up+at+end+of+Q3","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102017-Economics-Russian-economic-growth-picks-up-at-end-of-Q3.html","enabled":true},{"name":"email","url":"?subject=Russian economic growth picks up at end of Q3&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102017-Economics-Russian-economic-growth-picks-up-at-end-of-Q3.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russian+economic+growth+picks+up+at+end+of+Q3 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102017-Economics-Russian-economic-growth-picks-up-at-end-of-Q3.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}