Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 11, 2015

Short sellers find holy shale shorts

Energy stocks in the Russell 3000 have seen a fresh high in average short interest as oil prices retreated in earnest, leaving the sector the most short sold out of the index.

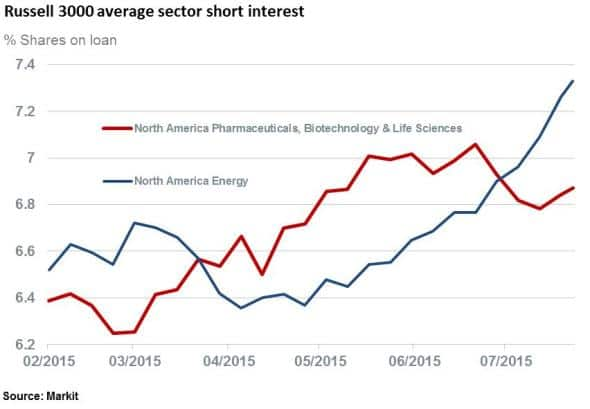

- Average short interest for the energy sector has risen to a new 2015 high of 7.3%

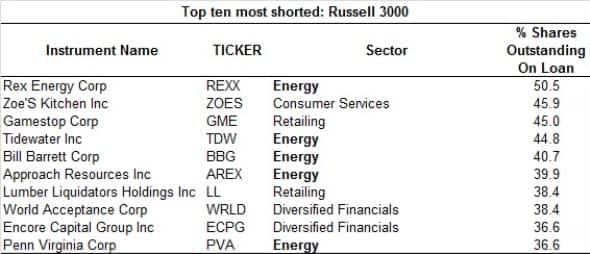

- Energy names make up half of the top ten most short sold companies within Russell 3000

- $18.4bn worth of short positions currently are open across the US energy sector

Sectors swap pole positions

Half of US energy stocks in the Russell 3000 are already down by ~40% in the last 12 months, while a further 20% have collapsed by ~75%. But renewed weakness in oil prices has seen short sellers once again flock to besieged energy firms.

Across the constituents of the Russell 3000, the energy sector has displaced biotech and reclaimed its position as the most short sold sector in North America; a title it managed to shrug off in March as oil prices reversed some of their losses.

Energy firms represent approximately 6.4% of this index, with a sector market cap of $1.5trn. Of this roughly ~$18.4bn are currently out on loan, comprising 6.3% of the entire Russell 3000 short positions.

Short sellers on target

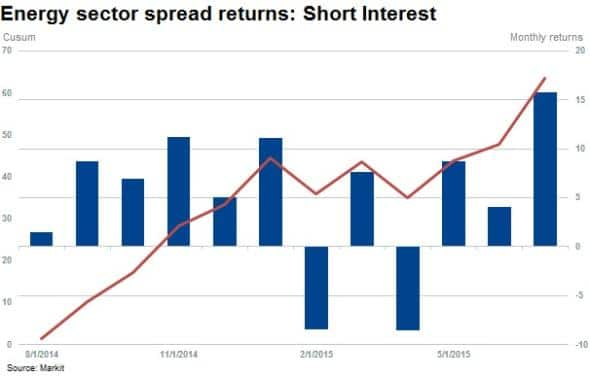

While the entire sector has proven to be a fertile ground for short sellers in the last year, as seen by the fact that the Russell 3000 energy names have fallen by 42% on average the last 12 months, the sector has proven even more profitable recently for short sellers, as seen by the Markit Research Signal Short Interest factor. This factor ranks energy names by the cumulative amount of short interest and has seen the 10% of energy names with the highest level of short interest underperform the 10% of names with the least shorting activity by a massive 64% in the last 12 months.

Returns were primarily derived from the most shorted names, driving two-thirds of the factor returns. July was a particularly robust month for the performance of the factor as oil prices fell, recording a 15.8% return. This essentially means that short sellers have been able to capitalise on the recent oil slump

Picking off the weak

The largest 30 of the roughly 200 Russell 3000 energy constituents have an average of 1.6% of shares outstanding on loan. The sector's ~160 smaller firms (whose market cap is under $10bn) average is almost 10 fold higher at 9.1%.

Smaller market cap energy stocks (under a $1bn) make up 50% of the top ten most shorted across the entire Russell 3000 universe. These five stocks have, on average, fallen by 38% in the last month alone, collapsing by 80% over the last 12 months.

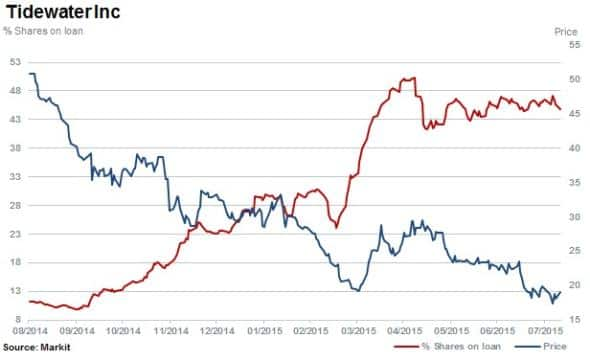

Tidewater is the largest of the top five most shorted in the Russell 3000 with $893m in market cap and 45% of shares out on loan. The stock has declined the 'least' out of the five in the last 12 months, falling 62%.

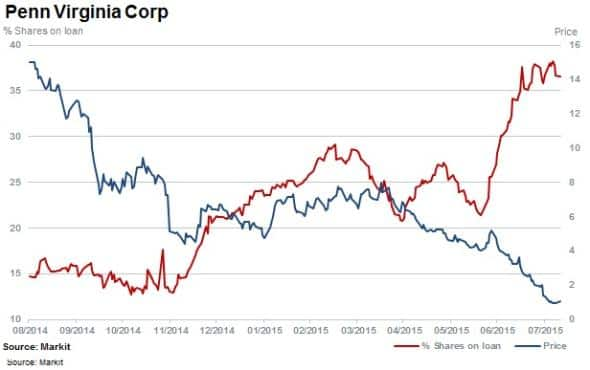

Penn Virginia has plummeted 92% in the last 12 months with a current market cap of $77m. The shale gas explorer/producer is the tenthmost shorted stock in the Russell 3000 with 37% of shares out on loan.

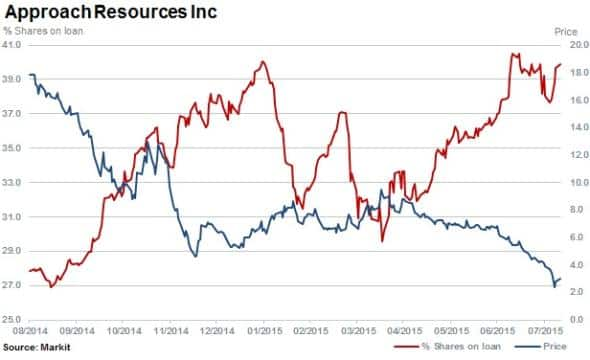

Shale gas and oil company Approach Resources announced last week that the it had cut back on capital expenditures and suspended drilling operations in the Permian basin for the rest of the year after posting a $12m loss for the second quarter.

Shares out on loan in the firm have increased, rising up to 40%, with the stock continuing to come under pressure; down by a staggering 83% in the last 12 months and 60% in the last three months.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-equities-short-sellers-find-holy-shale-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-equities-short-sellers-find-holy-shale-shorts.html&text=Short+sellers+find+holy+shale+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-equities-short-sellers-find-holy-shale-shorts.html","enabled":true},{"name":"email","url":"?subject=Short sellers find holy shale shorts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-equities-short-sellers-find-holy-shale-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+find+holy+shale+shorts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-equities-short-sellers-find-holy-shale-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}