Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 11, 2015

US corporate bonds widen to three year highs

Lower quality US high yield bond spreads have widened to multiple year highs; opening up a differential with higher quality high yield and investment grade credits.

- Markit iBoxx USD liquid high yield CCC index's spread widens to 2012 levels

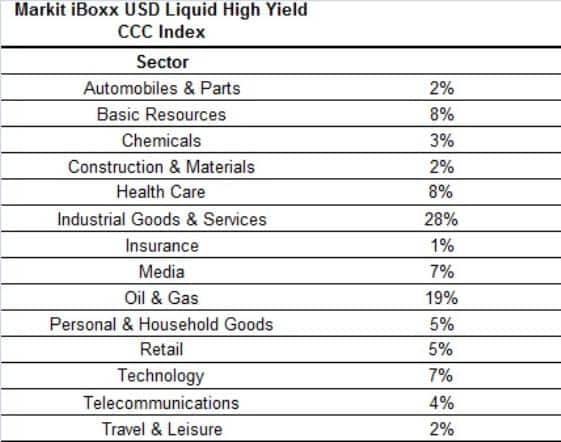

- 48% of Markit iBoxx USD liquid high yield CCC index comprises industrials and oil & gas

- IG bonds spreads are at their widest since August 2012; 74bps wider than mid-2014

Investor sentiment around the US high yield (HY) market has turned negative again. This is exemplified by ETFs tracking US HY bonds starting August with outflows totalling $849m.

These outflows followed what was the best month for US HY ETF inflows since February, as $7.47bn was poured into the sector after Greek tensions eased in July. But renewed pressure from a slowing China and weak commodity prices has prompted investors to look for returns elsewhere.

CCC

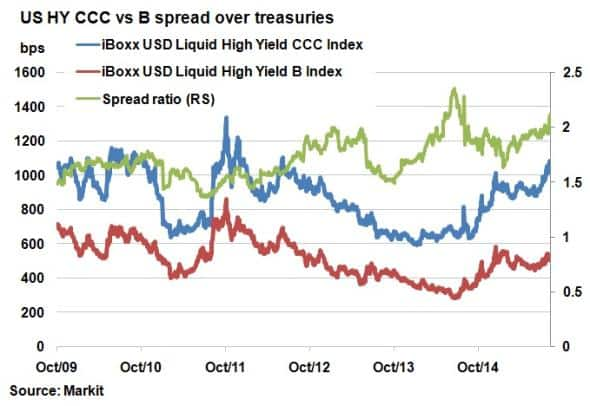

The negativity around HY bonds is also demonstrated by widening bond spreads. One trend in particular has been the pronounced widening seen in HY CCC rated credits. This segment has seen its spread over treasuries reach 1,081bps as of yesterday's close, according to the Markit iBoxx USD Liquid High Yield CCC Index. To put this figure into context, the last time the 1,000bps level was breached was over three years ago in 2012.

Delving further into the widening, 48% of the iBoxx USD liquid high yield CCC index is made up of just two sectors: industrials and oil & gas. Names in both sectors have come under sustained pressure by the prospect of a global slowdown in manufacturing and a drop in commodity prices. Investors have therefore remained cautious, particularly towards highly leveraged low quality assets which are more likely to default. As a result, this growing bearish sentiment has pushed the CCC index yield wider to a near four year high of 12.55%.

Higher rated HY rating segments have held up better than CCC. The spread ratio between CCC/B has risen steadily from 1.64 in January this year, to 2.04 as of yesterday's close. The average ratio over the past five years is 1.73. This divergence represents B rated credit's relative strength amid global headwinds, while still providing a yield of 7+%, according to the Markit iBoxx USD Liquid High Yield B Index.

HY vs IG

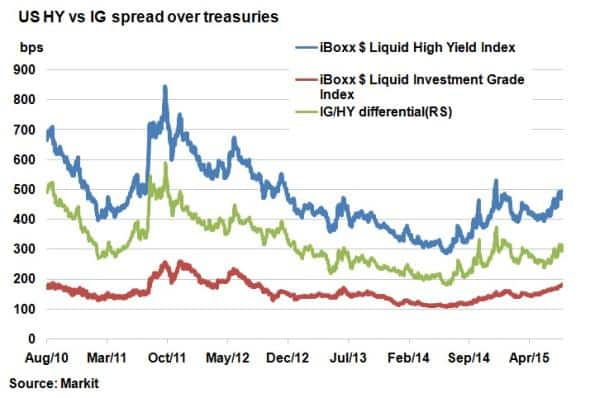

Relative to US investment grade (IG), HY spreads have continued to widen at a greater pace over the short term. The spread differential between the Markit iBoxx $ Liquid High Yield Index and the Markit iBoxx $ Liquid Investment Grade Index recently reached 316bps (July 28th), touching year to date highs. Both indexes have seen bond spreads widen since mid-May, but looking back over a one year period shows that IG credit has actually been on a prolonged risk off trend since mid-2014.

The latest spread over treasuries, 182bps, is the widest since August 2012 and 74bps wider than in mid-2014. The recent widening in IG credit has correlated with the move in HY, suggesting a broader credit market shift, but IG credit typically has stronger balance sheets and therefore may be better equipped to weather future headwinds.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-Credit-US-corporate-bonds-widen-to-three-year-highs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-Credit-US-corporate-bonds-widen-to-three-year-highs.html&text=US+corporate+bonds+widen+to+three+year+highs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-Credit-US-corporate-bonds-widen-to-three-year-highs.html","enabled":true},{"name":"email","url":"?subject=US corporate bonds widen to three year highs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-Credit-US-corporate-bonds-widen-to-three-year-highs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+corporate+bonds+widen+to+three+year+highs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082015-Credit-US-corporate-bonds-widen-to-three-year-highs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}