Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 08, 2014

UK construction rebounds in June, but official data still lag upbeat surveys

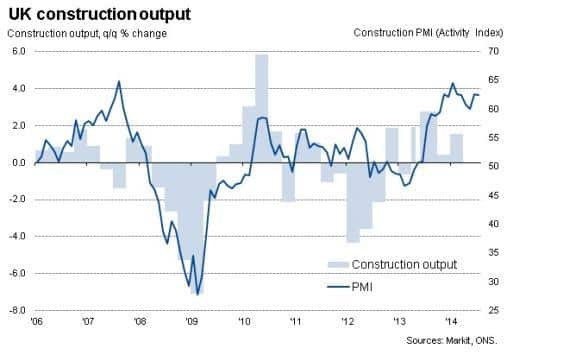

Official data on the health of the UK construction industry have been surprisingly disappointing so far this year, but there was some better news for June. It is possible that the weakness of the official data relative to upbeat surveys since late last year could lead to the official data being revised upwards, with implications for stronger economic growth in the first half of 2014. Such revisions would inevitably strengthen the case for interest rates to rise.

June rebound

Data from the Office for National Statistics recorded a 1.2% rebound in construction sector output in June. Although this increase merely compensated for an equivalent decline in May, it at least meant the industry saw output stabilise over the second quarter as a whole. Initial estimates from the ONS had indicated that construction output fell 0.5% in the second quarter. However, the revision was not enough to cause the ONS to revise up its current estimate for 0.8% GDP growth in the three months to June.

According to the ONS, new work rose by 0.9% in June while repair and maintenance jumped by 1.6%. These increases pushed total activity up 5.3% on a year ago, with new work up 5.4% and repair and maintenance rising 5.0%.

Buoyant survey data

Even the slightly better picture of stagnation in the second quarter is greatly at odds with survey data from Markit/CIPS, which show the construction industry booming this year. The survey data indicate that a surge in house building is being encouraged by double-digit house price inflation. At the same time, businesses are spending more on investments in property. The survey data show that commercial activity, such as the building of offices, shops, factories and industrial units, has enjoyed the strongest start to a year for 14 years. Civil engineering activity is also booming.

The survey data therefore suggest that the official data are under-recording recent growth in the construction industry, and that revisions to recent official data could in turn lead to economic growth being revised higher over the past year. Such upward revisions would put further pressure on policymakers to raise interest rates to cool the economy.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082014UK-construction-rebounds-in-June-but-official-data-still-lag-upbeat-surveys.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082014UK-construction-rebounds-in-June-but-official-data-still-lag-upbeat-surveys.html&text=UK+construction+rebounds+in+June%2c+but+official+data+still+lag+upbeat+surveys","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082014UK-construction-rebounds-in-June-but-official-data-still-lag-upbeat-surveys.html","enabled":true},{"name":"email","url":"?subject=UK construction rebounds in June, but official data still lag upbeat surveys&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082014UK-construction-rebounds-in-June-but-official-data-still-lag-upbeat-surveys.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+rebounds+in+June%2c+but+official+data+still+lag+upbeat+surveys http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082014UK-construction-rebounds-in-June-but-official-data-still-lag-upbeat-surveys.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}