Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 11, 2015

US retail sales upturn adds to optimism on economy

Strong retail sales data add to signs that the US economy has pulled out of the soft-patch seen at the start of the year.

Sales surged 1.2% in May, and a flat April was revised higher to show 0.2% growth. The upturn pushes sales 1.7% higher so far in the second quarter. That compares with a 1.0% decline in the first quarter.

Over the latest three months, sales are 1.5% higher than the prior three months, which is the best performance since June of last year.

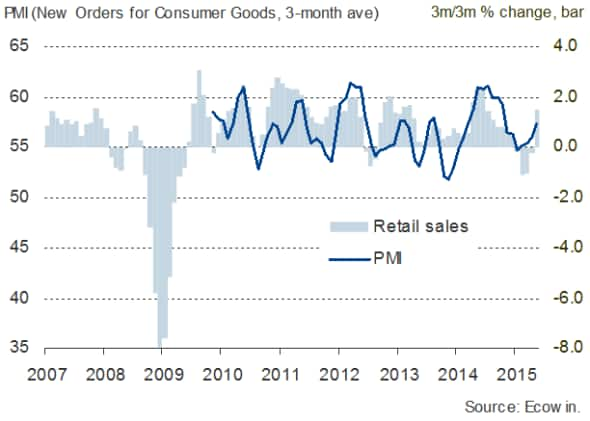

The improvement was signalled in advance by Markit's PMI data. The survey showed orders for consumer goods rising at the fastest rate for seven months in the three months to May, with the rate of growth having steadily increased since bottoming out at the start of the year.

Retail sales and the PMI

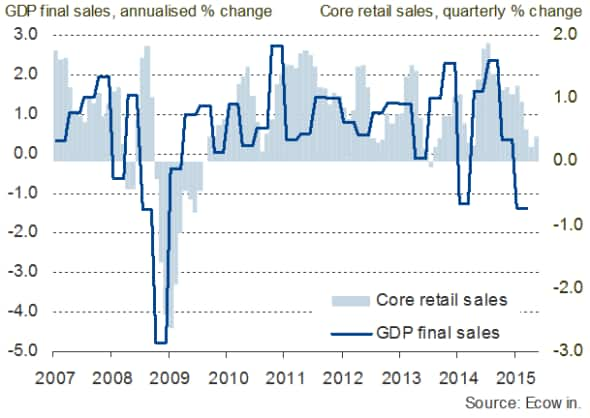

The official data also showed core sales rising for a third month after declining in the first two months of the year. The 0.5% increase in May follows a 0.3% rise in April and lifts core sales - a useful guide to GDP trends - 1.0% higher than the first quarter.

Upward revisions to March core sales data also now means core sales rose 0.3% in the first three months of the year, suggesting GDP could be revised higher from its current estimate (which points to a 0.7% annualised decline).

US core sales and GDP final sales

Not only have Markit's PMI data shown the economy to have fared better in the first quarter than the downturn signalled by the latest GDP data, but also point to GDP rising by a solid 2-3% in the second quarter alongside buoyant employment growth. The PMI's Employment Index hit a post-recession high in May, correctly anticipating the upturn in non-farm payroll growth.

The steady corroboration of the buoyant survey data from the recent flow of official statistics builds the case for the Fed to start hiking interest rates, with September looking the most likely date.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-us-retail-sales-upturn-adds-to-optimism-on-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-us-retail-sales-upturn-adds-to-optimism-on-economy.html&text=US+retail+sales+upturn+adds+to+optimism+on+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-us-retail-sales-upturn-adds-to-optimism-on-economy.html","enabled":true},{"name":"email","url":"?subject=US retail sales upturn adds to optimism on economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-us-retail-sales-upturn-adds-to-optimism-on-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+retail+sales+upturn+adds+to+optimism+on+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11062015-economics-us-retail-sales-upturn-adds-to-optimism-on-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}