Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 10, 2015

UK trade deficit widest on record once oil and volatile items are stripped out

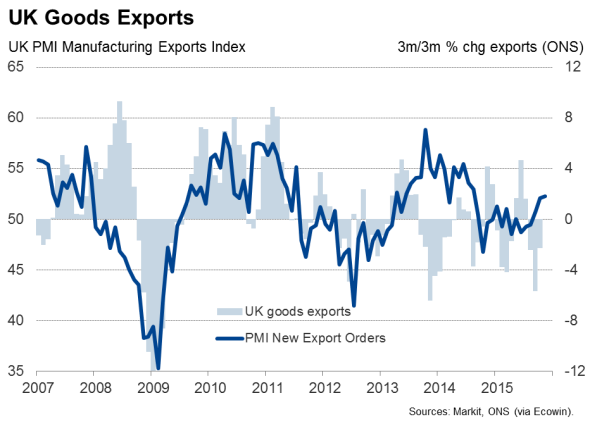

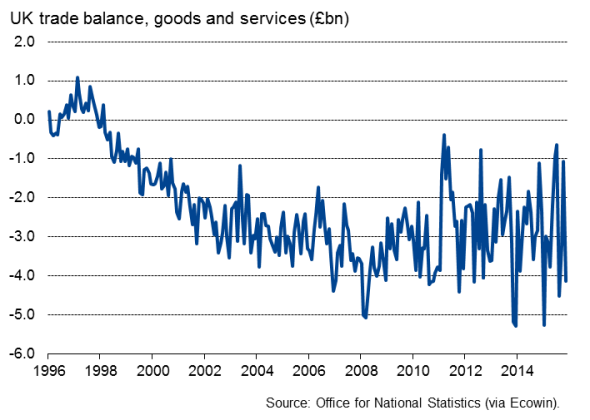

The UK's ongoing disappointing trade performance is highlighted by the latest official data. If oil and other volatile items are excluded, the trade deficit was the biggest on record in October. However, there are signs from the more recent survey data that exports are picking up again, aided by reviving demand in the euro area in particular.

The ONS reported that exports of goods and services fell 1.6% in October while imports surged 5.4%. The position in goods trade was even worse, with exports down 2.9% and imports jumping 7.0%. That took the overall deficit to "4.1bn and the goods deficit to "11.8bn, both three-month highs. However, if oil and erratics1 are excluded, the goods deficit rose to an unprecedented "10.8bn.

While the data paint a depressing picture of UK trade at the start of the fourth quarter, the numbers also need to be treated with caution. The underlying picture is perhaps not so bleak, though undeniably nor is it rosy.

Importantly, the monthly numbers are volatile and often revised heavily. It's best therefore to look at the three-month trend to get a clearer view of the trade picture (though even here it's hard to see any trend in a series which, over the past four years, looks to fluctuate wildly compared to prior years). Here we can see that the rate of decline in exports eased from 3.4% to 1.5% between September and October, while the rate of contraction in goods exports eased from 5.7% to 2.3% over the same period. PMI survey data suggest this improving trend continued into November, with the PMI in fact signalling the largest rise in goods exports for 15 months.

Companies are reporting that demand is picking up in certain key export markets, notably in the euro area, and that customer interest remains strong in the US and the Middle East. Demand remains weak from Asia, and China in particular, but there are nonetheless signs that conditions may be picking up. The global PMI surveys signalled an upturn in worldwide economic growth for a second successive month in November.

The import situation is perhaps also not as awful as the October data suggest. In the latest three months, imports of goods rose 0.9% to October, with total imports up 0.4%, which is perhaps not surprising given how the stronger pound is reducing the cost of imports. One positive note that can be taken from this is that the increase in imports at least points to robust domestic demand.

1 Defined as ships, aircraft, precious stones, silver and non-monetary gold.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-uk-trade-deficit-widest-on-record-once-oil-and-volatile-items-are-stripped-out.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-uk-trade-deficit-widest-on-record-once-oil-and-volatile-items-are-stripped-out.html&text=UK+trade+deficit+widest+on+record+once+oil+and+volatile+items+are+stripped+out","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-uk-trade-deficit-widest-on-record-once-oil-and-volatile-items-are-stripped-out.html","enabled":true},{"name":"email","url":"?subject=UK trade deficit widest on record once oil and volatile items are stripped out&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-uk-trade-deficit-widest-on-record-once-oil-and-volatile-items-are-stripped-out.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+trade+deficit+widest+on+record+once+oil+and+volatile+items+are+stripped+out http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-economics-uk-trade-deficit-widest-on-record-once-oil-and-volatile-items-are-stripped-out.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}