Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 10, 2015

Bank of England holds interest rates awaiting stronger pay growth

The Bank of England left interest rates on hold at their record low of 0.5% at their December MPC meeting. Once again, only one of the nine committee members, Ian McCafferty, voted for a tightening of policy.

The lack of action comes as no surprise. However, the ongoing reluctance to tighten policy contrasts with the more hawkish stance of US policy makers, who look almost certain to raise interest rates next week for the first time since 2006.

When presenting its latest Inflation Report last month, the Bank indicated that it did not expect to need to raise interest rates until 2017, due to inflation remaining below target. The Bank's meeting minutes indicate that it maintains the view that inflation will remain below 1% until the second half of next year. Policy makers in the US, however, faced with an economy growing at a similar rate to the UK, as well as a similar level of unemployment and inflation and even lower wage growth, are sending a clear message that now's the time to start the process of normalising policy.

The Bank of England has argued that the UK is a more open economy than the US and therefore faces a greater threat from weak economic growth overseas. While the Bank now seems to be downplaying this risk somewhat, concerns remain over how weak emerging market growth might affect the eurozone and thereby have a knock on effect to the UK.

Now the argument seems to be that interest rates do not need to rise due to lower oil prices (an element of inflation they are willing to 'look through' when prices are on the rise and would prescribe higher interest rates). However, if the US does decide to hike rates next week, and barring any nasty surprises, UK policy may soon start to look like it's fallen behind the curve and expectations will grow of an upward move in UK rates next year.

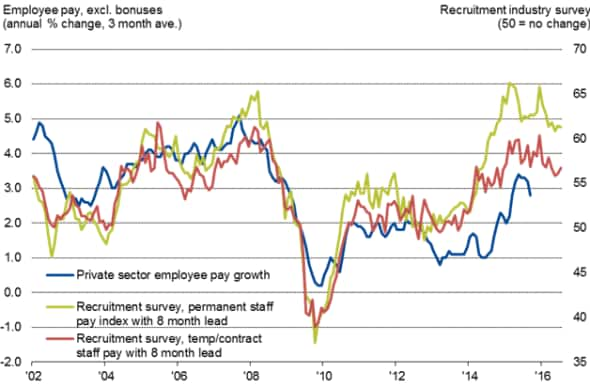

Wage growth will be crucial to the timing of any rate rise, so attention turns to next week's employment data. The MPC's minutes note how pay growth has 'flattened off recently', though it remains unclear to the Bank as to whether this reflects some short term volatility or whether lower headline inflation is feeding through to weaker pay reviews.

The weaker official pay data contrast with survey evidence, which found recruitment agencies reporting that pay growth remained strong in November amid the most severe tightening of the labour market seen for 18 years. Next week's data could therefore be instrumental in guiding policy.

Pay growth

Sources: Markit, ONS via Datastream.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-Economics-Bank-of-England-holds-interest-rates-awaiting-stronger-pay-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-Economics-Bank-of-England-holds-interest-rates-awaiting-stronger-pay-growth.html&text=Bank+of+England+holds+interest+rates+awaiting+stronger+pay+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-Economics-Bank-of-England-holds-interest-rates-awaiting-stronger-pay-growth.html","enabled":true},{"name":"email","url":"?subject=Bank of England holds interest rates awaiting stronger pay growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-Economics-Bank-of-England-holds-interest-rates-awaiting-stronger-pay-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+holds+interest+rates+awaiting+stronger+pay+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122015-Economics-Bank-of-England-holds-interest-rates-awaiting-stronger-pay-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}