Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 10, 2014

Rolling the volatility

Index rolls have contributed to spread swings, but fundamentals should not be ignored.

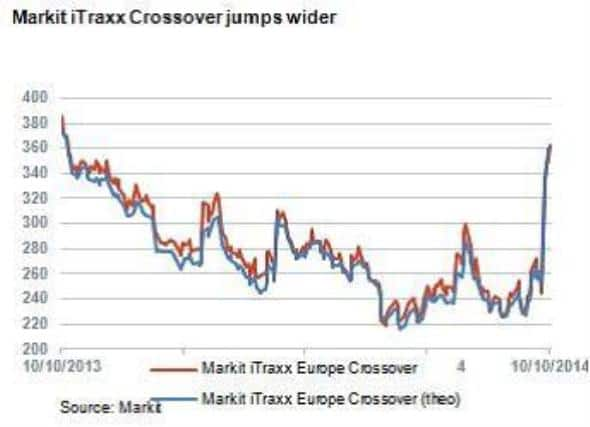

- Markit iTraxx Crossover jumps wider due to new additions

- European economic outlook is bleak

- Emerging markets sovereigns more sensitive to political developments

We remarked last week that volatility had returned to the credit markets, and the spread oscillations this week suggests the trend is set to continue.

However, this was no typical period for CDS. The vast majority of indices rolled on October 6th, later than the scheduled date of September 22nd, due to delays in adherence on the protocol for ISDA 2014 definitions. The roll usually increases activity and that was the case again, so it was no surprise to see some volatility.

The Markit iTraxx Europe was trading at 68bps, 8bps wider than the previous series. The new constituents in Series 22 are, on average, stronger credits than the names removed, and along with the maturity extension of the new contract, pushed the on-the-run index wider in comparison to its predecessor.

However, the 8bps move paled in comparison to the Markit iTraxx Crossover, which saw the new series widen by about 100bps compared to its predecessor. The index was expanded from 60 names to 75 names, which no doubt contributed to the widening. The names added from the supplementary list to previous series have become more liquid as a result of their inclusion in the Crossover, and there is every chance that we will see a repeat for Series 22.

But there were also fundamental reasons driving spreads wider. German industrial production figures declined by the largest amount for more than five years in August, adding to the considerable pessimism surrounding the eurozone's economic fortunes. Perhaps the poor economic data increases the probability that the ECB will implement full QE, including government bond purchases, sooner rather than later. All things being equal, this would be positive for risk assets.

But it is by no means certain that full QE is possible in a politically divided ECB, and the primary problem in the eurozone remains a lack of demand. Governments, particularly in Germany, need to make a contribution through fiscal policy, as the IMF and others have recommended. Unfortunately, there is no realistic prospect of this happening, as Wolfgang Schaueble recently confirmed.

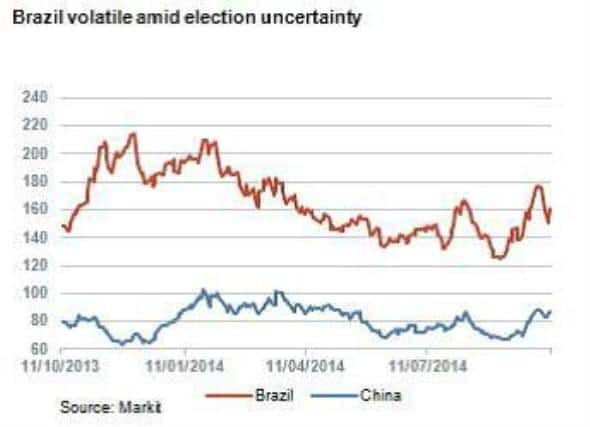

Eurozone sovereign CDS spreads are relatively unresponsive to economic data - the ECB's 'whatever it takes" commitment has seen to that. But emerging market CDS are more sensitive to fundamentals, and we have seen significant moves in the some of the most liquid names. Brazil's spreads widened from 125bps to 175bps in the run up to the first round of the presidential election on October 5th, with opinion polls indicating a highly uncertain outcome. Brazil's president, Dilma Rousseff, emerged as the winner, but failed to gain sufficient votes to avoid a second round run off.

The sovereign's CDS rallied on the news - the surprise runner up, Aecio Neves, is regarded as market friendly. More volatility can be expected ahead of the final vote October 26th.

China has also seen its spreads widen, though they are significantly tighter than its fellow BRIC Brazil. The ongoing protests in Hong Kong have added political risk into the mix of concerns, along with slowing growth and the outsized shadow banking system. China's medium term direction is sometimes overlooked in this era of central bank domination, but it remains a key factor in determining global economic growth.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-credit-rolling-the-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-credit-rolling-the-volatility.html&text=Rolling+the+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-credit-rolling-the-volatility.html","enabled":true},{"name":"email","url":"?subject=Rolling the volatility&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-credit-rolling-the-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rolling+the+volatility http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-credit-rolling-the-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}