Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 10, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week, plus names identified to potentially experience a short squeeze.

- Short sellers circle AMD as PC sales stall and competition heats up in semiconductors

- Markit data points to Gamestop being primed for a potential short squeeze

- Japanese auto parts maker U-Shin and used car dealer Gulliver are most shorted in Apac

North America

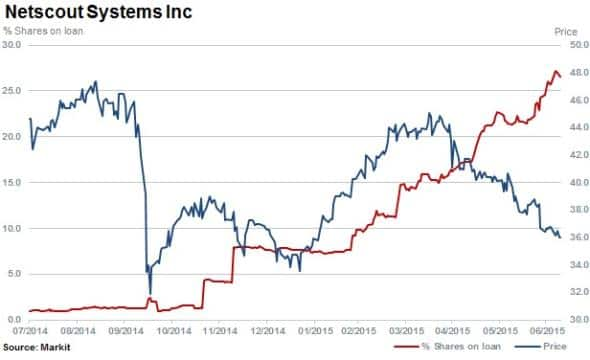

Most shorted in North America ahead of earnings this week is Netscout who provides application and network performance management solutions. Short interest has climbed to 26% of shares outstanding on loan while the stock price has declined by a fifth in the last three months.

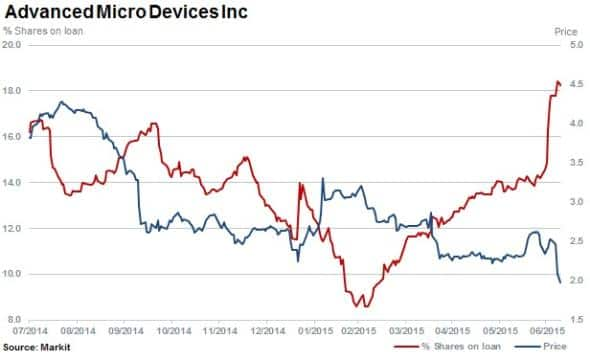

Second most shorted is semiconductor prodcuer Advanced Micro Devices (AMD) with 18% of shares outstanding on loan, climbing by almost 30% in last month.

AMD shares have slid over 50% in last year with a sharp drop in share price as the company announced it expects lower earnings on the back of decreased personal computer demand.

Commercial and retail bank People's United Financial is the third most shorted in the North America ahead of earnings. The firm has seen short interest jump by 20% in the last few weeks to 16% while shares have declined slightly.

Gaming the short squeeze

Markit's Research Signals' Short Squeeze model identifies the stocks most likely to experience a short squeeze across a universe of US shares.

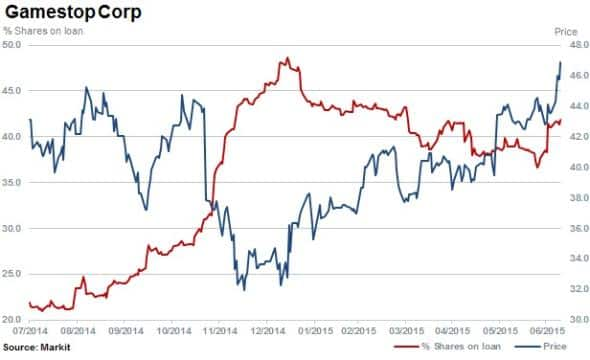

No stranger to the being among the most short sold firm in the US is Gamestop, which currently ranks highly as a potential short squeeze.

Other potential short squeezes identified this week include the Container Store Group (TCS), the Vector Group (VGR) and XOOM CORP (XOOM).

Europe

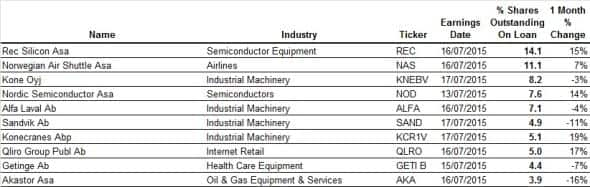

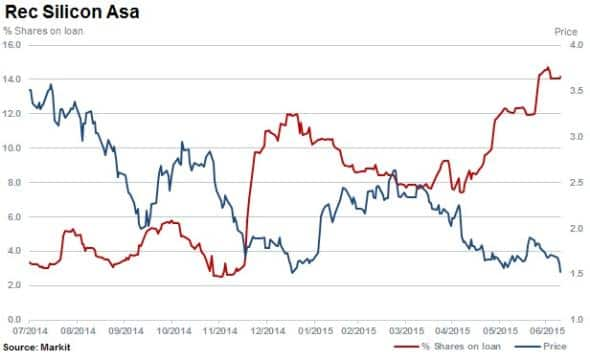

Most shorted in Europe is Rec Silicon, which produces polysilicon and other materials for the solar industry and silicon materials for the electronics industry.

The company's shares outstanding on loan have climbed to 14% over the last three months while the stock has fallen some 40%. Current consensus forecasts expect the company to post quarterly losses well into 2016.

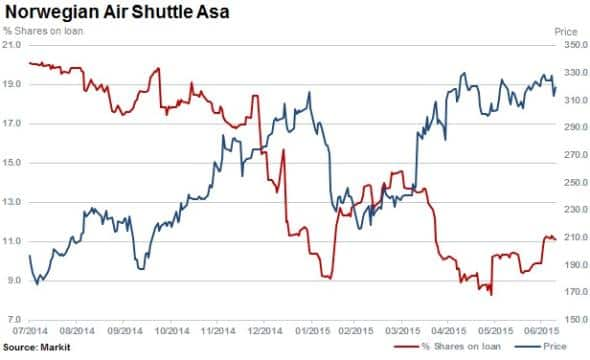

Even though a slight increase in short interest has occurred over the last month, short sellers have generally covered positions in Norwegian Air Shuttle over the last 12 months as the stock has continued to rally. Shares outstanding on loan have decreased by almost 40% over the last year.

Apac

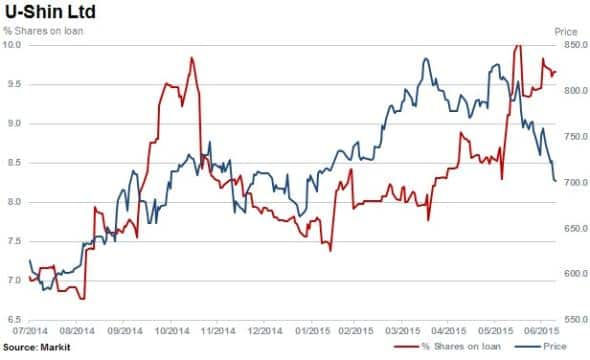

Japanese auto component manufacturer U-Shin is the most shorted ahead of earnings in Apac. With 9.7% of shares outstanding on loan, patient short sellers look to be benefiting from the recent 15% fall in the company's stock.

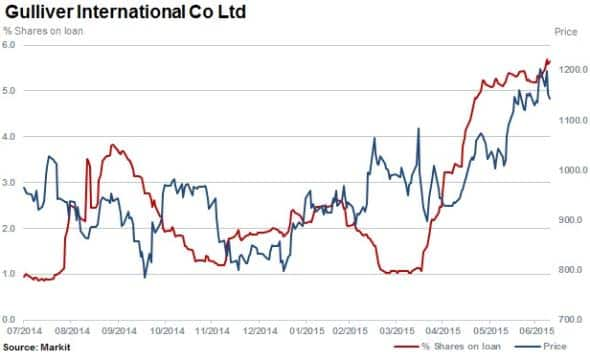

Second most shorted in Apac is Gulliver International which distributes and sells used cars. Short interest has increased fivefold in the last three months while the company's stock has risen by 15%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}