Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 10, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Fatigue in gun sales sees short interest rise 300% and shares in Smith and Wesson fall

- Short sellers hold on to Berkeley Group ahead of earnings, despite shares gaining ground

- Shares in Australian Metcash stage impressive recovery as shorts cover

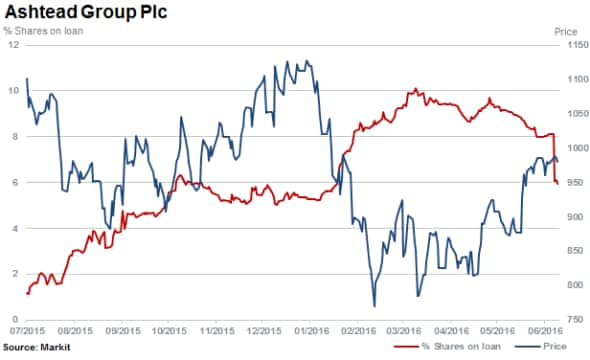

North America

Most shorted ahead of earnings this week in North America is gun maker Smith & Wesson, with 11.6% of its shares outstanding on loan (short interest).

Short sellers have returned to US gun makers after backing off last year, as surging sales driven by threats of tighter gun control saw Smith and Wesson shares rise 132% in 2015. However analysts have now moderated future expectations, downgrading the company even after it beat its own sales guidance for the previous quarter. Shares in 2016 plummeted after the news, erasing all gains year to date on fears gun sales have peaked.

Second most shorted in North America is PdvWireless with short interest of 7.9%. Previously named Pacific Data Vision, the company provides two-way radio communication solutions, predominantly directed towards fleet management, competing against cellular-based solution providers.

Shares have plunged almost 50% since the beginning of May 2016 with the company currently involved in a petition to realign its spectrum with a current nationwide 900MHZ licence.

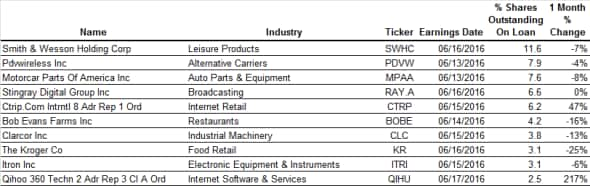

Short interest remains high in Motorcar Parts of America at 7.6% with shares tumbling by a quarter in the past three months as earnings consensus for the fourth quarter has been downgraded to marginally beat comparative 2015 levels.

With 6.6% of shares outstanding on loan, short sellers have held steady in Montreal based Stingray Digital, with shares rising 16% in the past six months. The company provides b2b digital music solutions and has recently received notice of a patent infringement.

Still seeing some material levels of short interest ahead of earnings is US listed ADR of Chinese firm Ctrip.com which is one of the most short sold ADRs currently.

Europe

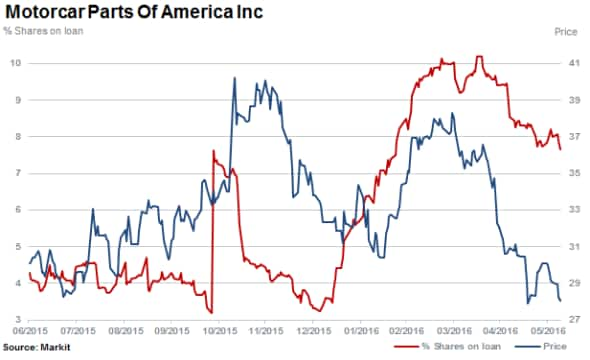

Most shorted ahead of earnings in Europe this week is Gerry Webber International with 6.1% of shares outstanding on loan.

Short sellers have shed 50% of positions in the German based Fashion retailer during the year; the firm's shares have fallen over 40% in the past 12 months. Second quarter earnings look set to fall short of 2015 levels with full year revenue and earnings expected to decline year-on-year.

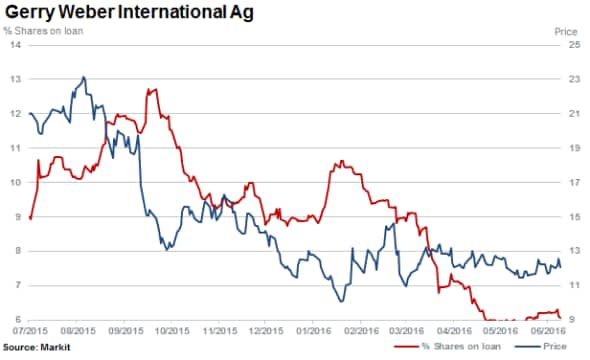

Shorts have covered sharply across Ashtead Group in recent days. The global equipment rental firm currently has 5.9% of shares outstanding on loan. Shares have rallied 25% in the past three months with short sellers shedding 27% of positions the week ahead of earnings.

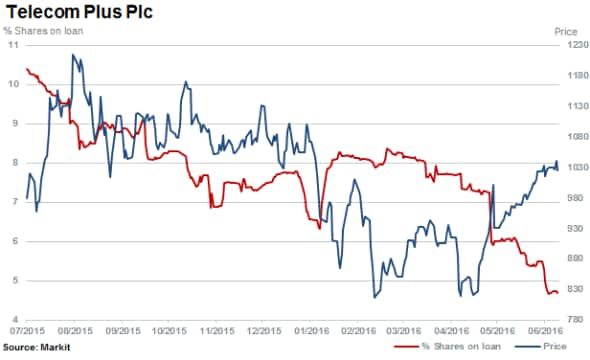

Short sellers have continued to cover in last years most shorted in Europe - Telecom Plus (trading as Utility Warehouse). Shares have staged an impressive 25% rally since mid-April, with short sellers covering over two thirds of positions.

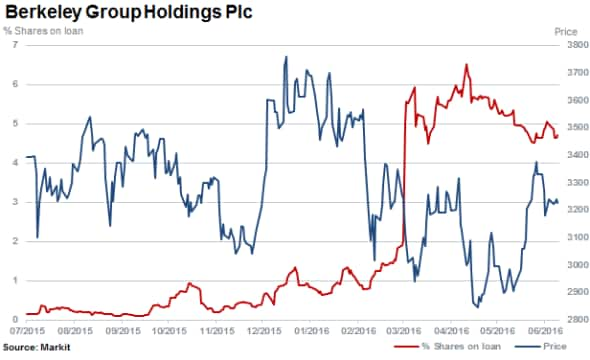

Possibly one of the most anticipated earnings reports in the UK given concerns surrounding the luxury housing market, house builder Berkeley Group is the fourth most short sold stock ahead of earnings in Europe. Short interest remains at high levels with 4.7% of shares sold short, despite shares rising 13% since mid-April.

Apac

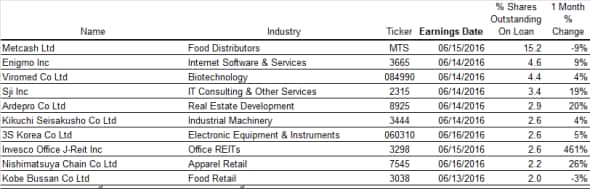

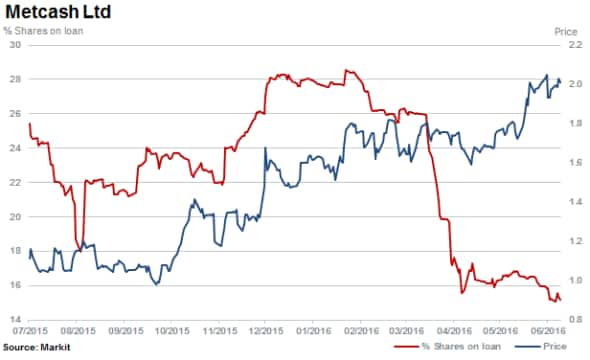

Most shorted ahead of earnings in Apac is Australian retailer Metcash with 15%short interest currently. Improved operating results the firm's grocery wholesale business has supported a recent share price recovery of over 100%, this has seen shares return back to 2014 levels.

Second most shorted in Apac with short interest of 4.6% is Enigmo whose shares have spiked 125% in the past three months.

Short sellers have covered a fifth of positions in Enigmo which is an internet and social commerce business based in Tokyo. Consensus forecasts indicate a large jump in sales and earnings expected for the full year.

Lastly, third most shorted in Apac is Viromed with short interest rising almost three fold in the past six months to reach 4.4%. The South Korean company develops and manufactures biopharmaceuticals for the treatment of human diseases.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}