Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 10, 2016

Fatigue in MLM shorts as Herbalife drags on

Short campaigns against MLM firms have been unable to reach a major breakthrough, which has in turn seen short sellers cover their positions in the sector's firms.

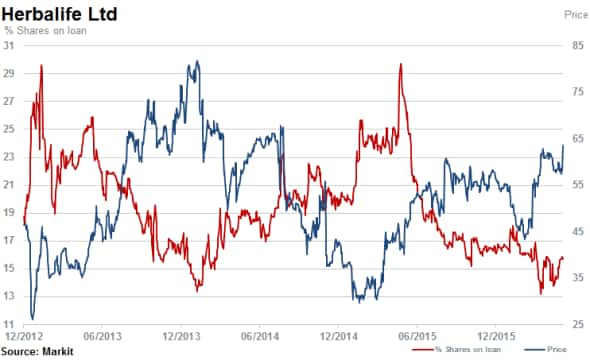

- Herbalife stock up 67% since initial activist campaign in 2012 with shorts covering by a third

- Shorts cover majority of positions in Avon as shares surge by 60% in six months.

- Primerica short interest surges fourfold reaching almost a fifth of shares outstanding on loan

Pershing Square's Bill Ackmanm, who has been long Valeant (a high profile short target), has over the past three years held a conviction short position in Herbalife. However while this trade has yet to come to fruition, with current pending regualtory investigations, shorts have been seen covering in 'multi-level-marketing' (MLM) firms.

During the current short campaign, Herbalife has also had a number of high profile long activist investors including Carl Ichan and Soros Fund Management. Ironically Pershing Square has been short longer than the two active long positions mentioned above.

With recent news of regulatory investigations possibly nearing their end at Herbalife, the stock is still up by 67% since December 2012 when Pershing Square first took its now infamous $1bn short position.

The possible spillover results into the rest of the MLM market on the back of a negative result for Herbalife do not seem to have intrigued shorts sellers, however. Short setiment towards other MLM firms has decreased overall and none have had any major public campaigns to the extent of Herbalife and some fatigue has now started to set in.

Shares in Avon have surged by 60% in the past six months with short sellers covering more than 70% of positions - currently there are 4.1% of shares outstanding on loan.

Tupperware Brands, which generates some of its sales through direct selling "Tupperware parties", has also seen short interest decline over 40% in the last three months as its shares climbed by 19%.

The exception to the above names however with 17.8% of shares outstanding on loan, is Primerica. The company has seen a fourfold increase in short interest over the past 12 months. The company sells a swathe of financial and investment products through a network of and has been referred to as the 'Herbalife of Finance'.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Equities-Fatigue-in-MLM-shorts-as-Herbalife-drags-on.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Equities-Fatigue-in-MLM-shorts-as-Herbalife-drags-on.html&text=Fatigue+in+MLM+shorts+as+Herbalife+drags+on","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Equities-Fatigue-in-MLM-shorts-as-Herbalife-drags-on.html","enabled":true},{"name":"email","url":"?subject=Fatigue in MLM shorts as Herbalife drags on&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Equities-Fatigue-in-MLM-shorts-as-Herbalife-drags-on.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fatigue+in+MLM+shorts+as+Herbalife+drags+on http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Equities-Fatigue-in-MLM-shorts-as-Herbalife-drags-on.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}