Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 10, 2016

Polish and Hungarian bonds miss emerging market rally

The two largest Eastern European emerging market Eurodollar issuers, Poland and Hungary have seen their dollar denominated debt underperform both emerging market peers and US treasuries.

- Polish and Hungarian Eurobonds have underperformed emerging market peers by 4% ytd

- Benchmark spreads in both countries are now 30bps wider than at the start of January

- Poland's CDS spread is 20% higher since January, but still implying an 'A' rating

The two largest Eastern European issuers of dollar denominated bonds have seen their bonds underperform both the high flying dollar denominated emerging market sovereign bonds and the more prosaic US treasuries since the start of the year.

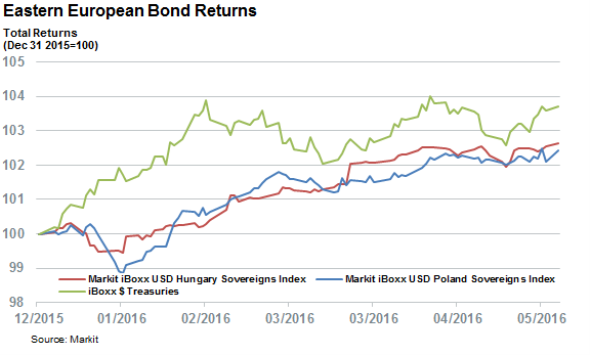

Year to date total returns of the Hungarian and Polish sub sections of the Markit iBoxx USD Sovereigns Indices, which track the Eurobond issues, have returned 2.6% and 2.4% respectively which puts them nearly 4% behind the 6.3% returns delivered by the Markit iBoxx USD Emerging Markets Sovereigns index.

Returns relative to US treasuries have been relatively better, but both Easter European countries are still over 1% behind the 3.7% year to date (ytd) total return delivered by the Markit iBoxx $ Treasuries index.

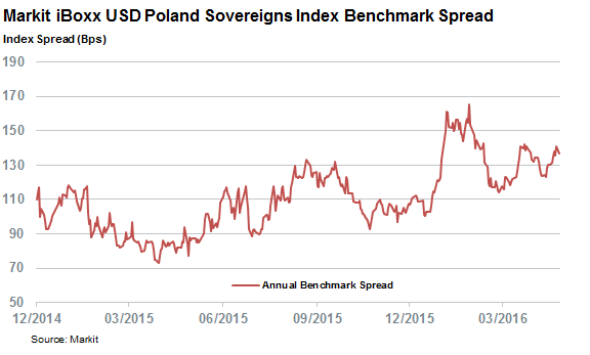

This underperformance relative to treasuries from both countries means that investors are now requiring over 32bps of extra yield in order to hold Polish and Hungarian dollar denominated debt since the start of 2016.

Poland lags behind

Polish Eurodollar bonds, which have lagged those of its Eastern European peer, are reflecting the country's recent downgrade from ratings agency S&P in mid-January. The agency cited concerns around the country's recent slide towards nationalism since its election of the Law and Justice party last October as a cause for its downgrade, which subsequently sent the benchmark spread to a new multi-year high.

While that measure of credit risk has since retreated, the current benchmark spreads of the Markit iBoxx USD Poland Sovereigns Index is still higher than at any time seen in the two years prior to January's downgrade, which goes to show that investors' angst is still very palpable.

Polish CDS spread implies 'A' rating

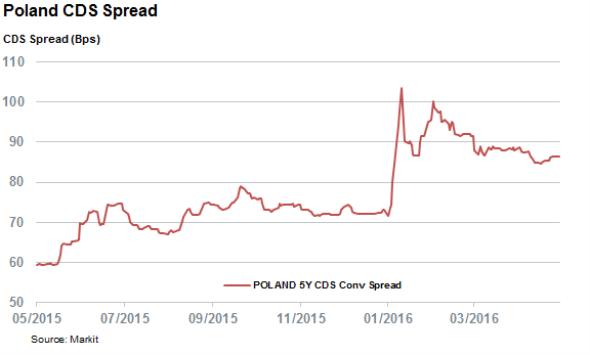

Poland's surging benchmark spreads were also reflected in its CDS spread as the cost to insure the country's bonds against default surged from 70bps to a two and a half year high of 103bps. Much like its bond spreads, Poland's CDS spread has since retreated to 86bps which is still over 20% higher than at the start of the year.

Poland's CDS spread implies an 'A' credit rating which is on par with its current Moody's rating, implying that the market is not expecting a ratings cut in Friday's review of the country's credit rating.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Credit-Polish-and-Hungarian-bonds-miss-emerging-market-rally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Credit-Polish-and-Hungarian-bonds-miss-emerging-market-rally.html&text=Polish+and+Hungarian+bonds+miss+emerging+market+rally","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Credit-Polish-and-Hungarian-bonds-miss-emerging-market-rally.html","enabled":true},{"name":"email","url":"?subject=Polish and Hungarian bonds miss emerging market rally&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Credit-Polish-and-Hungarian-bonds-miss-emerging-market-rally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Polish+and+Hungarian+bonds+miss+emerging+market+rally http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10052016-Credit-Polish-and-Hungarian-bonds-miss-emerging-market-rally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}